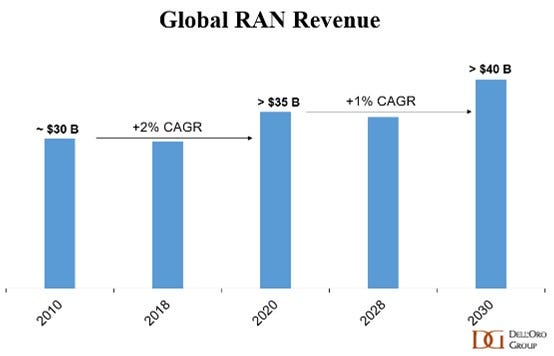

Dell'Oro optimistic about long-term RAN market prospects

Dell'Oro Group's RAN 2030 Advanced Research Report asserts that, despite the uncertainties in the RAN market, there are reason to be optimistic about it’s long-term growth prospects.

November 6, 2023

Dell’Oro Group’s RAN 2030 Advanced Research Report asserts that, despite the uncertainties in the RAN market, there are reason to be optimistic about it’s long-term growth prospects.

The report says that after growing at a 2% CAGR (compound annual growth rate) in the 4G era, global RAN revenues are projected to increase at a 1% CAGR between 2020 and 2030, ultimately culminating in investments of over $40 billion at the end of that period.

The ‘base case scenario’ is built on the assumption that RAN revenues peaked in 2021, and will continue to trend downward before picking up momentum in the latter part of the decade – so this is a message of optimism for the long term rather than the short or medium term for the market, which has been stuttering of late.

“The economic forces that have shaped the Radio Access Network (RAN) market over the past 30-plus years are expected to influence risk appetite and RAN investments for the remainder of this decade,” reads the release. “Despite the current period of heightened uncertainty and increased scepticism about the telecom and RAN outlook, our long-term perspective on this market remains unchanged.

“We believe that the tangible and intangible assets operators have amassed over the past decades are essential for addressing the evolving connectivity needs of consumers and businesses. While new business models and competitors will emerge, we still foresee operators playing a leading role in providing connectivity by the end of this decade.”

However the Dell’Oro report also says RAN’s growth prospects ‘remain challenging’. Operators can increase capital intensities over the short term with the deployment of new technologies but that acceleration tends to be temporary, we’re told, which creates a ‘relatively flat RAN trendline over time, ultimately limited by operator revenue trends.’

It points to opportunities around Fixed Wireless Access (FWA) and private network deployments as key to ’compensating for tepid Mobile Broadband (MBB) advancements.’

The report also claims that macro RAN deployments will dominate the first 6G wave, cloud RAN will play a leading role in 6G from the off, and small cells will comprise around 15% of the 2030 RAN market.

In August, Dell’Oro said that RAN sales declined at their fastest pace in nearly seven years during Q2 of this year. According to that report, following the ‘intense ramp-up’ from 2017 through 2021, RAN revenues stabilized in 2022 and the first quarter of 2023, however market conditions worsened in Q2 resulting in the year-on-year decline.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)