Swedish kit vendor Ericsson delivered flat Q4 and full-year numbers but insists the foundations have been laid for future growth.

January 20, 2023

Swedish kit vendor Ericsson delivered flat Q4 and full-year numbers but insists the foundations have been laid for future growth.

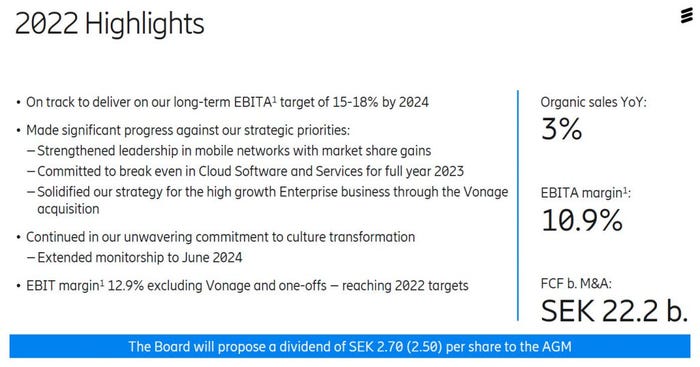

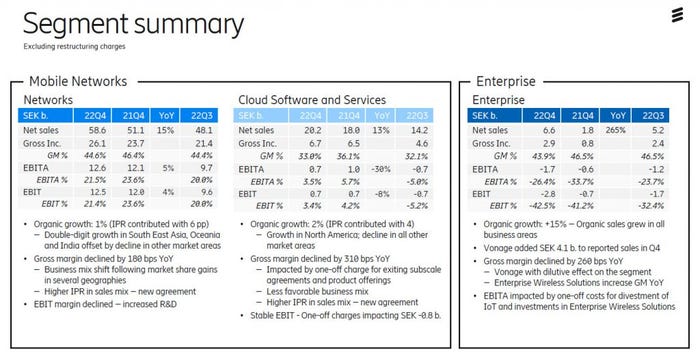

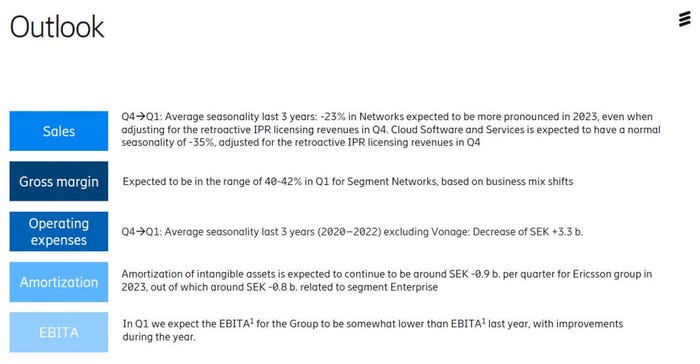

The top-line for Ericsson was that its quarterly sales were up 1% and full-year ones were up 3%. Net income was down 39% for the quarter, however, with EBIT margin almost halving. In an interview with Telecoms.com, Ericsson EVP and Head of Networks Fredrik Jejdling explained that a combination of the provision for another US fine, the write-off of some bad deals at its cloud division and a “business mix shift” away from North America contribute to the margin hit.

“With our fourth quarter result we are on track to deliver on our long-term EBITA target of 15-18% by 2024,” said Börje Ekholm, CEO of Ericsson, in his comments accompanying the quarterly report. “We remain fully committed to our strategic ambitions and have full confidence in the long term. During the quarter, we made measurable progress towards achieving these ambitions, against a backdrop of broad macroeconomic headwinds.

“Our strategy remains rooted in driving sustainable growth and maximizing value across all stakeholders. We are confident that we have the right team and strategy in place to extend our leadership in mobile networks; achieve profitability in Cloud Software and Services; execute in our high growth Enterprise segment; shape the industry landscape by becoming a platform company leveraging the 5G innovation platform; and continue our unwavering commitment to a culture of integrity.

“Building a culture of ethics and integrity remains a top priority, and I am convinced that best-in-class compliance will give our company a competitive advantage. Both the company’s resolution with the DOJ and the SEC in 2019 and the ongoing investigation into past conduct in Iraq clearly highlight the importance of intelligent decision-making and effective risk management.”

If the money recently set aside in anticipation of a US fine comes to represent the end of the matter then Ericsson will surely feel it has got off lightly. While the numbers were nothing to shout about, and missed some expectations, resulting in a share price decline of 5% at time of writing, they weren’t too bad either.

Jejdling was keen to stress that Ericsson still outperformed the broader market, as measured by Dell’Oro, and that the plan is still to grow its overall market share by a percentage point per year. The picture he and Ekholm would like to paint is on a company that has come through a difficult year with the pieces in place to bounce back in the mid-to-long term. Investors apparently remain unconvinced, however.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)