Don’t hold your breath for 5G new revenue streams – Northstream

As we get closer to the arrival of 5G there are growing calls to chill out on the hype and be honest about the benefits its can realistically be expected to bring.

November 15, 2017

As we get closer to the arrival of 5G there are growing calls to chill out on the hype and be honest about the benefits its can realistically be expected to bring.

In an interview with Telecoms.com Bengt Nordstrom, CEO of telecoms consultancy Northstream, warned that not only is 5G likely to roll out slowly, but the benefits to CSPs will be mainly in the form of efficiencies rather than sexy new revenue streams.

“We are at a paradigm shift in the telecom industry where we, for the first time when a new generation mobile standard arrives, must focus on what efficiency gains and cost savings it can achieve for us rather than what new revenue streams it can create,” said Nordstrom.

“In a capex constrained operator market, we cannot expect them to rapidly roll out 5G when the revenue upside is very uncertain. Operator investments in mobile broadband have been extensive over the last 10 years but still operator revenues are declining.”

Ever since the industry went mad in bidding for 3G spectrum that it then struggled to monetize, the question on the ROI of new generations of wireless tech for CSPs has been a delicate one. Marketing teams understandably want to saturate every advert and press release with ‘5G’ such that the market is in danger of being sick of the sight of it before it even turns up. Vendors, of course, want CSPs to feel compelled to spend obscene amounts of money on network upgrades for fear of missing the boat.

One of the big problems with all this hype, however, is that consumers have come to expect continual improvements in their mobile service without paying any extra for it. Furthermore the enhanced mobile broadband aspect of 5G is likely to be especially anticlimactic as there will be no dramatic increase in bandwidth just because you stick ‘5G’ on a handset.

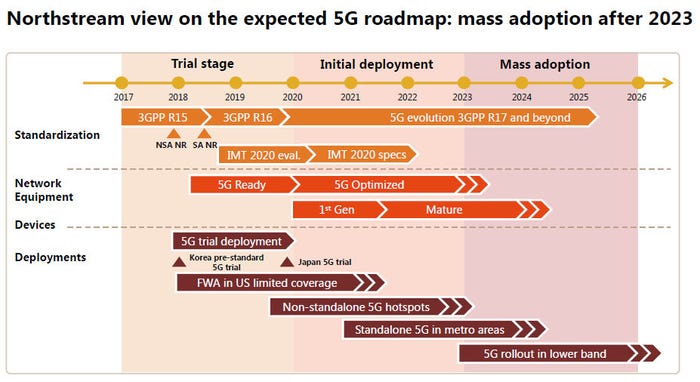

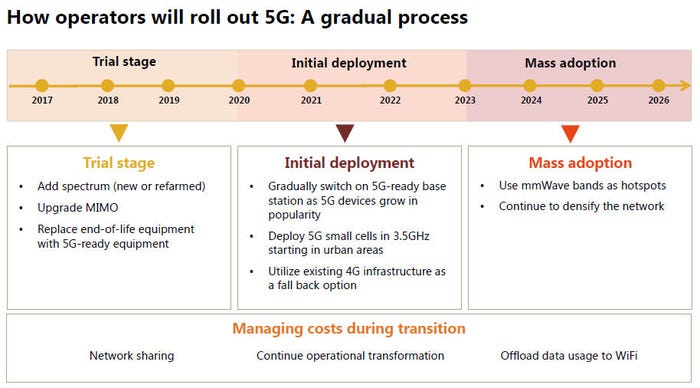

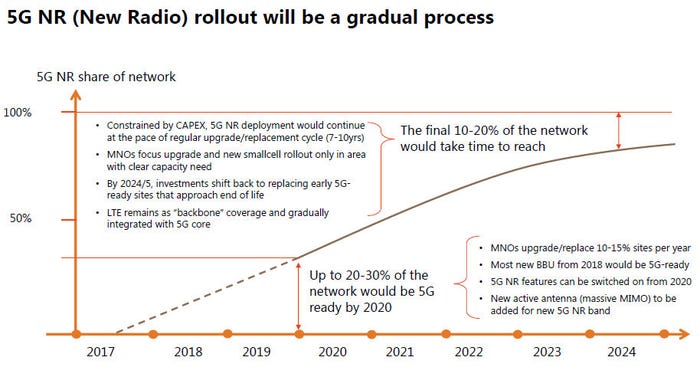

Nordstrom shared some of his company’s research with us, which provides some good insight into likely timelines associated with 5G. As you can see from the slides below, while the initial deployment is expected to commence in 2020, as everyone has been anticipating for ages, it’s likely to take a further three years for mass adoption to kick off. One reason for this is that MNOs can probably only afford to replace 10-15% of their gear per year.

Another commercial dilemma 5G might raise is the spectre of unmetered mobile broadband, moving to the model most fixed broadband has used for some time. The reason is likely to be similar – that diminished capacity constraints make such things more economically viable and unmetered plans may prove too great a competitive temptation for challenger MNO brands to resist.

“One interesting aspect of 5G is that the capacity improvements it delivers could result in all operators offering ‘all you can eat plans’,” said Nordstrom. “That would change the market dynamics quite a bit.”

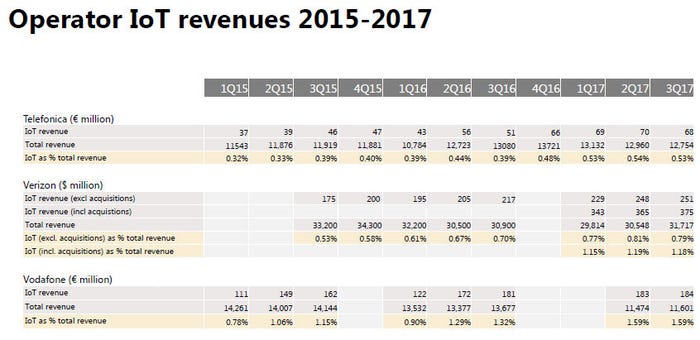

Talking about operator market dynamics, Northstream has also been keeping an eye on quarterly IoT revenues from those operators that announce them. The final slide below indicates that after some promising initial growth, IoT revenues are now stagnating “When we look at the Q3 results from Vodafone, Telefonica and Verizon it seems like IoT revenues have stopped growing in spite of that the number of connections are growing fast,” said Nordstrom. “We take it as a sign of that it has become an increasingly competitive market place.”

That’s one way of looking at it, another is that IoT – one of the three pillars of 5G alongside eMBB and low-latency wireless – is also facing a moment of truth where the initial hype has hit a wall of new revenue reality. 5G and its offshoots will surely generate new revenue eventually, but Northstream’s message seems to be that this is unlikely to happen anytime soon and the ROI is more likely to come from boring old efficiencies in the mid-term.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)