Operator business ability linked to BSS agility

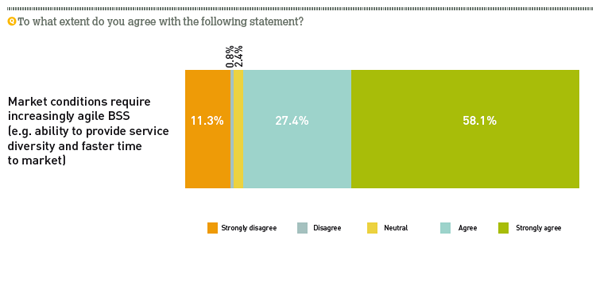

An operator’s approach to BSS (business support systems) – including billing, charging and policy - can determine how easy or challenging it is to respond to the market and maximise revenue opportunities. In a recent survey of over 100 operators by Telecoms.com Intelligence, 85 per cent acknowledged that market conditions require increasingly agile BSS systems enabling operators to provide service diversity and faster time to market.

April 9, 2014

An operator’s approach to BSS (business support systems) – including billing, charging and policy – can determine how easy or challenging it is to respond to the market and maximise revenue opportunities. In a recent survey of over 100 operators by Telecoms.com Intelligence, 85 per cent acknowledged that market conditions require increasingly agile BSS systems enabling operators to provide service diversity and faster time to market.

In March, Telecoms.com Intelligence was commissioned by Openet to discover how operators feel about their current BSS choices and their BSS plans for the future. Of the over 100 network operators that responded to the survey, there was an overwhelming sentiment that the agility of an operator is largely tied to the agility of the BSS it relies on. But with the pace of innovation certain to accelerate for the foreseeable future, operators bear the burden of legacy systems in their BSS environments that apply limitations to their agility. And specialist BSS vendors are seen as the most appropriate company type to address these issues.

It is common for network equipment providers to bundle BSS software in with the infrastructure purchase in order to enhance their proposition. This has the effect of somewhat obscuring the true cost of a BSS platform and perhaps unsurprisingly, the majority of respondents (35 per cent) use BSS from a mixture of network equipment providers and specialist companies, while a similar amount (29 per cent), get their BSS directly from their network equipment provider alone. Less than ten per cent buy from specialist providers exclusively. Going forward, more than 40 per cent of respondents do not expect their supplier mix to change within the next five years, although 28 per cent say they will actively move towards a more specialist approach. Only seven per cent expect to move the other way, suggesting a growing appreciation of specialist expertise.

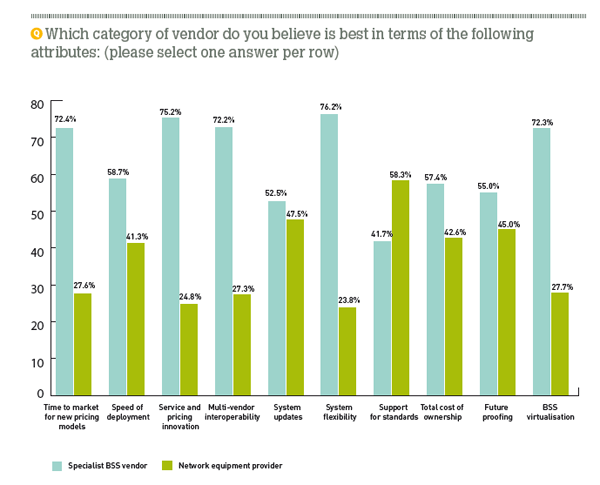

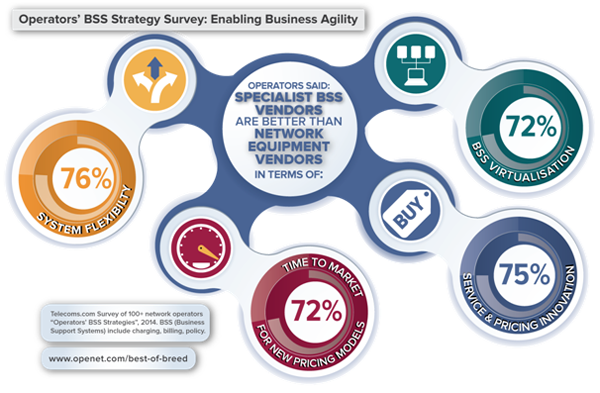

“Looking at four key attributes of business agility, over 70 per cent of the operators surveyed pointed to specialist BSS vendors for the best solutions. Operators highlighted that compared with BSS solutions from NEPs, specialist BSS vendors offered the best solutions in terms of service and pricing innovation (75 per cent), time to market for new pricing models (72 per cent), system flexibility (76 per cent) and BSS virtualisation (72 per cent),” said Corine Suscens, Senior Marketing Manager at Openet.

What’s more, there is little appetite among operators to perform their own integration of BSS software. As a result there is significant scope for collaboration between specialise BSS providers and system integrators to provide best of breed solutions, pairing functionally rich software with the specialised skill set of the system integrators.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)