COVID halves premium consumers willing to pay for 5G – EricssonCOVID halves premium consumers willing to pay for 5G – Ericsson

The COVID-19 pandemic has drastically reduced the premium consumers are willing to pay for 5G services, according to Ericsson.

November 17, 2020

The COVID-19 pandemic has drastically reduced the premium consumers are willing to pay for 5G services, according to Ericsson.

Consumers are now willing to pay a 10% premium for a 5G plan bundled with digital services, a new survey conducted by Ericsson this summer and designed to assess the impact of COVID-19 on 5G adoption, shows. A similar study carried out in May 2019 put that premium at 20%.

But its not all doom and gloom. One in three early adopters are still willing to pay that 20% premium, the survey showed, with respondents in the US, South Korea and elsewhere showing less price sensitivity on 5G. Further, the problem could be short lived: 45% of respondents said they expect household income to increase over the next 12 months, while one third expect to spend more on mobile broadband connectivity over the same period. The survey covered 7,500 smartphone users across 17 global markets and forms part of a new consumer and market insight report, Harnessing the 5G Consumer Potential, from the Swedish vendor.

Early adopters meant inflated 5G ARPU in 2019, while the pandemic triggered a sharp drop this year. “However, 5G ARPU subsequently will recover ground, as the COVID-19 impact lessens and service providers roll out added 5G-related services, that open new revenue streams and help upsell 5G to early adopters who are willing to pay a premium,” Ericsson said in the report.

25% of survey respondents said they are likely to upgrade to a 5G smartphone, which is probably a reasonable figure, given the early stage of the market. However, Ericsson noted that “bout half of those who plan to purchase a 5G smartphone in the US, Australia, Sweden and Switzerland are existing iPhone owners looking to upgrade to iPhone 5G models.” So…it’s still all about the handsets. Clearly operators have not yet managed to convince the consumer market that 5G can offer anything truly different.

However…

The potential revenue sloshing around from consumer 5G is huge.

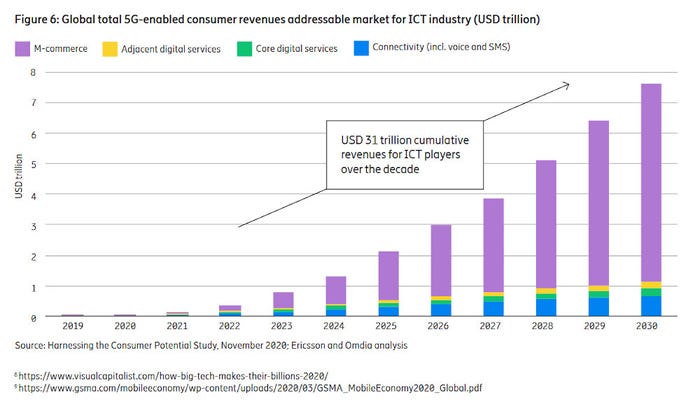

The 5G platform will underpin close to US$31 trillion in cumulative consumer revenues for ICT players over the 10 years to 2030, according to the Ericsson report.

Given the vendor’s penchant for an outlandish, headline-grabbing prediction – 50 billion connected devices by 2020, anyone? – it’s worth taking a closer look at that figure.

The vast majority of those revenues are in m-commerce (see chart). M-commerce accounts for more than $7 trillion in predicted annual revenues in 2030, leaving just north of $1 trillion split between connectivity, including voice and SMS, core digital services and adjacent digital services.

Of the $31 trillion, service providers can hope to capture somewhere in the region of $3.7 trillion, which works out to an annual average of around $712 billion, most of which will come from connectivity. But there’s a caveat: that figure will be achievable “only if service providers are proactive with their strategies for the 5G consumer market,” Ericsson warns.

One presumes those strategies need to extend further than encouraging consumers to upgrade to a new iPhone…

Nonetheless, there is food for thought here for the telcos. There’s a lot of revenue still to play for, even once you look past all the zeros in the headline figure.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)