Ericsson laments “unsustainably low” operator investment levelsEricsson laments “unsustainably low” operator investment levels

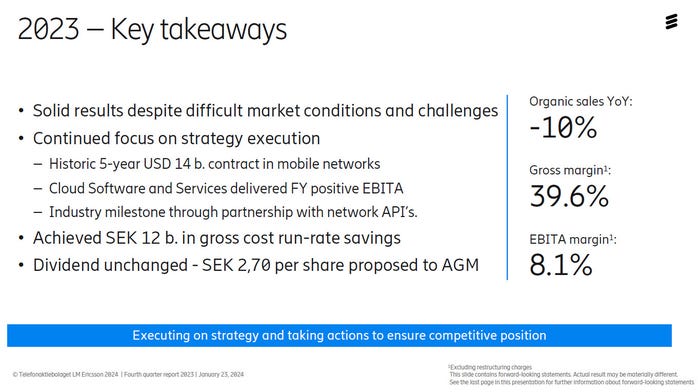

Swedish kit vendor Ericsson announced ‘solid results in challenging environment’ but sees little sign of the market picking up any time soon.

January 23, 2024

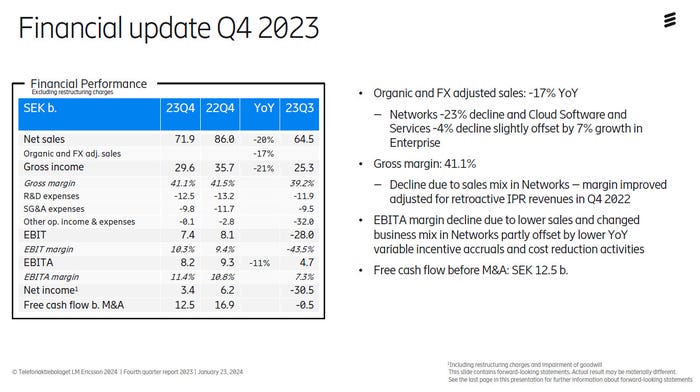

The numbers were as indicated: OK considering how muted the general telecoms market is. Sales were down 17% year-on-year, thanks to a 23% decline in the networks division – Ericsson’s biggest. The main narrative was almost identical to last quarter, with a focus on general belt-tightening in order to endure this difficult macro environment. One positive is the quarterly improvement in EBITA margin, which nonetheless still has a way to go before hitting the long-term target of 15%.

Ericsson bases much of its market evaluation on research from Dell’Oro, which recently announced that it expects the current slump in RAN spending to continue for at least another year. “The mobile network industry remains challenging,” said Ericsson CEO Börje Ekholm in his quarterly comments. “We expect the current market uncertainties to prevail into 2024 with a further decline of the RAN market outside China as our customers remain cautious and the investment pace is normalizing in India. The new US contract will start to ramp up in the second half of 2024.

“Underlying demand from growing data traffic and 5G only being in the early stages of build-out will require additional network investments. In our view, the current investment levels are unsustainably low for many operators. We are therefore confident that a market recovery should materialize. However, the timing of market recovery is ultimately in the hands of our customers.”

There are a couple of major assumptions supporting Ekholm’s stated confidence in a market recovery. Growing data traffic may well require additional investment to support but a lot of that could be relatively cheap software upgrades. The other inference is that 5G has yet to get going properly but maybe it never will, as a source of ROI for the telecoms industry. The massive write-down of Ericsson’s investment in Vonage would seem to support that concern.

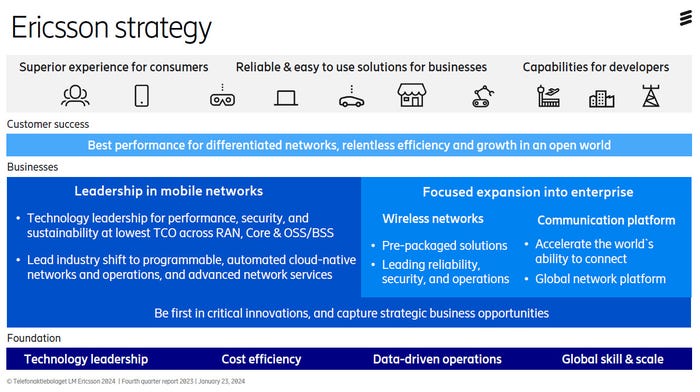

But what can he do, given the reluctance of his biggest customers to spend money, other than hang in there and fantasise about better times ahead? The presentation to accompany the numbers was unusually short, with Ekholm forced to reiterate Ericsson’s underlying strategy in an apparent plea for continued patience from investors. Ericsson’s share price was unmoved by the announcement, implying it more or less met expectations.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)