5G growth comes with new operator spending requirements – GSMA5G growth comes with new operator spending requirements – GSMA

There will be 5.5 billion 5G connections globally by the end of the decade, with 5G becoming the dominant mobile technology by 2028, according to research published by the GSMA.

February 29, 2024

But while rapid growth in the 5G ecosystem means that the peak of operator investments has now passed, upcoming developments in this generation of mobile technology mean that operators will still be spending heavily in the years to come.

5G connections reached 1.6 billion as of the end of 2023, an increase of around 600 million over 12 months, the industry body's GSMA Intelligence arm reported. Connections will continue to grow at pace in the years to 2030, by which time 5G will account for 56% of all mobile links.

As of last month, 261 operators in 101 countries had launched commercial 5G services, with a further 90 operators in 64 markets having committed to rolling out the technology. Just 47 of those commercial 5G services used standalone networks, operators having been more reluctant to commit to 5G SA than we might once have predicted. But the GSMA notes that there are another planned 89 deployments in the near term, which will significantly increase the number of operators able to tap into the benefits that real 5G was always slated to bring: network slicing, ultra-reliable low latency services, a simplified network architecture and so forth.

The industry body's discussions with operators show that 50% identified network slicing capabilities among their top two choices when identifying the benefits of rolling out 5G SA.

Network slicing should bring additional 5G monetisation opportunities. For now though, many operators are leaning on the likes of 5G-based fixed wireless access to help with that. As the GSMA points out, "FWA has proven to be an important use case for 5G technology, with many operators prioritising the solution in their overall 5G rollout strategy."

As of January, 117 operators in 57 markets had launched 5G-based FWA. Or to put it another way, more than half of 5G markets have 5G FWA.

Those 5G monetisation opportunities increase with the next technology evolution: 5G-Advanced. Standards are due to be finalised imminently with the first deployments likely to get underway later this year.

Indeed, GSMA survey data shows that more than half of operators expect to deploy 5G-Advanced within a year of standards being released.

"As a result, increased 5G SA and 5G-Advanced activities will kick-start a new round of 5G investment in 2024, especially in pioneer markets," its report reads.

That's good news for the vendor community. Huawei has been a particularly strong advocate for 5G-Advanced – or 5.5G, as it prefers to call it – and was vocal on the subject at Congress this year.

For the operators, there are big benefits: 5G multicast services, low-cost IoT support, and enhanced integration with satellite resources top the GSMA's list of potential operator use cases, in that order.

But spending on 5G SA and 5G-Advanced technologies, for the more advanced operators, along with ongoing initial 5G rollouts in less developed markets, mean that capital expenditures are not going to come down by much in the next few years.

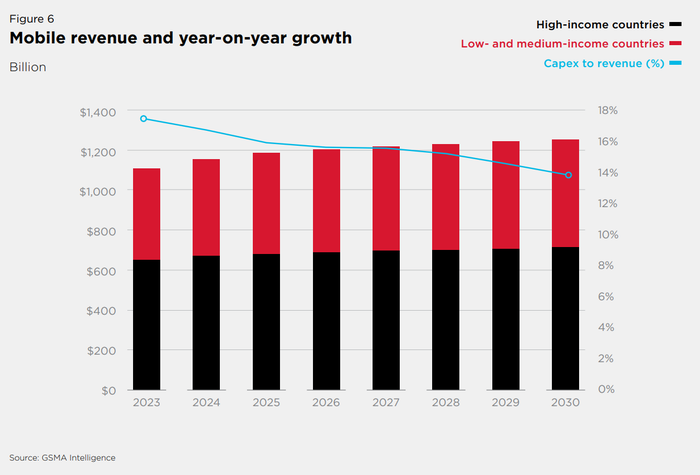

The global mobile capex/revenue ratio was 19% at the end of 2022, likely marking the peak of the 5G investment cycle, the GSMA noted. "However, mobile operator capex is still projected to reach $1.5 trillion between 2023 and 2030," it said. "Operators will also have to contend with stubborn opex costs, which are often around 4X capex costs. This is driving operators to accelerate network and service automation along with other opex-saving initiatives."

That's a lot of spending. But with collective annual global mobile revenues set to hit $1.25 trillion in 2030, the telcos really should be able to afford it.

Read more about:

MWC 2024About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)