China drives massive jump in Huawei profits for 2023China drives massive jump in Huawei profits for 2023

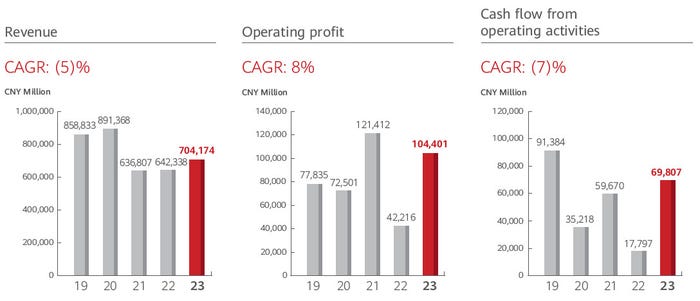

Embattled Chinese telecoms vendor Huawei announced a year-on-year profit increase of 144% for full-year 2023.

April 2, 2024

Who needs anyone else when you dominate the world’s biggest market? Huawei’s revenues are still below the levels they were before America’s campaign against it began in earnest, yet the all-important profit metric continues to go from strength to strength. Revenues were up 10% but operating margin more than doubled, resulting in that 144% net profit jump.

"The company's performance in 2023 was in line with forecast," said Ken Hu, Huawei's Rotating Chairman. "We've been through a lot over the past few years. But through one challenge after another, we've managed to grow. The trust and support of our customers, partners, and friends around the world is what helped us keep going, keep surviving, and keep growing."

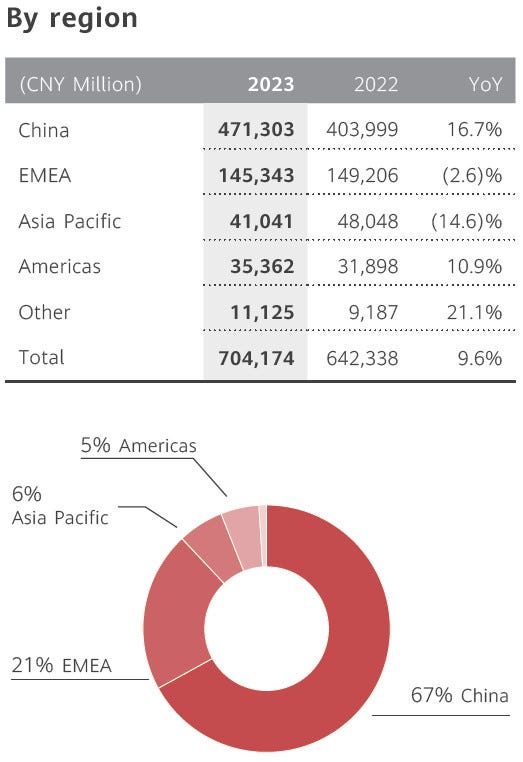

That last bit needs to be taken with a pinch of salt, since nearly all of that revenue growth came from Huawei’s domestic market, which now accounts for two thirds of Huawei’s business. EMEA is Huawei’s biggest international region by some distance but even that declined, with any gains in the Middle East and Africa presumably more than offset by Europe’s continued outlawing of its kit in their networks. Huawei will be encouraged by its growth in the (presumably south) Americas.

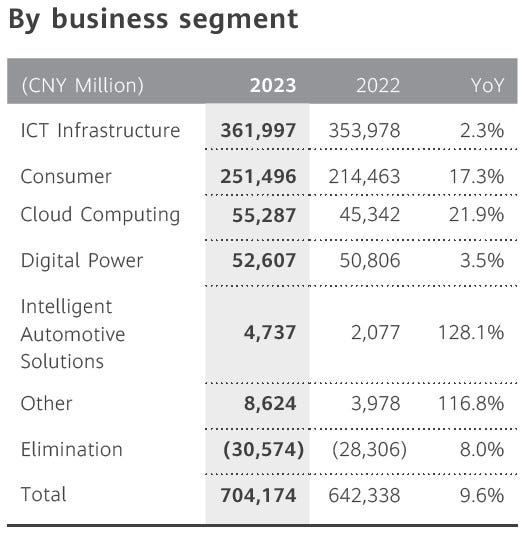

In terms of business areas, Huawei’s diversification strategy seems to be going fairly well. While its telecoms infrastructure revenues were flat, consumer (mainly phones) and cloud posted solid growth, while its nascent automotive division saw revenues more than double. Huawei is keen to emphasise its emphasis on R&D and expects its ability to out-innovate its rivals to be its main competitive advantage.

Of course, being a cause célèbre of the Chinese state doesn’t do any harm either, and is a likely reason for Huawei’s exceptional profitability. If you discount 2021’s profits, which were inflated by one-off asset sales, 2023 is possibly Huawei’s most profitable year ever. Last year’s operating margin of 14.8% was over 60% higher than even in 2019, when Huawei was largely unaffected by US restrictions.

The way things are going geopolitically, Huawei’s reliance on China is likely to grow even further over time. There is some irony in the fact that, by punishing Huawei for its presumed closeness to the Chinese state, the US has made that relationship more intimate than ever. With Ericsson and Nokia struggling and Open RAN getting off to a slow start, there’s a distinct possibility that Huawei and China will be able to significantly out-spend the West on telecoms R&D for the foreseeable future and thus gain a significant strategic advantage.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)