Regulatory Headaches: Implementation of Roaming III and strategies to manage the pain

Knowing some pain is coming does not always reduce the impact when it comes, ask anyone growing up in the pre-health and safety school playground of the 1980’s were entertainment revolved around activities any marauding Viking would be proud of. The sense of impending doom coming whenever the break-time bell rang is most likely the way European operators had been feeling in the run up to the May 10th meeting to agree the final details of Roaming III. However there are strategies one can use to reduce pain for particular ailments and the current analgesic for regualtory price capping is bundling.

May 21, 2012

By Paul Merry

Knowing some pain is coming does not always reduce the impact when it comes, ask anyone growing up in the pre-health and safety school playground of the 1980’s were entertainment revolved around activities any marauding Viking would be proud of. The sense of impending doom coming whenever the break-time bell rang is most likely the way European operators had been feeling in the run up to the May 10th meeting to agree the final details of Roaming III. However there are strategies one can use to reduce pain for particular ailments and the current analgesic for regualtory price capping is bundling.

The rules laid out in Regulation III contain provisions for strict pricing cuts with additional reductions being implemented on a 12 month rolling basis until at least 2014. Enforced cuts can be kept active until 2022 if it is felt that it is required. Effectively prices will be slashed by 46 per cent for voice and data roaming services will be cut from averages of around $4 to just $0.26 per MB by 2014 while competitors will be allowed to compete in roaming markets previously reserved for operators alone. That is should they be interested in doing so. Anecdotal evidence shows there has been little interest in the opportunities roaming offers to such players; thus far only one MVNO (Lebaro Mobile) has expressed any interest directly to the EU. No doubt other players will express an interest as the market matures and opportunities become clearer but at this point commitment from MVNOs is thin on the ground.

From the operator perspective with a voice or data bundle the per min/MB charge can be kept within the boundary of regulated price cap while room is left for potential profit. The larger the bundle offered the lower the per minute/MB charge if the bundle is completely used. However, the larger the bundle the lower the likelihood a roamer will be able to fully use the bundle.

Another important point to remember is that price caps must be offered as a Euro-tariff but it is not compulsory to offer the Euro-tariff alone; other packages and tariff offerings are sanctioned. Analysis undertaken for our latest roaming research (http://www.ic.informatm.com/spreadsheets/show/121329) demonstrates that pricing options vary with the picture for average prices in the region differing from what one would expect in a price capped market.

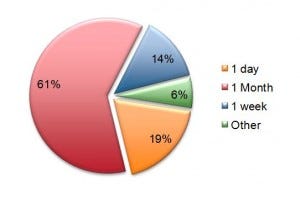

Figure 1: Selected bundled Roaming offerings average durations

Source Informa Telecoms and Media

Figure 1 shows the strong prevalence for long bundle lengths despite the average length of a roaming trip being four days for a consumer and three days for an enterprise user (frequency of calls varies between these segments).

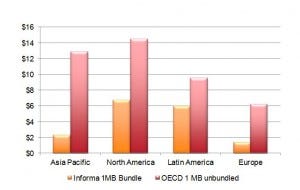

Figure 2: Regional Cost per MB bundled and unbundled data roaming plans – Average 1MB cost

Copyright Informa Telecoms and Media – 2012

In figure 2 the relative cost of 1 MB of data is compared between bundled and unbundled offerings using OECD averages and Informa bundled data roaming tariff research.

The correlation shown here between the size of the discount and the bundle compared to unbundled offerings is substantial and adds support to the claim operators are relying on roaming bundling as a mechanism to fulfil roaming price caps.

Looking at the regional variations in bundled and unbundled pricing the greatest differential is seen in the Asia Pacific region. This is due to the competitive nature in this market that see’s large data bundles offered to attract customers. The substantial differential seen in Europe is most likely an illustration of the strategy operators are using to counteract pricing regulation – encouraging bundle take-up.

The conclusion one can draw from all this is that we are heading for a future defined by roaming bundles, at least in heavily regulated markets like Western Europe. What regulators will have to say about this, if anything, remains to be seen.

Read more about:

DiscussionYou May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)