SoftBank group back in black after investment rebound

Shareholders in Japanese tech conglomerate SoftBank are having to come to terms with the fact that it’s now effectively an investment fund.

August 11, 2020

Shareholders in Japanese tech conglomerate SoftBank are having to come to terms with the fact that it’s now effectively an investment fund.

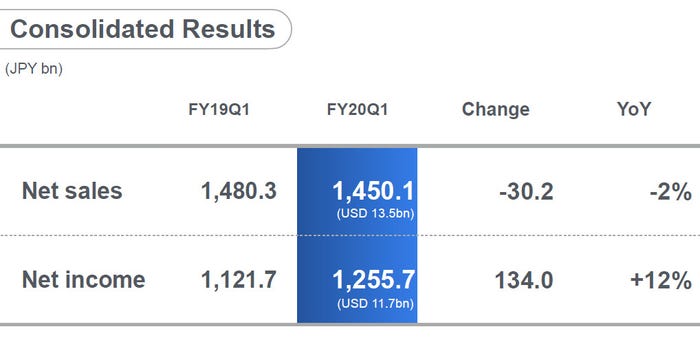

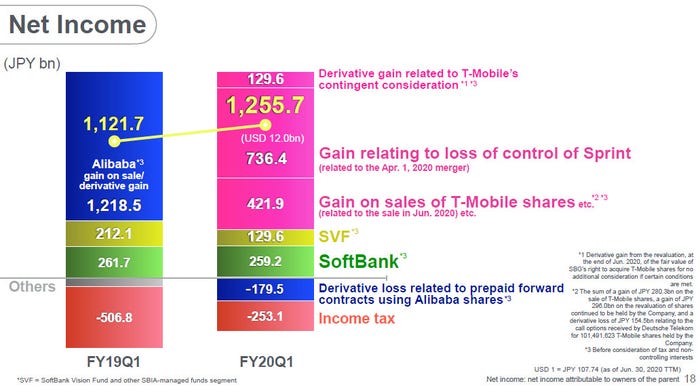

As anyone who owns such funds will know, their value is largely dependent on the currents affecting the global stock markets and the same seems to apply to SoftBank group. In calendar Q1 2020 SoftBank reported a loss of $12.5 billion thanks to a bunch of its Vision Fund investments tanking as the coronavirus crisis kicked in. A quarter later it flipped that picture to an $11.7 billion profit as stock markets rallied from their March nadir.

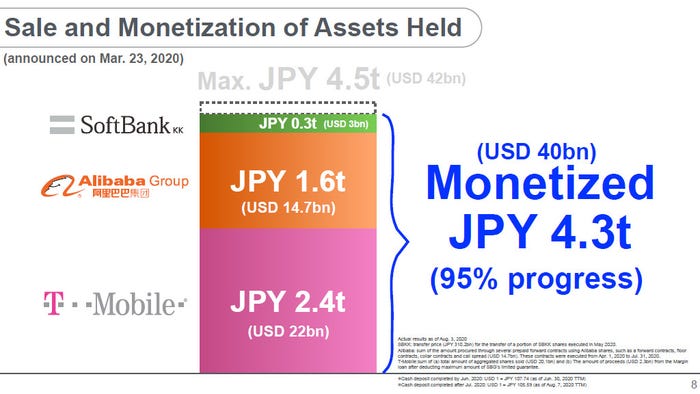

SoftBank’s rebound owed as much to flogging assets as anything else, however, with all the mucking about involving Sprint and TMUS combining with the previous flogging of a big chunk of its Alibaba holdings to raise close to $40 billion.

There was an air of vindication to the SoftBank presentation, almost as if it resented the anxiety felt by investors after its previous earnings. There were no strange unicorn metaphors this time, just a clear statement that investors should wind their necks in, as everything’s under control.

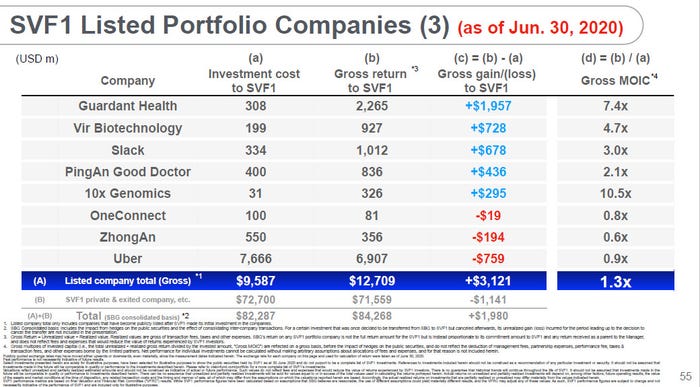

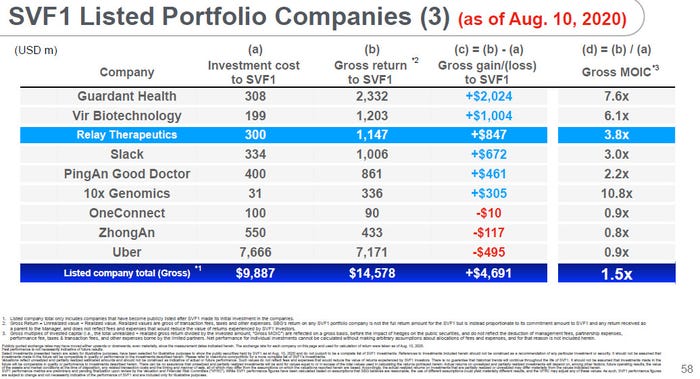

To labour the point further SoftBank presented the following two tables to show what a difference a month or so makes when it comes to playing the markets. The company seems to be especially pleased with its biomedical investments and, in a separate slide, flagged up US domestic insurance company Lemonade, which uses AI to do everything quicker, and has contributed around half a billion bucks of investment gains to the SVF.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)