Samsung’s profit crashes on weak semiconductor sales

Samsung Electronics reported a net profit decline of 57% in Q1, with total revenue going down by 14%. The semiconductor unit suffered the worst.

April 30, 2019

Samsung Electronics reported a net profit decline of 57% in Q1, with total revenue going down by 14%. The semiconductor unit suffered the worst.

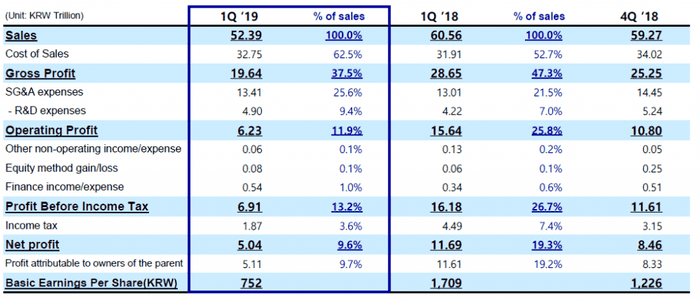

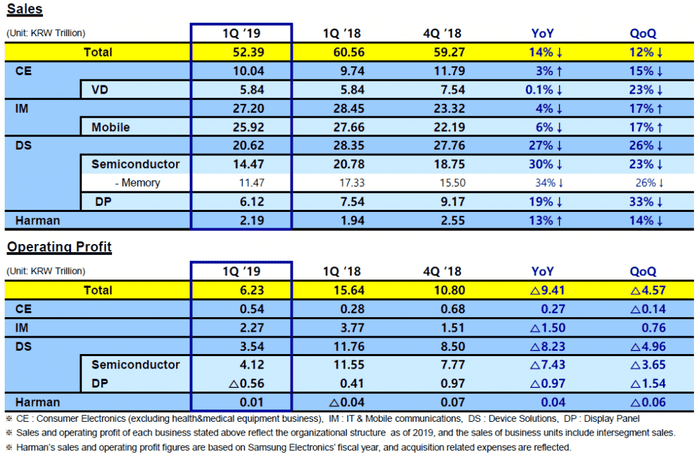

Samsung’s quarterly revenue went down from KRW60.56 trillion ($52 billion) a year ago to KRW52.39 ($45 billion) in Q1. The gross margin level came down from 47.3% to 37.5%. The operating profit dropped to KRW6.23 trillion ($5.3 billion) from KRW15.64 trillion ($13 billion), a decline of 60.2%. The net profit came down by 57% to KRW5.04 trillion ($4.4 billion).

On business unit level, Device Solutions reported a 27% drop in revenue, the sharpest decline among all the business units. Inside the unit, Memory chips declined by 34%. Samsung attributed the weakness to “inventory adjustments at major customers”, indicating its customers including other smartphone makers, have been selling slower than expected.

IT & Mobile Communications, Samsung’s largest business unit by sales, the business was more stable. Revenue from the handset business dropped by 4% from a year ago, but grew sequentially by 17%. Samsung saw strong demand for its Galaxy S10 products, but the de-focus of mid-range and lower products limited the volume growth. The recent debacle of S10 fold, high profile as it may be, should not have had any material impact on Q1 as it was scheduled to launch in Q2. Samsung’s network business, though small in comparison to its competitors, reported a strong revenue growth of 62% to reach KRW1.28 trillion ($1.1 billion), benefiting from the “accelerating commercialization of 5G in Korea”.

Samsung gave cautious lift to its outlook for Q2 but more optimistic with the second half of the year. It foresees the memory chip market stabilising in Q2 and stronger growth in the second half due to seasonality and product line refreshing. On the mobile side, Samsung sees growth in shipment in Q2 thanks to continued demand for the S10 products and positive market response to its new mid-range A series. It sees the 5G products and the fold form-factor making material contribution in the second half.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)