Ericsson shares spike as it rolls with the Chinese punchesEricsson shares spike as it rolls with the Chinese punches

Swedish kit vendor Ericsson managed to offset continued decline in China with gains elsewhere and improved its margins in Q4 2021, which seems to have pleased investors.

January 25, 2022

Swedish kit vendor Ericsson managed to offset continued decline in China with gains elsewhere and improved its margins in Q4 2021, which seems to have pleased investors.

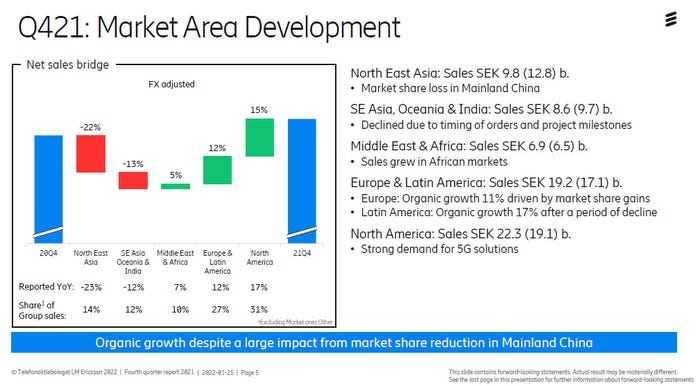

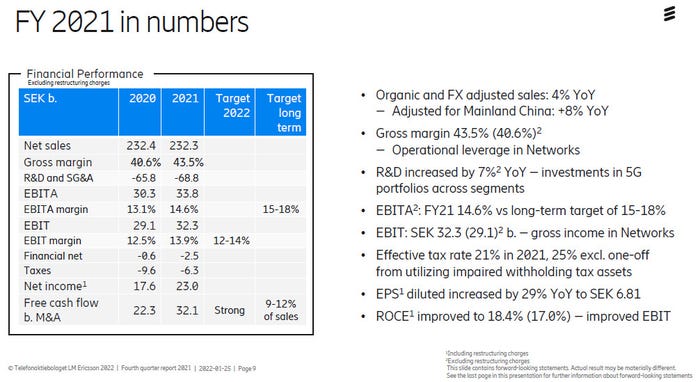

Organic sales grew slightly by 2% year-on-year, but that includes the drag of a three percentage point decline in China. Gross margin also improved by three percentage points, resulting in a 41% YoY jump in profit. All this contributed to an 8% spike in Ericsson’s share price as investors approved of all that lovely extra cash in the bank.

“Our strategy to invest in technology leadership and grow market share in our core business underpinned a robust financial performance in 2021 and ensured a good Q4 for Ericsson overall,” said Ericsson CEO Börje Ekholm. “Our commitment to pursue value from growth in wireless enterprise took a significant step forward with the announcement of our ambition to acquire Vonage, which will give us the foundation to develop a Global Network Platform to drive innovation on top of the 5G networks.

“This adds to already strong progress in 2021 in our organic enterprise portfolio – Dedicated Networks and IoT – and follows the successful integration of Cradlepoint. With a full-year EBIT margin[2] of 13.9%, we reached our 2022 target one year early, while absorbing significantly increased investments in R&D, Enterprise, cybersecurity and compliance.”

In other words the five-year plan of refocusing on core competences, investing in R&D and generally running a tight ship has yielded the anticipated results a bit quicker than expected. We had a quick chat with Ericsson’s head of networks Fredrik Jejdling and he was keen to flag up how big a part investment in chips and general electronic wizadry has played in Ericsson being able to offer competitive profits with a decent margin.

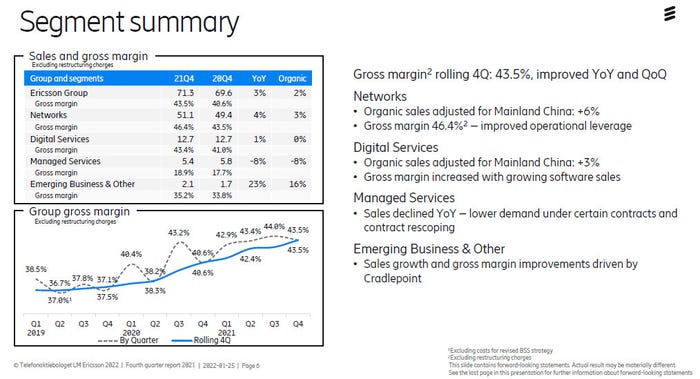

As you can see from the first slide below, China remains a nightmare, but that’s already priced in. Jejdling insisted the SE Asia decline was not part of broader trend, but let’s see what the next quarter brings. Meanwhile it’s business as usual across the business segments, with Networks growing, Digital Services flat and Managed Services continuing its managed decline.

Ericsson’s full year can be viewed as a qualified success, given the circumstances beyond its control in China. Again, while sales were flat, the improved bottom line is cause for celebration. Having said that, a lot of that cash was blown on Vonage so investors will be keeping a close eye on Ericsson’s enterprise fortunes to see if that bet had paid off.

Get the latest news straight to your inbox. Register for the newsletter now

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)