After reaching milestone, TIM Brasil needs to ensure sustainable growth

TIM Brasil, after achieving the number two spot in the Brazilian mobile market last August, hit another milestone in April. For the first time, the operator has beaten its competitor Vivo in the metropolitan region of Sao Paulo. In April, TIM reported a market share of 31.8 per cent in the code 11 area, which covers Sao Paulo, while Vivo’s share was 30.9 per cent. The achievement is significant, given that the Sao Paulo metropolitan region has about 20 million inhabitants and the country’s highest GDP.

May 30, 2012

TIM Brasil, after achieving the number two spot in the Brazilian mobile market last August, hit another milestone in April. For the first time, the operator has beaten its competitor Vivo in the metropolitan region of Sao Paulo. In April, TIM reported a market share of 31.8 per cent in the code 11 area, which covers Sao Paulo, while Vivo’s share was 30.9 per cent. The achievement is significant, given that the Sao Paulo metropolitan region has about 20 million inhabitants and the country’s highest GDP.

TIM’s success can be attributed to its portfolio of new plans launched in 2009, dubbed Infinity and TIM Liberty, which have boosted its financial results and market share. Infinity is a prepaid plan that charges for only the first minute of calls to TIM numbers, both fixed and mobile.

TIM Liberty is aimed at postpaid customers and offers unlimited on-net calls. TIM also has an attractive data-plan portfolio, with prices starting at BRL0.50 (US$0.25) a day. Undoubtedly, TIM’s results are impressive. But mobile market growth is sustainable only if followed by network investment. TIM, whose subscription base grew 25.6 per cent from 2010 to 2011, is already struggling to continue expanding without compromising network quality. Recently, the Brazilian Federal Court prevented the operator from selling new mobile lines in the states of Pernambuco and Ceara because of network-quality problems.

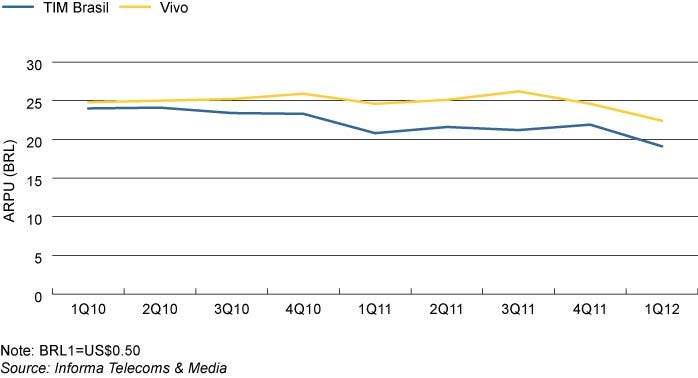

Attractive and competitive offers do help attract new customers in the short term, but in the long run, TIM will need to do more to retain subscribers. The provision of high-quality and reliable mobile services is fundamental to maintaining consistent growth. Vivo, by investing heavily in network expansion and upgrades, has been able to attract high-end users (22 pe cent of postpaid subscribers, in contrast to TIM’s 14.4 per cent), and maintain market leadership, with a 29.8 per cent share and higher ARPU than TIM’s.

Fig 1: Blended ARPU by operator, 1Q10-1Q12

Vivo has made significant investments in 3G since the launch of services at end-2008. It upgraded 100 per cent of its 3G network to HSPA in 2010, and in 2011 launched HSPA+ in the Sao Paulo metropolitan region.

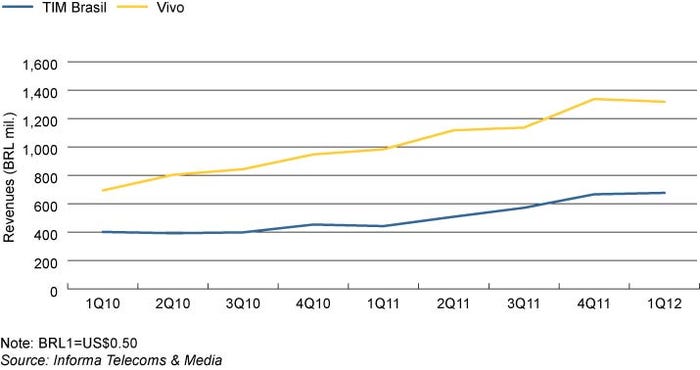

But TIM has not sustained its 3G deployment in a similar fashion. In April this year, its 3G network coverage was only 20 per cent that of Vivo, which has extended its signal to 2,727 cities. As a consequence, TIM has not been able to take full advantage of the strong demand for data services in country. Despite significantly increasing its customer base, including mobile broadband subscriptions, in 1Q12, TIM’s data revenues were still 48.7 per cent lower than Vivo’s, while the difference in market share by subscriptions was only 2.87 percentage points.

Fig. 2: Data revenues by operator, 1Q10-1Q12

The LTE spectrum auction in June is an opportunity for TIM to improve the quality of its customers’ mobile broadband experience. The technology will enable the operator to offer higher speeds, targeting the high-end users who most value service quality. TIM could also use LTE for network offloading, improving the quality of 3G services as well. The amount of spectrum available for 3G networks is limited, so TIM will be left behind if it does not acquire 4G licenses. The demand for mobile broadband is booming in Brazil, and TIM must be able to provide a high quality of service if it wants to continue growing, both in revenue and

subscription terms.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)