5G could unlock $150bn cloud gaming opportunity

Telcos are staring at a potential $150 billion revenue opportunity if they can tap into growing demand for cloud gaming over 5G.

September 14, 2020

Telcos are staring at a potential $150 billion revenue opportunity if they can tap into growing demand for cloud gaming over 5G.

This is according to a study commissioned by network software vendor Ribbon that was carried out by SapioResearch. It found that 79 percent of hardcore gamers would consider switching their home broadband and mobile service to 5G if it meant they would get a better gaming experience. Of that proportion, the majority would pay extra for the privilege, with around 60 percent prepared to pay more than a 50 percent premium over their current tariff.

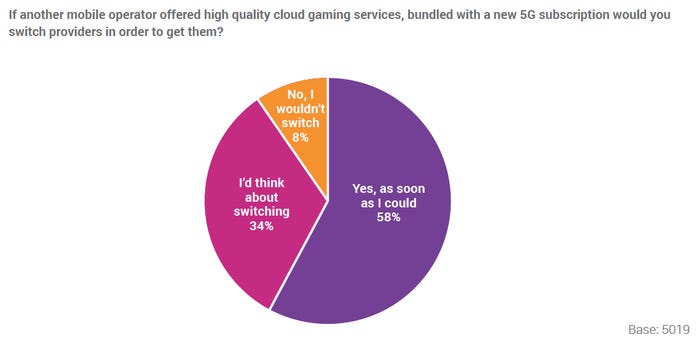

The study quizzed more than 5,000 consumers across five countries who admitted to spending at least three hours per day playing videogames before coronavirus lockdowns gave them even more spare time to devote to it. 58 percent of them said they would churn as soon as possible to an operator that bundled a cloud gaming service with a 5G package.

“The research clearly shows that these avid gamers present a highly addressable audience for carriers. They are aware of the Internet speeds they receive, understand the detrimental impact of latency on their gaming experience, and are prepared to spend what it takes to negate these issues,” said Patrick Joggerst, CMO and EVP of business development at Ribbon, in a statement.

“Carriers that invest in and build standalone 5G networks will be the first to offer advanced connectivity and will find themselves well-positioned to form new partnerships with gaming content providers and dominate the 5G cloud gaming sector accordingly,” he added.

Indeed, an operator could offer network slices to cloud gaming providers that would guarantee a decent connection. The gaming platform benefits from being able to offer a more reliable and stable experience, while the operator enhances the appeal of its 5G service to a demographic that is willing to pay for it. “Cloud gaming, combined with 5G,is a gainful area for carriers to address,” Joggerst said.

Juniper Research recently predicted that global videogame revenues will grow to $200 billion per year by 2023, up from a predicted $155 billion this year. The fastest growing segment of the videogame sector is expected to be mobile and cloud gaming.

Telcos are already well aware of the opportunity, and many of them are already taking steps to capitalise. Some, like Deutsche Telekom with MagentaGaming, are going all in by launching their very own cloud gaming services, pitting themselves directly against online platforms like Google Stadia, Apple Arcade, and Microsoft xCloud, for instance.

Others meanwhile are aligning their brands with established names in the videogaming market. For example, Verizon has sponsorship deals with esports brands and game-streaming service Twitch. Vodafone and Telefonica are striking similar partnerships in Europe.

As standalone 5G networks begin to roll out, and as uptake accelerates, some of those operators that have already got a taste for the videogaming market may well try and take a bigger bite out of it.

“5G-native networks leverage advanced technologies including network slicing to offer deterministic performance, high speed, and strict service guarantees,” Joggerst said. “These capabilities will help usher in new business and use cases for carriers to capitalise on.”

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)