Major satellite players and telcos aim to run IRIS²

A number of major satellite companies, telecoms operators and others have come together to bid for the right to implement the EU's IRIS² low-earth orbit satellite project.

May 3, 2023

A number of major satellite companies, telecoms operators and others have come together to bid for the right to implement the EU’s IRIS² low-earth orbit satellite project.

The consortium this week announced that it will be run by Airbus Defence and Space, Eutelsat, Hispasat, SES and Thales Alenia Space, with the backing of a core team from Deutsche Telekom, OHB, Orange, Hisdesat, Telespazio, and Thales. The group is responding to the publication of a tender the tender published by the European Commission a month ago, which aims to award a concession contract for the implementation of the EU’s €6 billion secure connectivity programme.

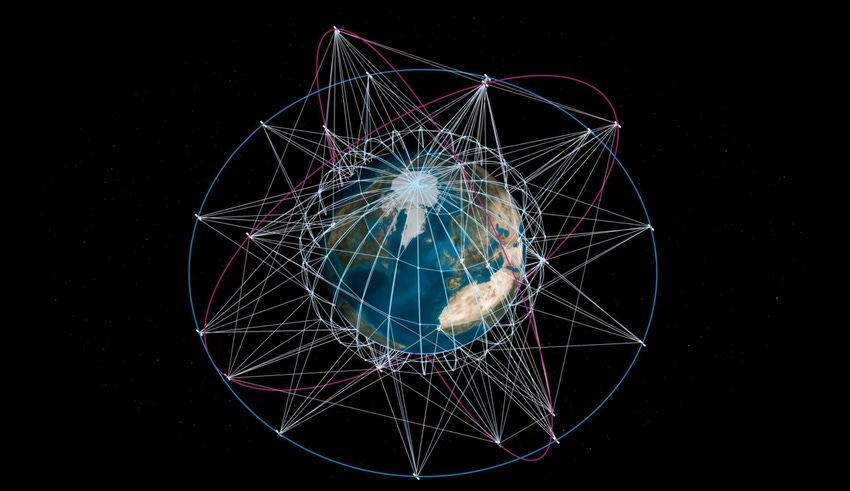

The Infrastructure for Resilience, Interconnectivity and Security by Satellite constellation, or IRIS², as it is better known, is essentially an EU-backed alternative to the likes of Starlink and other LEO satellite projects. Brussels is after a homegrown, EU government-backed secure, space-based connectivity programme that will support member states’ security needs, connect critical infrastructures, carry out crisis management and take on border and maritime surveillance.

Or as the new group of space and telecoms players puts it, “together, they will aim to create a state-of-the-art satellite constellation based on a multi-orbit architecture that would be interoperable with the terrestrial ecosystem.”

The Council of the European Union gave the final go-ahead to IRIS² in March, just over a year after the €6 billion project was first formally presented. The plan covers the 2023-2027 period, with the first early services due to start next year, followed by full operational capability by the end of the four years.

Last year Brussels said it would contribute €2.4 billion to the project – based on prices at the time – with the remainder of the sum to come from the private sector.

And judging by Tuesday’s announcement from the space companies and telcos, the private sector is pretty interested in getting involved.

However, while the various parties confirmed they had inked their IRIS² partnership, and had plenty to say on the subject of collaboration, European sovereignty, and so forth, they shared no details on the financing of the project and very little on what it will entail for them.

They will set up a European space and telecoms team between them that will be built on their collective experience in secure satellite communications solutions, they said. The consortium is not a closed group, but rather is encouraging the participation of others, including start-ups, mid-caps and SMEs, to bring about “a more innovative and competitive European space sector where new business models will emerge.” That’s the thinking anyway.

“The integrated team aims to foster collaboration among all European space players across the whole connectivity value chain with a view to enabling EU’s strategic autonomy through the delivery of sovereign, secure and resilient government services to protect European citizens,” the consortium’s statement reads.

“The team will leverage synergies between government and commercial infrastructures,” it continues. “The teaming partners are also well positioned to provide commercial services to bridge the digital divide across European territories and to increase Europe’s global outreach and competitiveness as a space and digital power on the global market.”

Scant on actual detail and peppered with buzzwords and phrases… but that’s probably to be expected at this stage in proceedings.

The key thing to note at this stage is that the project is proceeding quicker than we might have expected. And that’s a big plus point for the EU.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)