Ericsson got just 2% of China Mobile’s 700MHz radio awardEricsson got just 2% of China Mobile’s 700MHz radio award

As anticipated, Ericsson was awarded just 2% of the available base station work for China Mobile’s 700 MHz 5G rollout, with even Nokia getting a bigger share.

July 19, 2021

As anticipated, Ericsson was awarded just 2% of the available base station work for China Mobile’s 700 MHz 5G rollout, with even Nokia getting a bigger share.

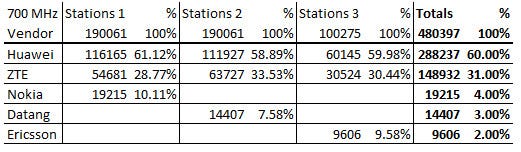

China Mobile seems to have only published the results of its 700 MHz tender in Chinese, so we’re reliant on Google for the translation, apart from the numbers for which the language seems to be global. The work was apportioned into three lots and the percentage of each lot granted to each vendor was stated. We chucked all that into the spreadsheet below to calculate the number of stations won and thus overall percentages by vendor.

As you can see, Ericsson got the least and Nokia made an appearance having got none of the 2.6 GHz work. Datang is a Chinese state-run company so Chinese vendors got 94% of the work. Ericsson anticipated this in its earnings announcement last week, but still felt compelled to issue a short press release acknowledging its fallen circumstances.

“In line with earlier market guidance to investors, this is materially lower than the market share previously awarded to the company in the 2.6GHz CP2 (11%),” said the Ericsson announcement. “China Mobile is the first operator to award under the latest round of CP’s for 5G radio. Given the context and based on the bidding rules, should Ericsson be awarded business in China Unicom and China Telecom we believe it would be in a similar range as with the China Mobile award.

“As previously disclosed by Ericsson most recently in its Q2 2021 financial report and in its 2020 annual report, the risk of lower market share award follows the decision by the Post and Telecommunication Authority (PTS) to exclude Chinese vendors’ products from the 5G auction in Sweden.”

Nokia hasn’t said anything, which is probably wise. The neatly rounded total percentages indicate there was nothing competitive about this process and that the awards were dictated by the Chinese state. So, in effect, China is largely banning non-Chinese vendors, the inverse of what it’s punishing Sweden for. The main difference, apart from the token 6% of foreign vendors, is that the state intervention was overt in Sweden but is, as ever, covert in China. And then it wonders why some people don’t trust its companies.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)