Chinese smartphone sales plummetChinese smartphone sales plummet

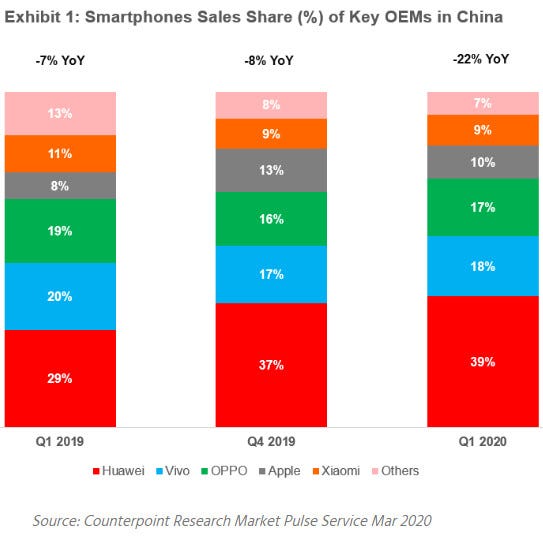

The latest numbers from Counterpoint Research reveal Q1 2020 smartphone sales in China plunged by 22%.

April 29, 2020

The latest numbers from Counterpoint Research reveal Q1 2020 smartphone sales in China plunged by 22%.

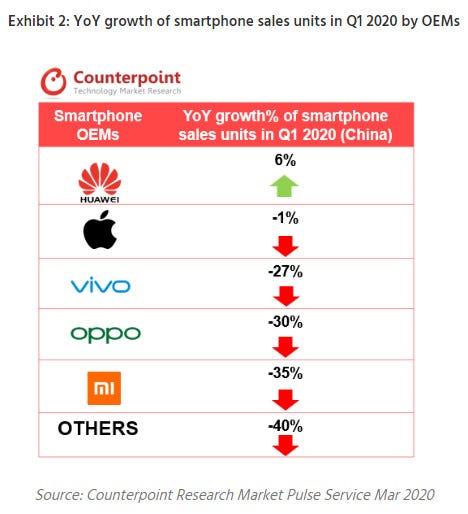

Somehow Huawei managed to buck that trend, however, as it continues to go from strength to strength in its home market. The table below reveals all of Huawei’s Android competitors experienced annual sales declines of between 27% and 40%, yet Huawei miraculously increased its smartphones sales by 6%. Looks like all that R&D spend is really paying off! Meanwhile Apple held firm as rich people continued to be rich.

“The drastic fall in Q1 China market was primarily dragged down by the dismal sales of smartphones in February (-35% YoY), when the country was severely impacted by the COVID-19 pandemic and commerce activities were minimal,” said Flora Tang of Counterpoint. “However, during the lockdown period in China, local e-Commerce giants such as Alibaba and JD.com managed to sustain efficient business operations and delivery services in major Chinese cities outside of Hubei province.

“For the strong support from these e-Commerce players, China’s smartphone sales appeared less negative than our original expectation. We also estimate that the online share of smartphone sales in China surged to over 50% during Q1, from about 30% in 2019, though the share is likely to drop in Q2 after the pandemic is largely contained.”

“iPhone 11 was the best-selling smartphone model in Q1; it has topped China’s best-selling models list for 7 consecutive months,” said Ethan Qi of Counterpoint. “Consumers continued to purchase iPhones from e-commerce platforms despite the shutdown of Apple stores across China during February. As for the Huawei group, it continued to lead and gained share with a complete product portfolio covering the entry-level to premium segments. Huawei Mate 30 5G, Mate 30 Pro 5G, Huawei Nova 6 5G, and HONOR 9X were all among the top-selling models list during the quarter.”

On reason for Huawei’s exceptional performance could be its early entry into the 5G market. According to Counterpoint that market alone grew by 120%, compared to Q4 2019. “The dominance of Huawei in China’s 5G smartphone market was more evident— it contributed to over half of the total 5G phone sales in Q1, followed by Vivo, OPPO, and Xiaomi,” said Mengmeng Zheng of Counterpoint.

“By Q1 2020, various vendors had launched the sub-US$400 5G smartphones in China, such as Vivo Z6 5G, Xiaomi K30 5G, realme X50 5G, and ZTE AXON 11 5G. For the aggressiveness of Chinese OEMs to grow the penetration of 5G phones to lower-tier price bands, we expect 5G smartphones to rise to account for over 40% of total smartphone sales in China by the end of 2020.”

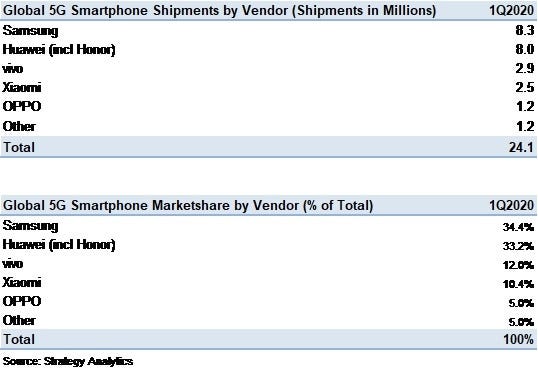

Despite that, Huawei was still in second place globally in terms of Q1 5G phone sales, according to Strategy Analytics. “Samsung vaulted into the lead in Q1 2020, shipping 8.3 million 5G smartphones globally in Q1 2020,” said Ville-Petteri Ukonaho of SA. “Samsung has strong global distribution networks and operator partnerships and new 5G smartphones in Q1 2020. Nearly all of Huawei’s 5G smartphones were shipped in China.”

“Chinese smartphone vendors captured 61 percent of top 5 vendor 5G smartphone shipment volumes in Q1 2020, with the majority of those volumes going to the Chinese market,” said Neil Mawston of SA. “This reflects the speed with which Chinese operators have rolled out 5G networks, as well as the underlying demand for 5G smartphones, despite the Covid-19 pandemic that shut down large parts of China during the Q1 2020 period. As China continues to ramp up economic activity, we expect 5G shipments to this market to continue to expand dramatically in 2020.”

Here’s the SA Q1 table. They might want to give that moody bold font a rethink.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)