Enabling enterprises with digital BSS

Against the backdrop of the ongoing pandemic and its effect on digital transformation, telcos are turning their attention back to Enterprise.

August 16, 2021

Telecoms.com periodically invites expert third parties to share their views on the industry’s most pressing issues. In this piece Selvam Ramamoorthy of Tecnotree looks at how BSS can help operators serve enterprise customers.

Telecom operators have traditionally focused on consumer audiences, with performance ratings based on YoY or QoQ net additions of subscribers, as well as increases in the ARPU. However, with growing competition from OTTs and the increasing difficulty in adding new subscribers, Communication Service Providers (CSPs) are being forced to explore new avenues for growth and improvement of their market positions.

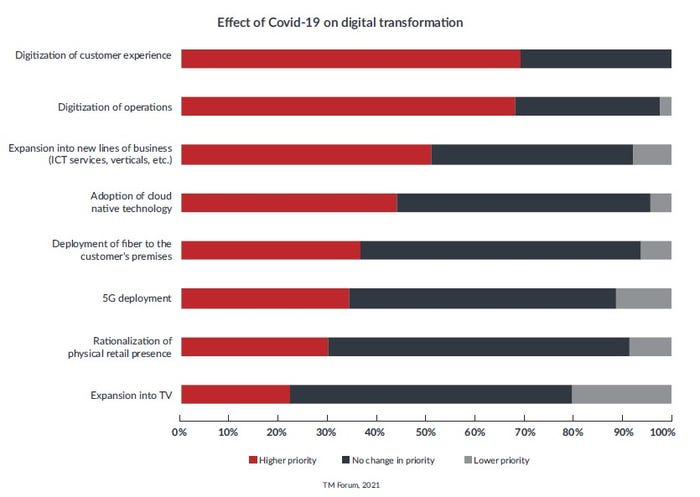

Against the backdrop of the ongoing pandemic and its effect on digital transformation, telcos are turning their attention back to Enterprise, particularly expansion into new lines of business (Information and Communications Technology services, verticals, etc.).

This is borne out by data from the most recent Digital transformation tracker, published by TM Forum. It shows that expansion is now one of top three sector priorities, eclipsing even 5G deployment.

The report also goes on to highlight that “the percentage of respondents expecting gently increasing revenues from the rollout of these services has increased by 16.5% in just over a year for CSPs”

Enterprise Services & Ongoing Challenges

Enterprise used to exist as a muted business entity. However, with operators looking to increase revenue with minimal investments, they have started focusing on different services such as:

ICT or connectivity solutions including leased line, dedicated internet and Multiprotocol Label Switching (MPLS) – all aimed at providing fixed and voice connectivity between the different locations/offices of the Enterprise,

Unified communications, driven by IP based systems

Provision of Machine 2 Machine (M2M) capabilities via SIM cards for fleet management or metering utilities such as water, electricity etc.

Other VAS services such as bulk SMS/USSD, toll free voice/SMS services

Some of these connectivity solutions have been largely influenced by the pandemic, which meant that enterprises and large organizations were forced to work remotely; establishing a need to remain connected. Enterprise customers also included starting from SOHO (Small Office Home Office) businesses with 1-10 employees, the small & medium enterprises (SMEs) with 50-500 employees and then large enterprises & Multinational Corporations (MNCs) with more than 1000 employees. Each of these segments had their own, unique set of requirements.

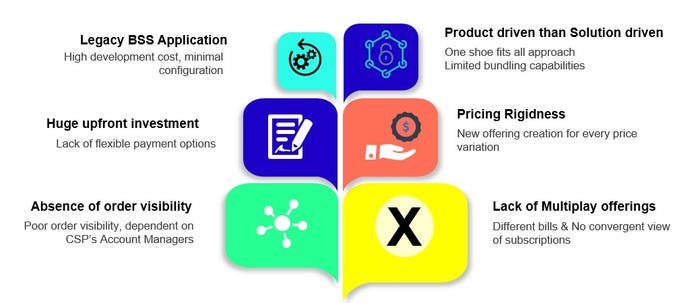

Figure 1: Enterprise Challenges

These connectivity solutions often involved multiple steps, starting with a design/desktop survey, followed by a feasibility study, and finally the implementation. This can vary from 30 – 90 days, depending upon factors such as design complexity, equipment, and workforce availability; As different teams are involved at different steps of the process, end to end tracking of orders and timely follow-up is essential for the account managers.

Key factors to consider in BSS Modernization

Given the changes in CSP priorities and increased focus on the enterprise, CSPs can only reap the associated benefits of a BSS modernization program by ensuring their underlying BSS applications meet the dynamic requirements of different enterprise segments. The key enablers of this are listed below:

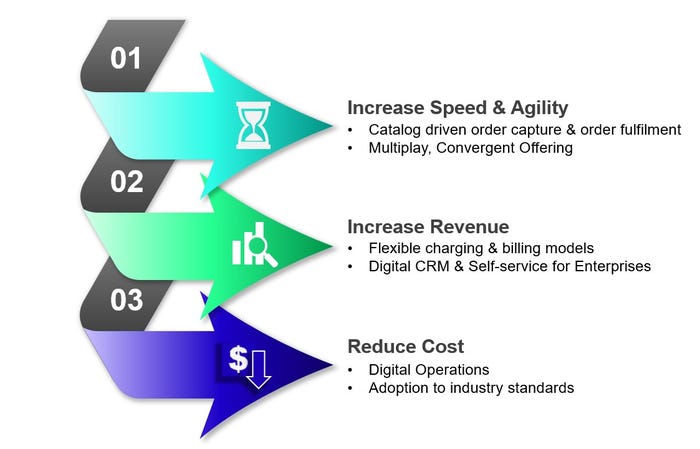

Figure 2: Enterprise Enablers

Catalog driven Order Capture & Order Fulfilment – One of the key recommendations for CSPs fulfilling the needs of the enterprise is not to create a standard set of offering and try selling to them, but to co-create these offerings from design up till launch i.e.focus on having solution approach rather than a product approach.

To be successful, the product catalog must be powerful, enabling the quick creation of offerings that have multiple characteristics and pricing options. These will enable CSPs to negotiate with enterprises through the Configure Price Quote (CPQ) process, while also ensuring they have dynamic orders generated based on the finalized offering.

Multiplay, Convergent Offering – In our experience, we have come across CSPs trying to manage their mobile business separately from enterprise business. We foresee merging and creating an augmented scope for bundles supporting multi-play and combined offerings. This will result in better customer experience and one stop shop for all of enterprise needs.

Flexible Charging & Billing Models – With the rise of try and buy, where almost all subscription-based businesses are willing to offer a free trial before the first payment, it is imperative for charging & billing systems to support this as a de facto feature. CSPs can also look at providing milestone-based billing, which saves enterprises from making upfront investment, but pay only when they are satisfied with the accomplishment of milestone.

Digital CRM & Self-Service for Enterprises – As the nature of products and services can be complex, transparency is of the utmost importance, meaning enterprises must be made aware of their subscriptions and the charges against each of those subscriptions. This must be created in the CRM application and propagated to all the customer touch points to create a seamless experience.

Traditionally, account managers used to manage enterprises via sales funnel management and CPQ processes, but since the pandemic, increasing number are keen on to digital channels, hunting new experiences and better bargains. This is where the self-service channel is crucial for enterprises – to try to mix and match different offerings, negotiate price, place & track orders, raise tickets and confirm acceptance.

Open APIs – Given the logical extension of enterprises is to explore 5G use cases for different verticals and personas, integrations are only going to become much more complex in the future. Conformance to Open APIs can make this transition easier for CSPs and reduce their integration cost, while still enabling new use cases.

Conclusion:

Enterprises are set to be the new revenue drivers for CSPs, especially as they continue to expand into ICT services and localize as per their market needs. Therefore, it is imperative that underlying BSS systems should be ready to support these ever-changing business models, while also catering to their future 5G requirements. The BSS sector should equip the CSPs to go out and try as many as new business models and scenarios, without having to worry about pricing policies, complex integrations and endless customizations.

Selvam Ramamoorthy is part of Product Office team at Tecnotree, currently handling the digital transformation requirements of global CSPs. He has been part of large transformation projects across Africa and the Middle East.

Selvam Ramamoorthy is part of Product Office team at Tecnotree, currently handling the digital transformation requirements of global CSPs. He has been part of large transformation projects across Africa and the Middle East.

Read more about:

DiscussionAbout the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)