Amazon muscles in on Premier League Football market

Amazon has been announced as the latest rights holder of the English Premier League, as the sports market becomes even more fragmented and expensive for fans to follow.

June 7, 2018

Amazon has been announced as the latest rights holder of the English Premier League, as the sports market becomes even more fragmented and expensive for fans to follow.

As part of the deal, Package F, Amazon will now be able to broadcast 20 matches per season from one Bank Holiday, boxing day, and one midweek fixture programme, which will also be in December. Both rounds of games will be available to Prime subscribers, including in the cost, as well as various different highlights packages.

“We welcome Amazon as an exciting new partner and we know Prime Video will provide an excellent service on which fans can consume the Premier League,” said Premier League Executive Chairman Richard Scudamore.

Amazon is slowly edging its way into the sports market, adding the Premier League to American Football content and its partnership with the ATP World Tour and US Open Tennis, as well as dozens of sports docu-series. There have been rumours the business is investigating other major sports in the US, such as basketball and baseball, though the Premier League move should be seen as nothing more than a tentative step for the moment.

“The last two packages were sold at a discounted rate and you can hardly base a media strategy on two days of sport per season so there might be some questions around the packaging of the rights,” said Ed Barton of Ovum. “As it is, Amazon has an opportunity to test how valuable EPL is and how effective it is at monetising those rights without making an outsize financial commitment.

“Advertising, subscription and sponsorship models are all likely to be given a workout. Will the rights lead to an uptick in Prime subscriptions or reduce churn? Does the linear nature of sport translate into higher value advertising? Can they funnel some of that EPL audience into buying stuff on Amazon? Will they pad Twitch’s audience with the mostly male viewers who want to watch the football?”

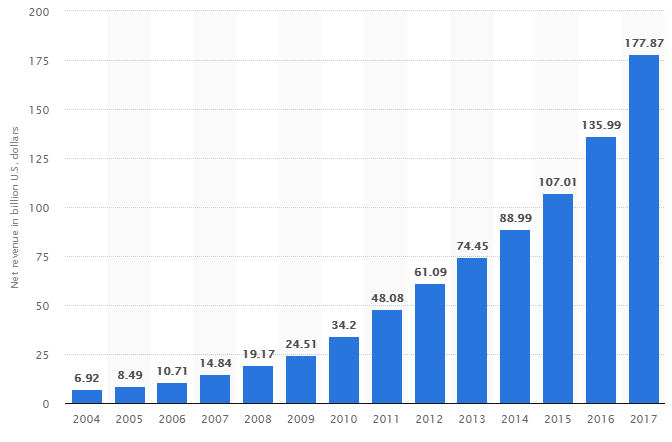

Net Sales Revenue ($Billion) Of Amazon From 2004 To 2017 (Statista)

While it is only a brief foray into the world of sports, it will either offer fuel for ambition or a quick lesson in fail fast exploration. Premier League Football has consistently been the headline attraction of Sky, but there have been questions surrounding the value of such content in today’s society. As Barton points out, leaning into other revenue streams in the Amazon business model could be a successful venture, as it is questionable whether a standalone sport business model can be successful.

BT is one company which has suffered in the content world, taking the opposite approach to Amazon. The full-steam-ahead approach to establish BT in the world of sports content might have had some early success, a lack of supporting content in other genres might explain why subscription numbers headed south in the last two quarters. There will of course be various explanations for this, but the BT Sport experiment does not look to be a raving success.

That said, CCS Insight’s Paolo Pescatore thinks the repercussions could be positive for BT.

“Overall, this is also great news for BT with its TV platform the only place where users can watch all the Premier League matches from 2019, thanks to its content relationships with Amazon and Sky (for Now TV). And let’s not forget it has secured more games and the cost per game has come down,” said Pescatore. “The Premier League rights is a great addition to the ATP tennis rights it secured last year. Both come into effect next year – rivals, should watch out!”

However, should the experiment prove to be a success Amazon Prime customers should expect a bump up in price, or at least to be offered sport content as a premium feature. Pescatore pointed out the current model, £79 per year or £7.99 a month, is not sustainable for the internet giant should it want to expand its presence in the sports arena.

“We believe that Amazon will introduce a new sports channel bundle for Prime subscribers,” said Pescatore. “Also, it could seek to introduce advertising to support its push into linear TV. Another option could be events based advertising. This way it will benefit from new streams of revenue. Undoubtedly, Amazon is pulling together a strong and growing set of live TV rights to complement its vast content relationship.”

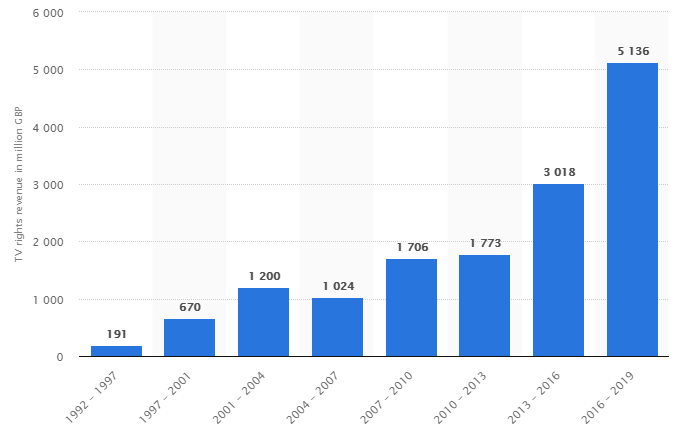

Premier League Tv Broadcasting Rights Revenue From 1992 To 2019 (Statista)

One question which some might ask is whether this is a sensible strategy from the Premier League. Maximising revenues through different rights holders is obviously a sound business strategy, but crossing over so many distributors in the same geography is questionable.

Initially, when Sky was the sole provider of Premier League football in the UK the value was unquestionable. It secured 100% of the audience, admittedly for a notable expense, but there was obvious ways to monetise the investment through advertising as the numbers were significant. Through the last few years the price per game has increased, though it has dipped slightly this time around, but the number of different ways to watch the sport has increased. The initial outlay has increased, as has the competition to secure subscribers. Sky is now paying more for a smaller audience; the value is starting to come into question.

With Amazon thrown into the mix now as well, consumers are being pulled every direction. It might become too expensive to watch every single game before too long, and it would not be unsurprising to see one of the rivals pack in sports ambitions as it becomes increasingly complicated to generate ROI. The Premier League might be fighting to bleed the assets dry right now, but whether this damages the long-term prospects of the business remain to be seen. If Sky decides to move the focus away from sports and invest elsewhere, clawing back that investment in the future might be difficult.

Moving away from the philosophical pondering, the now is quite clear; the Premier League is winning and rolling in cash, while the consumer is losing.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)