Fiber-optic is important for 5G but operators will need a range of options

Only 5G cell-sites served with fiber-optic cable or microwave links will be able to support the latency tolerances required by some LTE and 5G applications.

September 7, 2018

Telecoms.com periodically invites expert third parties to share their views on the industry’s most pressing issues. In this piece Jake Saunders VP, Asia-Pacific & Advisory Services at ABI Research, looks at some of the backhaul questions that need to be answered as we enter the 5G era.

Momentum behind 5G is building. Through ABI Research’s own analysis, 48 countries have either carried out consultations or have taken steps to auction spectrum and licenses for 5G services. Korea, Japan and the USA probably have the most extensive 5G commercial deployment plans in place but what is particularly remarkable is the spread of countries across the globe that have committed to 5G commercial deployment by 2020.

5G offers an unprecedented leap in bandwidth speeds compared to the previous generation. This is made possible by using high-band frequency spectrum, as well as key antenna technologies, such as massive MIMO. Bands in three spectrum ranges will be needed for 5G: Sub-1 GHz, 1-6 GHz, and above 6 GHz. Crucial 5G spectrum bands above 24 GHz will be agreed upon at the World Radiocommunication Conference in 2019 (WRC-19); this includes 26 GHz and 40 GHz, which already have significant international support for 5G access. Outside of the WRC process, the 28 GHz band is also supported for 5G access by important markets such as the United States, Japan, and Korea. For the initial enhanced mobile broadband use case, spectrum within the 3.3 GHz to 3.8 GHz range is emerging as an important harmonized 5G “mid-band.”

Each cellular access technology has taken off at a faster rate than the previous generation. GSM took 6 years to reach 100 million subscriptions. 3G’s HSPA+ took 5.25 years, 4G’s LTE 3.5 years, LTE Advanced took 3 years. We will see if 5G further shortens the time to ‘100 million subscriptions’ but the rapid growth in subscriptions combined with the amount of 5G traffic that will be generated, will put increased pressure on the backhaul infrastructure of mobile networks. Over the course of ABI Research’s forecasts, mobile data traffic is anticipated to grow at a Compound Annual Growth Rate of 28.9% to surpass 1,307 exabytes on an annual basis in 2025. 4G and 5G subscribers may only represent 55% of total subscriptions in 2025, but they represent 91% of the total traffic generated in 2025.

Backhauling the Traffic

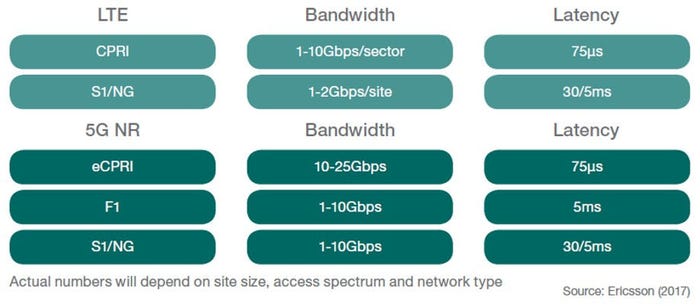

The exponential growth of mobile data traffic has been driven largely by the uptake of streaming TV and movie services, as well as video content in social media and instant messaging. A 4G base station based on the Common Public Radio Interface (CPRI) architecture requires bandwidth of 1 Gbps to 10 Gbps per sector, while a 5G base station with the upgraded Enhanced CPRI (eCPRI) architecture requires 10 Gbps to 25 Gbps. However, mobile service providers cannot ignore the latency requirements for 4G and 5G services. A 4G or 5G base station based on eCPRI architecture requires no more than 75 microseconds, but even in the most latency-tolerant scenario (S1/NG), latency of no more than 30 ms is needed.

Many operators have either upgraded their networks to LTE-Advanced or are in the process of doing so. In the case of LTE-Advanced, new RAN optimization techniques impose critical performance requirements on the X2 interface (essentially the IP control and user plane for communications links), which results in a latency cap of no more than 10 ms from end to end. This means latencies across the backhaul network need to be <1 ms. In 5G, for mission-critical applications, latencies will need to be sub-1 ms.

Fig.1: 4G and 5G Bandwidth and Latency Requirements (Source: Ericsson)

Only 5G cell-sites served with fiber-optic cable or microwave links will be able to support the latency tolerances required by some LTE and 5G applications. For some ultralow latency critical applications, the length of the fiber-optic cable will be constrained by the fact that information can only be transmitted at 5 microseconds/Km. For eCPRI cell-sites, the fiber-optic link will need to be less than 15 Km. In geographic areas served by geostationary satellite backhaul, mobile operators may be constrained to 2G, 3G, and non-latency-sensitive LTE services.

5G Backhaul Will Need Options

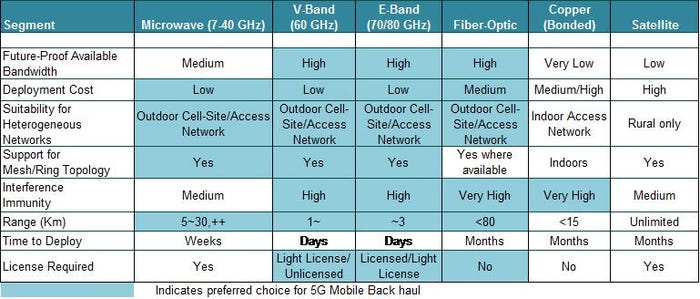

Mobile operators have a challenging time backhauling the mobile voice and data traffic from varied environments, such as urban, suburban, rural, offices, residential homes, skyscrapers, public buildings, tunnels, etc. Table 1 below outlines how mobile operators rely on a variety of backhaul approaches to transmit their traffic to and from macro and small cell base stations.

Fig.2: Mobile Backhaul Technology Trade-Offs, Wireless versus Fixed versus Satellite (Source: ABI Research.)

Mobile carriers are increasingly facing the reality of having to deploy a Heterogeneous Network (HetNet) architecture of macro and small cells that may rely on 3G, 4G, and 5G. Microwave and millimeter bands (V-band (60 GHz) and E-band (70/80 GHz)) are suitable for HetNet backhaul because it allows for outdoor cell site and access network aggregation of traffic from several base stations, which can then be handed off to the mobile switching centers and finally the core network.

At the end of 2017, ABI Research estimates the majority share of backhaul links (an aggregate of macrocells and small cells) were supported by traditional microwave 7 GHz to 40 GHz (56.1%) backhaul equipment. The higher bandwidth requirements of LTE are driving a significant roll-out of fiber (26.2%). Bonded copper xDSL connections (3.5%) are available in 2017, but the need for this technology will continue to decline. Satellite-based backhaul, which primarily plays a role in backhauling traffic in peripheral locations or rural environments where microwave may not exist, represents 1.9% of backhaul links worldwide. Satellite backhaul has a minority share of the market-place but it is still an important backhaul access technology.

On a worldwide basis, fiber-optic backhaul is expected to grow to 40.2% of macrocell sites by 2025, which just eclipses microwave in the 7 GHz to 40 GHz band with 38.2%. Microwave Line-of-Sight (LoS) in the 7 GHz to 40 GHz bands is still a long-term viable solution for macrocell sites. Microwave links in the 41 GHz to 100 GHz bands will double from 5.1% to 12.6%.

Jake Saunders will be speaking on Eliminating the Digital Divide in the Evolution to 5G at 5G Asia 2018, taking place 18th – 20th September in Singapore. Find out more about the event and join him there.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)