Altnets call for structural separation of BT and Openreach

The Independent Networks Cooperative Association (INCA), which represents the UK's alternative network operators, has called for a dramatic re-shaping of the market.

September 14, 2023

The Independent Networks Cooperative Association (INCA), which represents the UK’s alternative network operators, has called for a dramatic re-shaping of the market.

In a new report (PDF), it argues that competition in the fixed broadband sector is being jeopardised by Ofcom regulations that benefit incumbent BT’s infrastructure arm, Openreach.

INCA also notes that BT – as the largest ISP in the country – has committed to only use Openreach for its retail broadband networks, which also puts altnets at a disadvantage. Reason being, said INCA, is because altnets need large-scale ISP customers to help them pay for their networks. The current situation also has the potential to lead to unnecessary network overbuild in parts of the country that are too small to support multiple wholesalers.

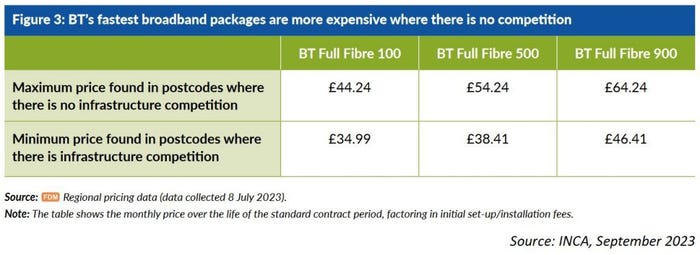

That said, the report also provides evidence that BT charges substantially lower prices for broadband in locations where Openreach faces competition from a rival wholesaler (see table) – so there are clearly some benefits to overbuild. You will note, however, that INCA chose to compare maximum prices in some areas with minimum prices in others, so it doesn’t really prove anything.

Nonetheless, INCA recommends some radical remedial measures.

Most eye-catching of which is the call for a full structural separation of BT and Openreach. The two are already functionally and legally independent entities, with the latter having separate management, brand, and board, as well as a regulatory requirement to offer equal treatment to BT and its rivals.

However, INCA argues that BT’s exclusive use of Openreach proves that the two still share strong common interests, and calls into question Openreach’s stated independence from the rest of BT Group.

“Enough time has been allowed for functional and legal separation to deliver, and both have failed,” said INCA chief executive Malcolm Corbett. “It is therefore time for a full structural separation of the passive infrastructure components of Openreach from the remainder of the group.”

Doing so would give BT the freedom to work with whichever provider offered the best combination of coverage, technology, service and price in a given area, said INCA, and remove any obligations to use Openreach simply due to their common ownership.

It is not difficult to imagine what Openreach’s counterargument would be.

It is the UK’s biggest wholesaler, and its FTTP network currently passes 11.5 million premises across the UK, which includes 3.7 million in the final third of the country that is hardest to reach. It plans to more than double its footprint to 25 million premises by December 2026. It will doubtless argue that it can only make that kind of investment as part of a larger group, and when it has the certainty that comes with having an ISP the size of BT as a long-term anchor customer.

It would also doubtless point out that there is plenty of retail competition, which keeps a lid on prices paid by end users, which is a more important factor than the number of networks.

Meanwhile, as well as splitting BT and Openreach, INCA also thinks changes might be needed at telco watchdog Ofcom.

It argues that Ofcom juggles too many responsibilities, being in charge of not just regulating telecoms and spectrum, but also TV, radio, and streaming services, and the postal service.

“We are concerned that Ofcom is distracted by its large portfolio of responsibilities, many of which are the subject of significant press and political attention,” said INCA. “To prioritise telecoms and broadband it may be necessary to consider organisational or structural changes to Ofcom itself.”

INCA also said that assumptions that Ofcom makes around the current structure of the wholesale broadband market and how it expects it to function are frequently at odds with the government’s aim of encouraging more competition.

These include encouraging new entrants in densely-populated urban areas but making the broad assumption that only Openreach will bother investing in rural and economically less viable areas. INCA also claims Ofcom offers regulatory support to larger rivals of Openreach, but not smaller ones.

Ofcom is also accused of assuming that Openreach will deliver on its rollout pledges, while altnets are more likely to miss theirs.

Ofcom’s approach differs “distinctly from government policy to actively encourage market entry of (by definition) small new market entrants to build new full fibre networks across the UK in both urban and rural setting,” INCA said.

It recommends that “Ofcom should explain how each of its telecoms-related decisions further the implementation of the government’s policies in each Ofcom telecoms consultation and decision document and in an annual report.”

These are just the highlights. In all, INCA has made a total of seven recommendations (see here), all of them calling for the government and Ofcom to do more to support altnets.

It is hard to see how INCA will make much headway with its recommendations.

While its grievances may well be justified, and backed up by evidence, all the while fibre networks continue to expand, and retail competition is healthy, the government and Ofcom are likely to conclude that although the market isn’t perfect, it is functioning well enough for now.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)