How to value spectrum – the current challenges in spectrum valuation

In order to successfully participate in a spectrum auction, the importance of correctly valuing spectrum cannot be overstated. If values are too low, operators risk not acquiring spectrum that could have created value for their shareholders. If values are too high, operators risk destroying value by paying more than the value they can create.

January 13, 2015

Telecoms.com periodically invites expert third-party contributors to submit analysis on a key topic affecting the telco industry. In this article Graham Friend, Managing Director of Coleago Consulting Ltd provides an assessment of the challenges of spectrum valuation, and considerations operators should take into account in their spectrum strategy.

In order to successfully participate in a spectrum auction, the importance of correctly valuing spectrum cannot be overstated. If values are too low, operators risk not acquiring spectrum that could have created value for their shareholders. If values are too high, operators risk destroying value by paying more than the value they can create.

Spectrum valuation is therefore highly risky, especially as auctions often involve significant cash (the US AWS-3 auction being a prime example) and receive a high degree of publicity. Correctly valuing spectrum has always been challenging and it is not getting any easier. In this article we highlight some of the new challenges facing operators, but first we will look at the basic principles of spectrum valuation.

Basic principles

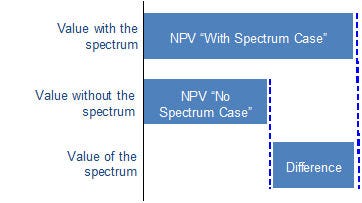

The basic principles of spectrum valuation are simple – the value of a block of spectrum is the difference between the value of the business with the spectrum (often referred to as the ‘with spectrum case’) and the value of the business without (the ‘no spectrum case’). The values of the business ‘with’ and ‘without’ are usually based on free cash flow forecasts that often match the duration of the licence on offer which may be anything from five to 20 years or longer. A further basic principle is that we assume that the business always adopts the value maximising marketing and technology strategy in each business case.

If an operator paid the full value of the spectrum at auction they would create no value. Bidding strategy at auction is therefore about maximising the difference between the value of a block of spectrum and how much the operator has to pay to acquire it.

We now consider some of the current challenges in estimating the value of a block of spectrum.

When is a ‘no spectrum case’ truly a ‘no spectrum case’?

At the height of the Dot Com boom many governments auctioned 3G spectrum and some operators paid spectacularly high prices which subsequently destroyed considerable shareholder value. One of the reasons for the high prices paid was that operators did not contemplate that over the coming 15 years of the licence other spectrum would be made available. They assumed that this was their only chance to acquire spectrum to support future data services and so they were prepared to “bet the farm” as they felt they had no other choice.

With the benefit of hindsight these operators would have recognised that they did have a choice and that more spectrum (e.g. 800MHz and 2.6GHz) would be made available at some stage in the future. When future, substitute spectrum is assumed to be available it may dramatically reduce the value of spectrum being awarded today.

The first challenge in spectrum valuation is therefore defining what is a sensible ‘no spectrum case’ because, whilst the ‘no spectrum case’ may not include the spectrum that the operator is trying to value, it may include spectrum that the operator expects to acquire at some stage in the future. The term ‘no spectrum case’ can therefore be a bit misleading.

The critical point is that if an operator does not take account of future spectrum awards then there is a risk that they dramatically over value the spectrum. Conversely, if they are overly optimistic about the release of additional future spectrum, which is then not released or significantly delayed, they risk under valuing the spectrum. Whilst some regulatory authorities publish a spectrum roadmap to address exactly these uncertainties, in other jurisdictions the availability of future spectrum is much less certain. The future spectrum assumptions made within the ‘no spectrum case’ will have a dramatic impact on spectrum values but they can be extremely challenging to develop.

The impact of spectrum re-farming

AT&T in the US expects to switch off its 2G network in January 2017. As a result, the spectrum that is currently supporting its legacy 2G traffic will be available for re-farming to newer technologies such as 4G. As much of the spectrum that is being auctioned today is destined for 4G services, the ability to re-farm existing spectrum provides an alternative to buying new spectrum at auction.

Through the large number of spectrum valuation projects we have delivered for mobile operators around the world we have seen that the assumptions made regarding spectrum re-farming have a dramatic impact on spectrum values. The challenge is in identifying the optimal spectrum re-farming strategy, not only from a technical perspective but also commercially. The issue is that there is always a very long tail of legacy customers who are not inclined to upgrade to the latest 3G and 4G devices. Finding the optimal strategy often requires solving a complex technical and commercial optimisation problems.

Device diffusion and the availability of VoLTE

The speed at which devices supporting new technologies disperse through the customer base has always been a critical assumption from a spectrum valuation perspective. The value of 4G spectrum, for example, typically increases the more rapidly 4G devices diffuse through the customer base. This allows greater data traffic to be carried on the spectrally more efficient LTE network, enhancing its value. However, the more data traffic that can be migrated away from legacy networks the greater the scope for re-farming which, as we have previously seen, also has a dramatic impact on reducing spectrum values.

Interestingly though, it is often not data but legacy voice traffic which limits the ability to re-farm and this is where the challenge arises. Not only must operators forecast the rate of device diffusion, which is hard enough, but they must also consider the speed at which VoLTE-enabled devices spread through the customer base. In the absence of VoLTE-enabled devices, operators must continue to provide legacy circuit switched voice services which require spectrum that operators would much rather re-farm to newer technologies.

Summary

Spectrum auctions continue to be high risk and high profile events for mobile operators. Correctly valuing spectrum is essential for successful spectrum auction participation; however the task of valuing spectrum is becoming more complex. Three of the most significant challenges today are: how to take account of future substitute spectrum awards; how to identify the value maximising re-farming strategy; and the importance of VoLTE device diffusion assumptions on the ability to re-farm.

Graham Friend, co-founder and Managing Director of Coleago Consulting, is a specialist in financial modelling, strategic business planning and valuation, and an expert on spectrum auctions and spectrum valuation. Graham has been consulting for more than 20 years and has been in the telecoms sector for over 15 years. He has led over 40 spectrum valuation and auction projects, and led projects for both regulators and operators across the world. Graham’s experience also encompasses MVNOs, mobile licence applications, due diligence and a range of strategic and operational projects. He is also involved in the developing and facilitating of business games, simulations and management development programmes within the telecoms sector.

Graham Friend, co-founder and Managing Director of Coleago Consulting, is a specialist in financial modelling, strategic business planning and valuation, and an expert on spectrum auctions and spectrum valuation. Graham has been consulting for more than 20 years and has been in the telecoms sector for over 15 years. He has led over 40 spectrum valuation and auction projects, and led projects for both regulators and operators across the world. Graham’s experience also encompasses MVNOs, mobile licence applications, due diligence and a range of strategic and operational projects. He is also involved in the developing and facilitating of business games, simulations and management development programmes within the telecoms sector.

Read more about:

DiscussionAbout the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)