Investing in Africa tip four: Create network sharing agreements

There is some visibility of network sharing in South Africa, Nigeria and Ghana, but in general, the model in Africa remains limited. Generally an operator-led initiative, most of Africa's mobile operators remain tight-lipped when it comes to network sharing, unwilling to give away any competitive advantage.

April 1, 2010

There is some visibility of network sharing in South Africa, Nigeria and Ghana, but in general, the model in Africa remains limited. Generally an operator-led initiative, most of Africa’s mobile operators remain tight-lipped when it comes to network sharing, unwilling to give away any competitive advantage.

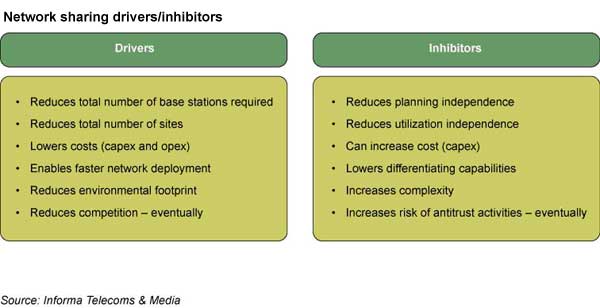

Regulatory authorities need to do more (and have started to do so) in encouraging tower sharing agreements between operators. Not only does this reduce an entry barrier for new operators, which is good for spurring competition in rural areas, but the pooling of tower infrastructure helps operators expand into rural markets thereby helping universal service obligations. Given the existence of these obligations in many markets, the network sharing concept helps operators to reduce capex levels.

The theory goes that a future investor would be wise to set up network sharing agreements – indeed if such an investor came from Europe or the Indian sub-continent, it could point to a number of successful arrangements. However, something that any investor would need to remember is that whilst network sharing would help an operator bring down costs, in Africa, structural costs would still remain high, due to power shortage and poor infrastructure. Furthermore, would existing operators really want to share their infrastructure with a new competitor?

In truth, though, there seems little reason for not introducing tower agreements. Take a market such as the DRC, where active subscription penetration remains very low at approximately 13 per cent (as of end-2009), spanning vast distances between inhabited areas is a huge challenge to operators. In such a market, many remote base stations operate off the country’s power grid running on a diesel generator needing to be re-filled regularly. This means the opex required to sustain the operator’s infrastructure is very high and for very few (and low revenue-generating) customers. Surely, in such a case, and in a market where there are six operators, all trying to protect margins whilst ensuring rapid roll-out strategies to keep abreast of subscriber growth, it would be wise to enter into a network sharing agreement.

netshare

Interestingly, network sharing has been prevalent in India for some time now with more than one third of all towers shared (as of June 2009), according to our estimates. The fact that this is the case has helped in the continued rapid rise in subscriber numbers across rural areas.

intelligencentre

Source: Intelligence Centre

Whilst most of the operators see this as a necessity – the latest wave of new operators represented by Etisalat DB and Unitech entered into tower sharing agreements immediately – the formation of a separate tower company has helped incumbents to unlock the value of their infrastructure. The attraction of additional revenues is appealing given the value created from an otherwise depreciating asset. And with operating costs relatively low, new revenues generated from tower tenancy can lead to high margins.

Airtel subsidiary Bharti Infratel owns 42 per cent of Indus Towers, formed in 2007 together with fellow operators Vodafone Essar (42 per cent) and IDEA Cellular (16 per cent). The company owns towers in regions where the joint owners operate and shares towers with tenants such as Aircel and Reliance Communications. This is a model that would be worth pursuing in a marketplace as competitive as that of Africa’s. Not that this would be unique to Africa as Helios Towers Africa received the investment required to build a network of towers and lease space on those towers to operators in the region at the end of 2009.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)