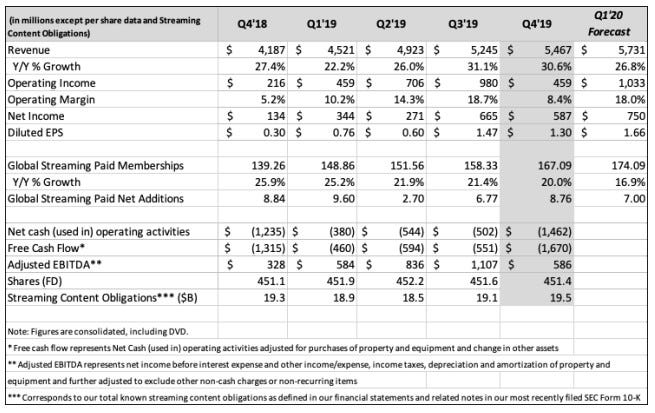

Video streaming giant Netflix reported revenue growth of 31% on the back of 21% subscriber growth, but it will face a lot more competition this year.

January 22, 2020

Video streaming giant Netflix reported revenue growth of 31% on the back of 21% subscriber growth, but it will face a lot more competition this year.

These numbers were a bit better than forecast and were rewarded with a small share price bump. Perhaps investor exuberance was tempered by the need for Netflix to invest ever greater amounts of cash on content in the face of relentless competition. With the ramping of a bunch of fresh rivals from the US in the form of Disney, HBO and Apple, this pressure to invest will only increase, but the cash has to come from somewhere.

“Worryingly, the company is burning through a lot of cash,” said Paolo Pescatore, Analyst at PP Foresight. “It needs to recoup this by adding customers more quickly, increasing prices or taking on more debt. Therefore, expect price rises in all key markets during 2020.”

“There’s a fine juggling act by raising revenue through price increases vs. retaining subscribers. This could backfire as many of the new and forthcoming video streaming services are cheaper than Netflix. This makes Netflix vulnerable in its home market where it stands to lose out, quite considerably as underlined by these latest results.”

“Let the streaming video wars commence. Netflix has a huge head start and remains in pole position given its broad content catalogue and extensive relationships with telcos and pay TV providers. It should be able to weather the streaming battles over the short to medium term. All the future subscriber growth will come from its overseas operations. EMEA is and will continue to be a key region of growth for coming quarters.”

Of all the new competitors Netflix seems to be most wary of Disney+, with its massive back catalogue of family blockbusters. You can hear in the earnings chat below that the Netflix leadership reckon most of the growth for Disney+ will be taken from linear TV rather than Netflix, but there is presumably an absolute ceiling on the amount a typical household is willing to pay for video content of all types. Faced with all these new offerings some people are bound to reconsider their Netflix membership in 2020.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)