Ericsson shares plunge 10% as turnaround remains elusive

Ericsson’s Q2 2017 numbers contained few highlights and its guidance was mainly downbeat, resulting in a further significant fall in its share price.

July 18, 2017

Ericsson’s Q2 2017 numbers contained few highlights and its guidance was mainly downbeat, resulting in a further significant fall in its share price.

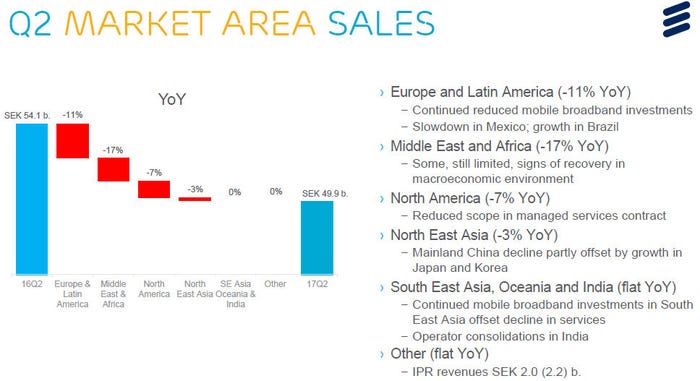

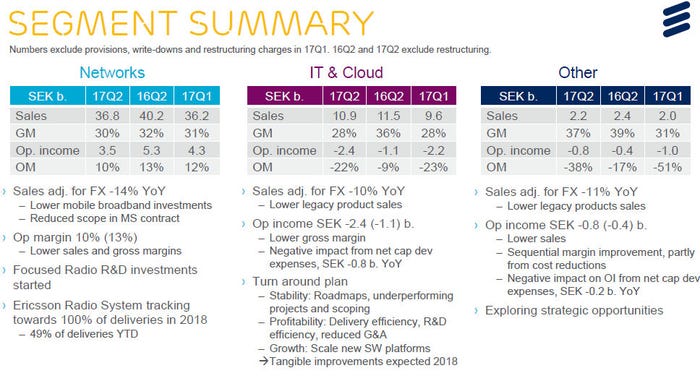

Revenues were down 13% year-on-year, when adjusting for constant currency, and that decline was spread pretty evenly across the world, with EMEA and the Americas all looking especially weak. The Networks business segment accounted for nearly all of that decline, with software sales especially disappointing, although IT & Cloud and Other both declined too. There was no news regarding the anticipated sale of the Media unit.

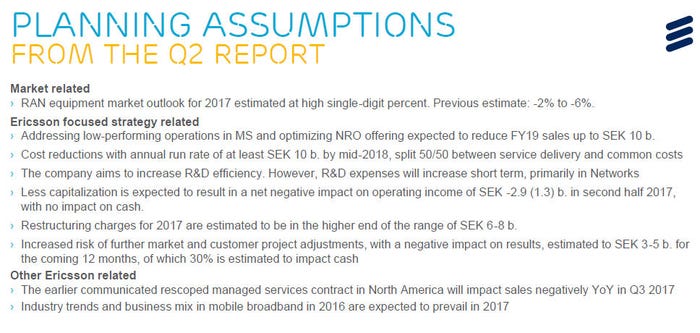

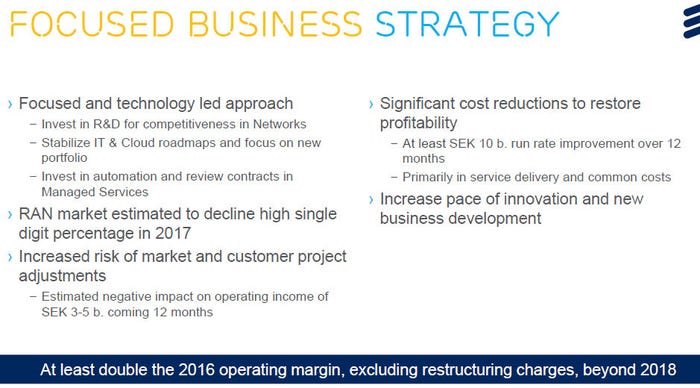

On the analyst call CEO Börje Ekholm sounded pretty downbeat and apologetic. When the numbers aren’t great CEOs like to focus on what highlights they can find but, other than reiterating his determination to sort things out, there were few available. On top of the weak numbers Ericsson adjusted down its general RAN market outlook to ‘high single digit percentage decline’ from more like -4% the previous quarter. He also lamented that operators seem to be more ken on investing in the fibre backbone than RAN kit these days.

We are not satisfied with our underlying performance with continued declining sales and increasing losses in the quarter,” said Ekholm. Execution of our focused business strategy is gaining traction. However, in light of current market conditions, we are accelerating the planned actions to reduce costs.

“One key component in our focused business strategy is to reduce costs and increase efficiency. In light of the current market outlook, we will accelerate our actions to ensure that we can meet our target of doubling the 2016 operating margin beyond 2018. Actions will be taken primarily in service delivery and common costs and do not include R&D. Our plan is to implement cost savings with an annual run rate effect of at least SEK 10 b. by mid-2018, of which approximately half will be related to common costs.

“In light of current market environment and company performance, we are accelerating actions to reduce costs. Our focused business strategy is designed to take us back to technology and market leadership and improve company performance, also in a tough market. We see initial signs of traction in strategy execution including increased investments in R&D in Networks and ramp up of deliveries of Ericsson Radio System, increasing our competitiveness in the market.”

Analysts were especially keen to get more detail on why Ericsson has downgraded its RAN market outlook but few specifics were forthcoming. They also wanted to know why Ericsson continues to write down the value of existing deals but once more the guidance was vague, effectively amounting to ‘shit happens’.

At time of writing Ericsson’s shares were down around 10% following the Q2 earnings announcement. It seems there is limited sympathy for continued lamentations about weak market conditions and, right now, Ericsson is providing investors with little reason to anticipate a turnaround anytime soon.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)