Turning BSS agility into business ability

‘Agility’, a word used to gauge a company’s ability to respond to the market with flexibility, has become the operator watchword of 2014. It highlights the dawn of an era when operators require not only real-time visibility of their customer’s activity but also the ability to react in real-time to succeed.

April 15, 2014

‘Agility’, a word used to gauge a company’s ability to respond to the market with flexibility, has become the operator watchword of 2014. It highlights the dawn of an era when operators require not only real-time visibility of their customer’s activity but also the ability to react in real-time to succeed.

In March, Telecoms.com Intelligence set out to discover how operators feel about their current BSS choices and their BSS plans for the future. Over 100 network operators responded to the survey which, comissioned by BSS specialist Openet, revealed an overwhelming sentiment that the agility of an operator is largely tied to the agility of the BSS it relies on. But with the pace of innovation certain to accelerate for the foreseeable future, operators bear the burden of legacy systems in their BSS environments that apply limitations to their agility.

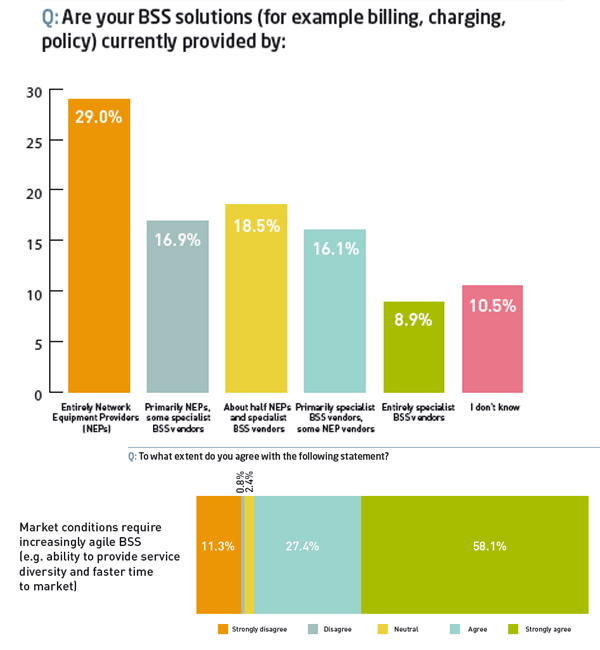

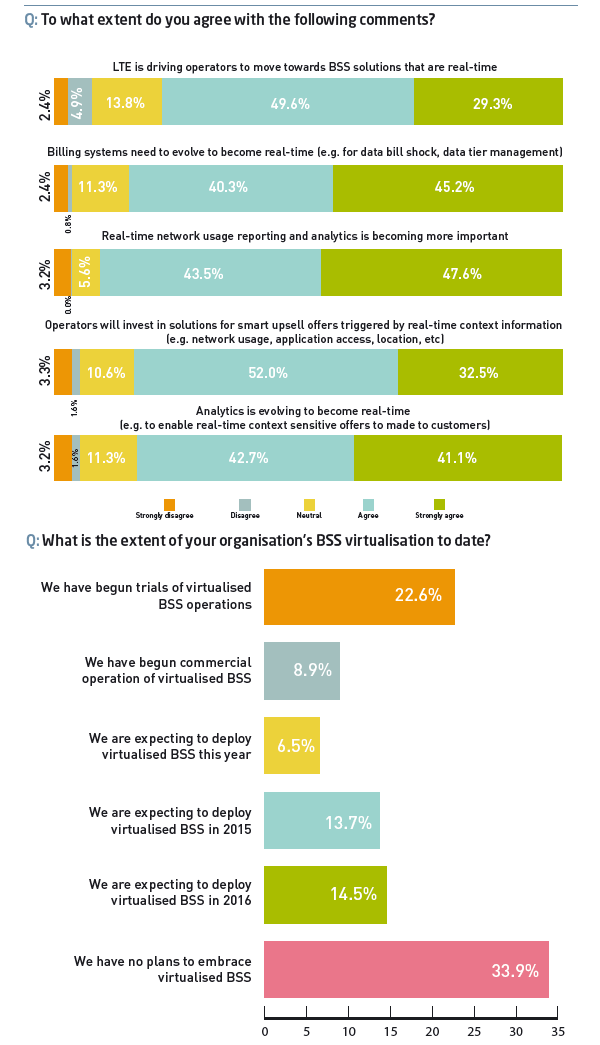

In total 86 per cent of respondents either Agree or Strongly Agree that current market conditions require increasingly agile BSS that give operators the ability to provide service diversity and a faster time to mark et. Moreover, 91 per cent of respondents believe Strongly or Very Strongly that real time network usage reporting and analytics is becoming more important and billing systems need to evolve to cater to this need. Meanwhile 86 per cent believe Strongly or Very Strongly that a BSS portfolio needs to be able to handle real time reporting, to avoid bill shock, and real time reactivity for data tier management.

Such functionality will be a key measure of agility and LTE is a significant contributing factor in this trend, with operators expected to invest in solutions for smart upsell offers triggered by real-time, contextual information such as network usage, application access or location— usage situations which are all expected to be driven by LTE adoption.

It is common for network equipment providers to bundle BSS software in with the infrastructure purchase in order to enhance their proposition. This has the effect of somewhat obscuring the true cost of a BSS platform. One of the respondents, in a free Turning BSS agility into business ability ‘Agility’, a word used to gauge a company’s ability to respond to the market with flexibility, has become the operator watchword of 2014. It highlights the dawn of an era when operators require not only real-time visibility of their customer’s activity but also the ability to react in real-time to succeed. text response, confirmed that network equipment providers “offer [BSS] at very low price, sometimes almost free with the network gear,” to add value.

Perhaps unsurprisingly, the majority of respondents (35 per cent) use BSS from a mixture of network equipment providers and specialist companies, while a similar amount (29 per cent), get their BSS directly from their network equipment provider alone. Less than ten per cent buy from specialist providers exclusively. Going forward, more than 40 per cent of respondents do not expect their supplier mix to change within the next five years, although 28 per cent say they will actively move towards a more specialist approach. Only seven per cent expect to move the other way, suggesting a growing appreciation of specialist expertise.

What’s more, there is little appetite among operators to perform their own integration of BSS software. As a result there is significant scope for collaboration between specialise BSS providers and system integrators to provide best of breed solutions, pairing functionally rich software with the specialist skill set of the system integrators. Although virtualization goes some way to addressing this scenario, by allowing operators to ‘try out’ alternative suppliers without fear of technology backlash, there is still enthusiasm among carriers for sticking with the one-stop-shop, despite them for openly acknowledging that specialist BSS offerings are more attractive and capable.

Virtualization is just as important for BSS as for the wider network. Although the concept has been a stalwart of the IT sector for some time now, it’s still spoken about in the telco industry with a certain amount of caution. No small amount of this comes from the larger network equipment suppliers that have built a business on products that feature integrated software and hardware.

So the key observation is that while everybody is talking about virtualization, few have stuck their flag in the ground with regards to a mapped out virtualization strategy. There are some notable examples: Telefónica, which recently set out detailed and aggressive Network Functions Virtualization (NFV) plans; and Deutsche Telekom, which last year said it was reengineering its network because: “The biggest pain for us is that there is so much legacy technology in networks that it is dif ficult to bring new services to the market. We need to be able to program new services without rearchitecting the network.”

Although these two carriers are in the minority at present, there are suggestions that more announcements are in the pipeline. According to the survey, nine per cent of respondents have already begun commercial operation of virtualised BSS and 23 per cent of respondents have begun trials of virtualized BSS environments. A further seven per cent are expecting to dip their toe into the water this year and 28 per cent within the next two years. So in total, only 34 per cent of operators currently have no plans to embrace virtualised BSS. However it is likely this sentiment will change as the industry becomes more comfortable with the prospects.

Indeed the survey showed a clear under standing of the benefits of virtualization. A total of 7 3 per cent of respondents believe virtualization gives operators the ability to trial new services/business models with minimal disruption. And 61 per cent expect Virtualization will allow operators to eradicate fragmentation in their BSS environment, which bodes well for those seeking to reduce the number of supplier s they currently buy from.

There is also a strong sense that virtualization will create a more competitive environment in the BSS market, not just allowing operators to try out new specialist suppliers with little fear of vendor lock-in but also pushing some of the larger, more general network vendors to step up to the plate and commit to a virtualization strategy of their own or face market share erosion. Indeed, 70 per cent of respondents either Agree or Strongly Agree that virtualization has made it easier for new entrants, including BSS vendors to be considered as new vendors because hardware and integration issues are reduced. More to the point, as a previous question revealed, when it comes to BSS virtualization, 72 per cent of operator respondents believe specialist BSS vendors are better equipped to supply the necessary tools.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)