European cloud players face declining market share as US hyperscalers clean up

A report states that while EU cloud providers are growing revenues, their share of the market is declining as Amazon, Google, and Microsoft now account for 72% of the regional market.

September 28, 2022

A report states that while EU cloud providers are growing revenues, their share of the market is declining as Amazon, Google, and Microsoft now account for 72% of the regional market.

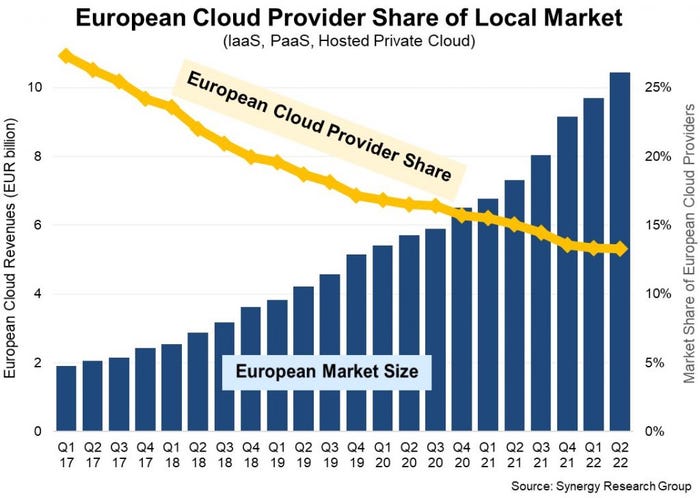

A new report from Synergy Research Group says that European cloud revenues reached €10.4 billion in the second quarter of 2022 – over five times larger than it was in 2017. However the growth has primarily benefited the big three US providers – AWS, Google Cloud, and Microsoft Azure – while European rivals are losing market share despite increasing their own revenues.

European firms offering cloud services – the larger of which include SAP, Deutsche Telekom, OVHcloud, Telecom Italia, and Orange – collectively grew their cloud revenues by 167% in the last five years, the fly in the ointment being they are representing a smaller part of the picture each year. Their market share has dropped from 27% to 13% during the period, while the big three US cloud providers now account for 72% of the European market and are steadily growing that dominance, according to the report.

The leading European players are SAP and Deutsche Telekom who account for 2% of the market each, while the rest of it is made up of smaller players from Europe, the US and Asia, all of which are apparently losing market share.

“The cloud market is a game of scale where aspiring leaders have to place huge financial bets, must have a long-term view of investments and profitability, must maintain a focused determination to succeed, and must consistently achieve operational excellence,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “No European companies have come close to that set of criteria and the result is a market where the six leaders are all US companies. As US cloud providers continue to invest over €4 billion every quarter in European capex programs, that presents an impossible hill to climb for any companies who wish to seriously challenge their market leadership.

“Consequently European cloud providers have mostly settled into positions of serving local groups of customers that have some specific local needs, sometimes working as partners to the big US cloud providers. Some of those European cloud providers will continue to grow but they are unlikely to move the needle much in terms of overall European market share.”

The last few years have seen a boom in the cloud computing services and it’s not gone unnoticed elsewhere that the primary beneficiaries have been Microsoft, Google and Amazon. The three companies are clearly surging ahead in terms of market share everywhere and of course making money hand over fist in the process.

It’s got to the point where UK comms regulator Ofcom has launched an investigation into whether the massive dominance of the big three raises any competition concerns. In a similar picture to the rest of Europe, Ofcom values the cloud services market at £15 billion in the UK, and reckons Microsoft Azure, Google Cloud and Amazon Web services account for 81% of revenues within it. If it concludes yes, this is bad for competition and ultimately customers, then there could be further action taken.

It’s hard to see what can really be done about all this however, either from the perspective of a smaller cloud player or a government regulator like Ofcom. If you’re the former, probably the only card you have to play is some sort of region specific offering that’s more tailored and customer service orientated than something like AWS, which is targeted at no sector, region, or function in particular. If you’re the latter, it’s not clear what impact any Ofcom ruling would have on the momentum of the three firms. Since they are US based, presumably any meaningful intervention would need to come from the US government.

It’s also worth pointing out no one seems to be accusing the three firms of doing anything wrong in order to get where they are. By virtue of scale, ability, brand awareness or whatever, they just seemed to have won the market between them. And it would be worse if just one firm had a corner on the market, as Microsoft sort of did in the PC software market a few decades ago.

There are plenty of noises being made by various legislative bodies around the world as to the rising influence of big tech in general over almost every aspect of our lives – a recent ‘listening session’ by the US government looked at such things as the effect of big tech on the broader markets in which they operate, data privacy, the excessive power and influence of their algorithms and the effect of social media on the mental health of children.

Obviously some of this goes much wider than market share of a particular segment – but often the questions of data privacy and social media responsibility involves the same companies, because part of how Big Tech gets So Big is down to how many additional sectors they have expanded into in the last decade, often by absorbing smaller players into the corporate blob via huge sums of cash.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)