Covid puts the brakes on China's cloud market

Spending growth in China's cloud infrastructure market fell below 20 percent for the first time ever in Q2 2022.

September 8, 2022

Spending growth in China’s cloud infrastructure market fell below 20 percent for the first time ever in Q2 2022.

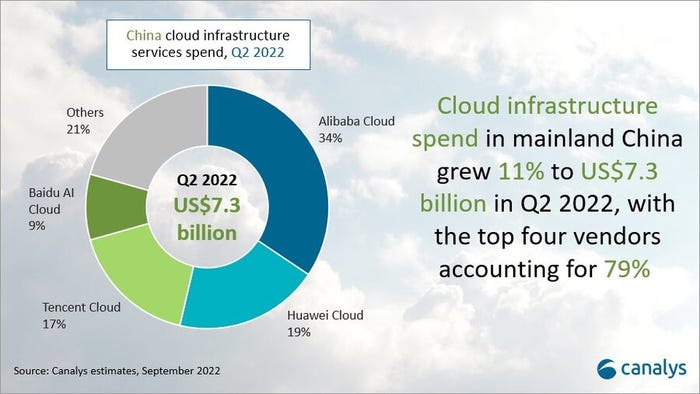

Figures published by Canalys on Thursday revealed that spending on infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) reached $7.3 billion in the three months to 30 June, up from $6.6 billion a year earlier. That’s a growth rate of 10.6 percent.

By way of comparison, in Q2 2021, when cloud spending in China hit $6 billion, that represented year-on-year growth of 53.5 percent on Q2 2020. What might also be of some concern is that spending was entirely flat sequentially, whereas the last couple of years have shown steady quarter-on-quarter growth.

Canalys said there are two factors at play here, one of which is that the country’s cloud providers are shifting their focus from revenue growth to high-margin, standardised products, as well as growing ecosystem development.

“The top cloud vendors are trying to enrich their cloud capabilities by building their own channel ecosystems to bring together self-developed platform technologies and industry experience from partners. These market leaders have recently held, or will hold, channel ecosystem summits to recruit more channel partners,” said Canalys research analyst Yi Zhang, in a research note.

“Chinese cloud vendors typically emphasise having strong vertical focuses, creating products and solutions specific to certain industries, but that comes with high customization costs that can be challenging to navigate when economic pressures increase,” added Canalys VP Alex Smith. “Channel partners can help avoid this by taking over the services component, leaving the vendors to focus on broader platform development.”

China’s cloud market is dominated by the big four: Alibaba, Huawei, Tencent, and Baidu, which according to Canalys had a combined market share of 79 percent at the end of Q2. Alibaba leads the way with 34 percent, followed by Huawei with 19 percent. Tencent is close behind with 17 percent, while Baidu is a somewhat distant fourth with 9 percent.

The other major factor that’s hampering growth is the resurgence of Covid-19, and more specifically the government’s Covid-zero policy. Earlier this year, China’s biggest city Shanghai was subjected to a strict two month lockdown that brought economic activity to a standstill. Although the lockdown lifted on 1 June, Bloomberg reported in late August that lingering restrictions have resulted in a sluggish economic recovery.

The policy shows no sign of abating. On 1 September, a lockdown was imposed on Chengdu, placing severe restrictions on 16 million of the city’s 21 million inhabitants. With Covid cases falling, the lockdown was expected to be lifted on Wednesday, but Reuters reported on Thursday that it has in fact been extended.

In July, it was widely reported that Beijing had quietly scrapped its target of 5.5 percent GDP growth for this year. That same month, the International Monetary Fund (IMF) trimmed its forecast for China’s GDP growth by 1.1 percentage points to 3.3 percent.

As previously reported, Covid-zero is already hitting smartphone demand. In late July, Canalys reported that smartphone shipments in China came in at 67 million in Q2, down 10 percent year-on-year. It attributed the decline primarily to weakening consumer spending power and confidence due to Covid restrictions.

With continued limits on economic activity and the resulting uncertainty, China’s cloud market looks be set for a bumpy second half of 2022.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)