Vodafone boosts Vantage's earnings, IPO potential by adding UK towers

Vodafone will transfer its 50% stake in UK towers business Cornerstone to Vantage Towers, having brokered a deal with joint venture partner Telefonica to operate the unit as a commercial entity.

January 11, 2021

Vodafone will transfer its 50% stake in UK towers business Cornerstone to Vantage Towers, having brokered a deal with joint venture partner Telefonica to operate the unit as a commercial entity.

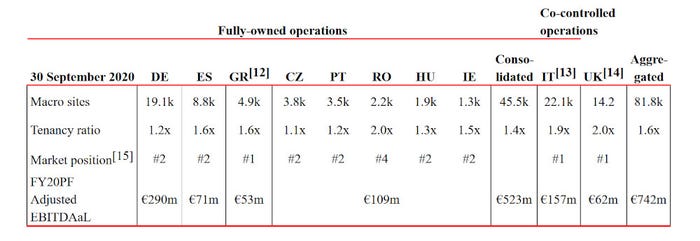

The move, which will take place later this month, will give Vantage Towers access to Cornerstone’s 14,200 macro sites and 1,400 micro sites in the UK, as well as significantly boosting its earnings potential; Vodafone puts the 50% stake’s contribution to 2020 pro forma adjusted EBITDA after Leases at €62 million, thereby pushing Vantage’s annual earnings to close to three quarters of a billion euros (see chart).

That will naturally have a knock-on effect on Vantage Towers’ forthcoming IPO. The flotation, due to take place in Frankfurt later this year, could value the business at close to the €20 billion mark, based on the myriad analyst reports on the subject over the past year or so and on various back-of-the envelope calculations using possible EBITDA multiples. Adding the UK towers into the mix will help Vantage command as high a price as possible. As yet, we don’t know what kind of price range Vodafone is shooting for, but group CEO Nick Read recently insisting the firm is on track for a flotation in early 2021, some more information should emerge sooner rather than later.

As well as making Vantage Towers more attractive, the move is also a positive one for the UK business.

Vodafone and Telefonica said they have agreed a commercialisation deal for Cornerstone, a 50:50 joint venture, which essentially means it is open for business for other network operators that might want to use its towers.

“Given the quality and reach of its infrastructure, Cornerstone is well placed to capture a significant portion of the additional market tenancies required for densification and coverage in the UK,” Vodafone said, in a statement.

Vodafone and Telefonica set up Cornerstone to house their shared passive infrastructure in 2012 and the pair will continue to serve as its anchor tenants. They have each signed a master services agreement (MSA) with Cornerstone, initially for an eight-year period with the option to renew for three further such timeframes, which establish the towers entity as their preferred supplier.

The telcos are in the process of winding up active network-sharing agreements in urban centres, including London, where traffic volumes are particularly high, but that should mean more tenancies for the newly-commercial Cornerstone.

“Cornerstone is a great addition to the Vantage Towers portfolio. Cornerstone is exactly the type of high quality grid we like to own: a number one market position, and two strong anchor tenants with network sharing agreements in place for whom we are the preferred supplier,” said Vantage Towers chief executive Vivek Badrinath, in a statement, repeating the message he shared at the company’s capital markets day in November.

At that event Badrinath shared that Vantage Towers has €1 billion or more to spend on acquisitions, looking in particular at new geographies, additional macro sites and adjacent market opportunities. Thus we can surmise that the transfer of the UK assets will not be Vantage Towers’ last headline-hitting move for growth in the coming months and years.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)