Ericsson declares its turnaround complete, but Digital Services still a problemEricsson declares its turnaround complete, but Digital Services still a problem

Swedish kit vendor had its latest Capital Markets Day, in which it celebrated steadying the ship but halved the profitability outlook for its software unit.

November 10, 2020

Swedish kit vendor had its latest Capital Markets Day, in which it celebrated steadying the ship but halved the profitability outlook for its software unit.

Investor days are rarely the most thrilling of events and this was no exception. There are lots of accounting terms like EBITDA (earnings before interest, taxes, depreciation, and amortization) and hedged statements about how things should go well, but then again they might not. Fortunate is the reader of a piece written by someone disinclined to dig too deep, therefore.

The top line is that things are going fairly well at Ericsson. When CEO Borje Ekholm got the job four years ago the company had lost its way and was regularly reporting losses. His priority, therefore, was to keep getting rid of people until the quarterlies were back in black and then look to grow from there. Today he was happy to reflect on a job well done.

“The execution on our focused strategy has delivered a turnaround which creates a robust base for the future and delivered global leadership in 5G today,” said Ekholm. “The Covid-19 pandemic is a humbling reminder that wireless connectivity fundamentally underpins future global growth and so urgent deployment is critical. It will support a global innovation opportunity for consumers and enterprise which touches every corner of our world and every sector of the economy.

“Our future value is inextricably linked to wider economic growth and we are well-positioned to play a lead role in the ecosystem of operators, businesses, and decision-makers on whose combined shoulders 5G’s full success rests.”

See what we mean? Not exactly thrilling, is it? Still, you can only play with the hand you’ve been dealt. The most significant fly in the ointment remains Ericsson’s Digital Services (software) unit, which continues to underperform. It’s probably the most representative of the previous CEO’s excessive diversification and is withering on the vine even more quickly than previously expected.

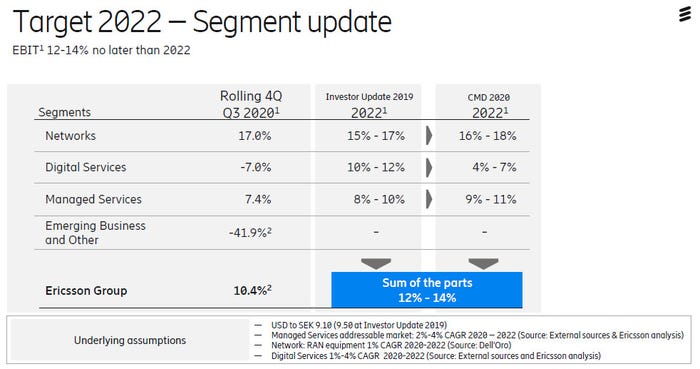

So, while Ericsson is maintaining its mid term margin target of 12-14%, it’s only able to do so due to an improved outlook for Networks and Managed Services, which offsets a hefty downgrade for Digital Services. It is worth noting, however, that Nokia’s software division is having a bit of a nightmare at the moment, so perhaps that whole market is just rubbish at the moment.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)