With western smartphone markets in steep decline the secondary market is gaining traction as a counter-intuitive way to reverse that trend.

February 13, 2019

With western smartphone markets in steep decline the secondary market is gaining traction as a counter-intuitive way to reverse that trend.

On first inspection a vibrant secondary (i.e. used) smartphone market seems like a threat to sales of new phones. Why would you bother buying a new one when you can get a decent second-hand one for a fraction of the price? But dig a bit deeper and you can just as easily conclude that making it easier for people to flog their old phones could incentivise them to upgrade more frequently.

The latter position is one adopted by smartphone security specialist Blancco, which has just published a report entitled ‘The Critical Importance of Consumer Trust in the Second-Hand Mobile Market’. The report is based around a survey of 5,000 punters from the UK, US, Germany, India and the Phillipines, which looked into their attitudes towards the secondary smartphone market.

As with all reports published by a company with a product or service to sell, it’s safe to assume there is a business reason for such an undertaking. In this case one of the things Blancco does is manage the data erasure on used devices when they’re collected to make sure no consumer data is hacked/breached/misused, so they have an interest in generating demand for such a service. That said, let’s have a look at the findings.

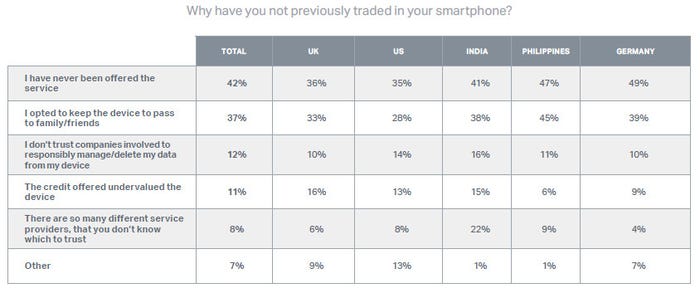

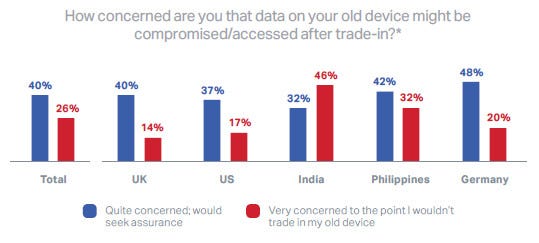

58% of those surveyed had never traded in a device and in the first table below you can see the stated reasons why. Cutting to the chase, people were then asked how concerned they were about their data security if they were to flog their old phone and, as you can see from the second table, the majority of people in all the countries surveyed had at least some concern.

“The secondary mobile device market is a huge success story,” said Russ Ernst, EVP, Products & Technology at Blancco. “Each of its major stakeholders – operators, OEMS and 3PLs [third party logistics] – have so much more value to extract from it as more global consumers choose to sell or buy used equipment if they trust in the process of used device collection and redistribution.

“Without a common, mandated and regulated rule book for smartphone processing, the ecosystem will be subject to abuse and malicious attack. The current ecosystem is made up of multiple stakeholders that collect devices from various touchpoints and redistribute them to many other parties.

“Since the speed of device processing is the only critical success factor, and as more devices flood the market, the chances of data breaches or issues related to data misuse will become increasingly likely. The secondary device market remains an amazingly lucrative and exciting opportunity for everyone, but only if it retains full consumer confidence built on trust and data integrity.”

Apple is being especially proactive in the secondary market by letting its loyal punters trade in their old iPhones as part of the price of a new one. The UK trade-in page makes it very easy to get a valuation and cleverly they will even accept non iPhones. Having said that they’ll only give you £445 for a 64GB iPhone X that they can resell for twice that amount so they’re not being that generous.

But Blancco does seem to have a point about the growing secondary market and it stands to reason that trust plays a big part in it. Presumably Apple fanboys are more likely to trust Apple itself than their operator or some random third party. While we don’t accept it as a given that a strong secondary market necessarily equals a strong primary one, it looks like there’s at least some money to be made from being a trusted reseller.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)