Helios Towers hails revenue growth in H1 2022, driven by M&As

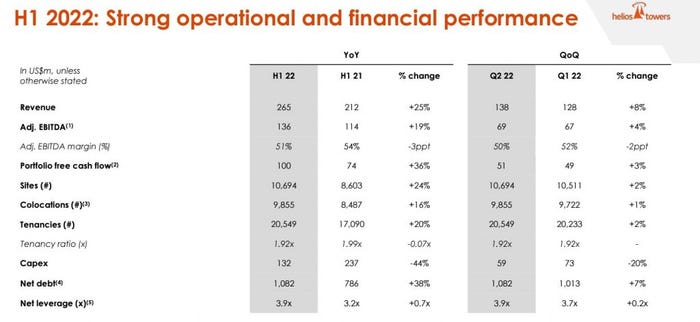

UK-based telecommunications tower company Helios Towers reported today 25% revenue growth YoY in H1 2022 to US$265.4 million, predominantly driven by acquisition sprees across Africa.

August 18, 2022

UK-based telecommunications tower company Helios Towers reported today 25% revenue growth YoY in H1 2022 to US$265.4 million, predominantly driven by its acquisition sprees across Africa.

Excluding the acquisitions in Senegal, Madagascar and Malawi, the towerco reported its revenue increased 12% YoY while results at Group level saw organic growth from tenancies increase by 20% YoY. Additionally, CPI and power price escalations have also had an impact on its results in the first six months of 2022 providing an “effective hedge” against economic volatility.

Meanwhile, its operating profit reached US$39.8 million in the first half of this year, increasing 48% YoY. As a result, Helios is sticking with its guidance for the remainder of the year as it aims to reach 1,200 – 1,700 organic tenancy additions, predominantly via new sites, and an adjusted EBITDA of 51-51% (a decrease from 53.6% in FY2021) due to acquisition plans.

“We have delivered strong organic tenancy growth in the first half of the year, which combined with the successful integration of acquired assets in Senegal, Madagascar and Malawi has resulted in impressive year-on-year financial performance.” said Tom Greenwood, CEO at Helios. “Despite broader global macroeconomic uncertainty, our uniquely positioned platform, highly visible base of quality earnings and unparalleled structural growth continues to drive sustainable value creation for all of our stakeholders.”

For those interested in the details of Helios Towers’ H1 2022 results, please see below:

With an increasing number of operators offloading their passive assets and towers to recoup some capital, Helios has had a good ride with its portfolio expansion strategy through M&As. The tower co has a presence across ten Middle East and African countries and more than 14,000 sites. The company is also currently pursuing the final steps of its acquisition of a 70% stake in Omantel’s passive infrastructure assets as well as Airtel Africa’s tower assets in Gabon, both expected to close by year-end.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)