Global smartphone recovery hampered by component shortages

The Q4 21 global smartphone shipment numbers show the recovery from the Covid slump of 2020 has been hampered by the chip crisis.

January 28, 2022

The Q4 21 global smartphone shipment numbers show the recovery from the Covid slump of 2020 has been hampered by the chip crisis.

Strategy Analytics was first out of the blocks this time, so we’re using their numbers. We use whoever offers numbers first so previous quarter, and thus full-year, tallies in the table we present below may differ from SA’s. It doesn’t really matter, though, since all analyst numbers are educated guesses anyway, and the variation isn’t that great between them.

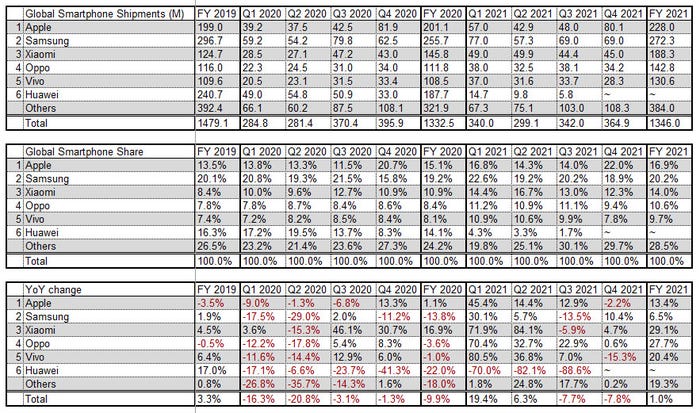

“Global smartphone shipments fell -3% YoY to 365 million units in Q4 2021,” said Linda Sui of SA. “Factory constraints and component shortages continued to restrict smartphone supply in the final quarter of last year. Full-year smartphone shipments rose +5% YoY to 1.36 billion units in 2021, recovering from a sharp Covid-led decline of -8% YoY during 2020.”

As you can see from the table, most of that year-on-year recovery was banked in the first quarter of last year, after which it seriously lost speed. The novel situation we find ourselves in is that it’s restricted supply rather than muted demand that is hitting the numbers. It’s also worth noting that SA has stopped bothering with Huawei, which seems fair enough. Having said that, the affiliated totally independent Honor brand seems to be going from strength to strength.

“Global competition among other major smartphone brands, beyond the top-five, was fierce during Q4 2021,” said Neil Mawston of SA. “Honor, Lenovo-Motorola, Realme and Transsion all outperformed the overall market and posted double-digit growth rates. Honor continued to soar in China. Lenovo-Motorola gained share from LG in the Americas. Realme had a very strong quarter in India, China, and elsewhere. Transsion held firm across the Africa region.”

“We forecast global smartphone shipments to grow a mild +3% YoY in full-year 2022,” concluded Sui. “This year will be a tale of two halves. Component shortages, price inflation, and Covid uncertainty will continue to weigh on the smartphone market during the first half of 2022, before the situation eases in the second half due to Covid vaccines, interest rate rises by central banks, and less supply disruption at factories.”

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)