Ericsson shares sink further after tough Q1 earnings reportEricsson shares sink further after tough Q1 earnings report

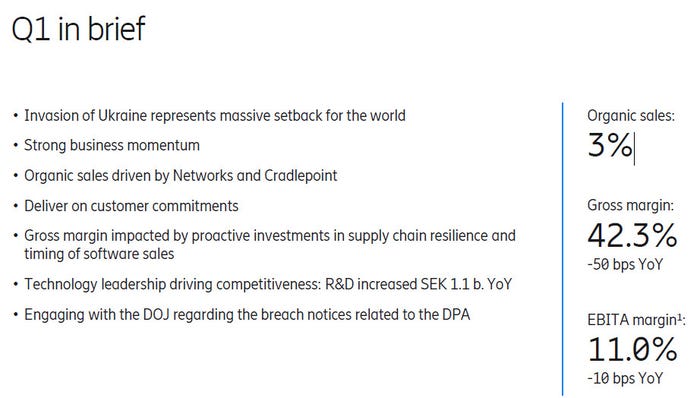

A combination of historical misdeeds in Iraq and the need to pull out of Russia loomed heavy on Swedish kit vendor Ericsson’s latest quarterlies.

April 14, 2022

A combination of historical misdeeds in Iraq and the need to pull out of Russia loomed heavy on Swedish kit vendor Ericsson’s latest quarterlies.

The Russia stuff was announced at the start of this week. While telecoms vendors have been agonising over the correct course of action to take with regard to doing business in that country after it invaded Ukraine, it looks like the EU took the decision out of their hands by removing a sanctions exemption for public telecommunication networks. Nonetheless Ericsson’s shares were down around 7% at time of writing.

Ericsson was forced to reveal its Iraq folly a couple of months ago, so you’d think that was priced into its shares too, but it seems likely that the company’s prognosis of the likely fallout from it caused an additional wobble from investors. Ericsson is currently on probation with the US after a previous corruption investigation, so the country is very likely to impose significant additional penalties.

“We are currently engaging with the Department of Justice (DOJ) regarding the breach notices it issued relating to the Deferred Prosecution Agreement,” said Ericsson CEO Börje Ekholm. “The resolution of these matters could result in a range of actions by DOJ, and may likely include additional monetary payments, the magnitude of which cannot at this time be reliably estimated.

“As this process is ongoing, we remain limited in what we can say about the historical events covered in the Iraq investigation and our ongoing engagement on the matter. We are fully committed to co-operating with the DOJ and our work to further strengthen our Ethics and Compliance program, controls and our culture remains a top priority. It was actually our improved compliance program that allowed us to identify the misconduct in Iraq that started at least back in 2011.”

That last sentence is intriguing. Ekholm seems to be asking the DOJ to take it easy as it’s only due to Ericsson’s increased vigilance that this historical naughtiness was uncovered. Alternatively it could be an attempt to exonerate his leadership and place all the culpability on the previous leadership. Either way it feels like a bit of a reach.

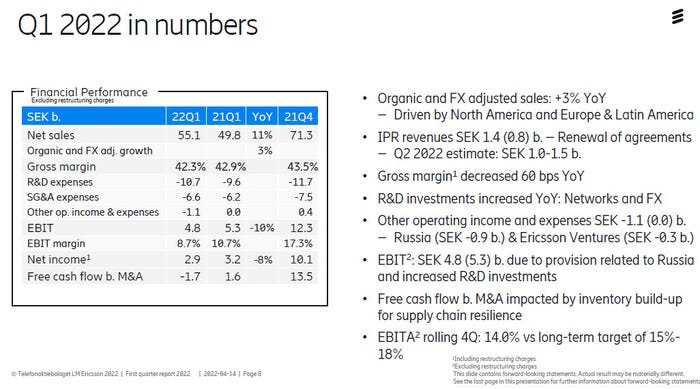

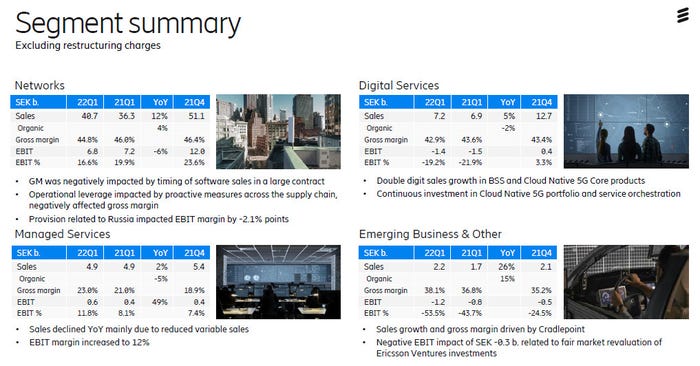

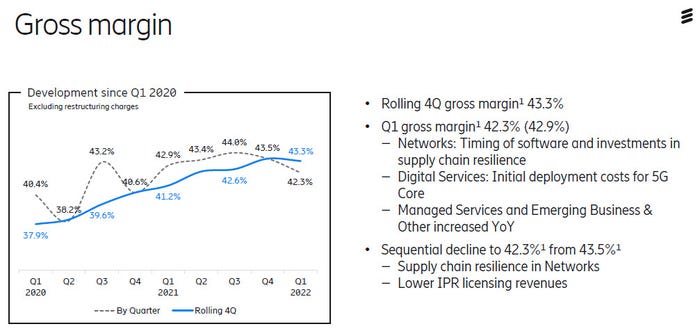

The underlying numbers were OK, with organic sales growth of 3%. However margin was hit by the Russia impairment as well as the decision to increase inventory to compensate for all the uncertainty flying around. A major recurring contract that is normally booked in Q1 was delayed, which was also a factor in gross margin falling to 42.3% from 42.8% a year ago.

So, while the underlying business is ticking along OK (thanks to the networks bit), these nasty surprises keep happening to spook investors. Ekholm’s comments seemed to allow for the possibility that the DOJ could do more than just issue a fine. Given the lack of completion in the 5G market an outright ban seems unlikely but, until the extent of the punishment is revealed, a major cloud will remain over the company.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)