Global telecoms kit market slides as carriers stop spendingGlobal telecoms kit market slides as carriers stop spending

The worldwide market for telecoms equipment declined in 2023 after years of stable growth as operators curtailed their spending, particularly in North America.

March 14, 2024

And the picture remains gloomy into 2024.

New figures from Dell'Oro show a 5% year-on-year slide in the around US$100 billion market, a worse performance than it had expected, driven amongst other things by a slowdown in 5G and home broadband investments, as well as macroeconomic trends and the remains of a post-Covid hangover,

The news comes as something of a surprise, the analyst firm having reported 2% market growth in the first half of the year, albeit with Q2 coming in flat. Further, the slide follows five consecutive years of growth, the analyst firm said.

Just as in the first half of the year, the pace of market decline in North America was faster than it had anticipated, the size of that market naturally dragging down results from the rest of the world. The region saw around a 20% slide in 2023 on the back of weak activity in the mobile RAN and broadband access sectors.

"On the bright side, regional dynamics were more favourable outside of the US," Dell'Oro vice president Stefan Pongratz wrote in a blog post. "Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe."

From a technology perspective, the drop-off in 5G spending last year compared with the year before is top of the pile when it comes to explaining the slump. Essentially, operators in the more advanced 5G markets where network coverage is high needed to invest a lot less in the RAN last year than they did previously. Clearly this was not offset by 5G spending in less advanced markets. Further, the slow transition to standalone 5G meant there was no boost from mobile core investments.

We saw equipment makers at Mobile World Congress recently make the case for the move to 5G Advanced, with many predicting that rollouts will start in earnest later this year. Dell'Oro's data helps to explain why; they need operators to plough more money into mobile kit.

It's not just about mobile though. Dell'Oro notes that operators have cut back on home broadband capex too. Specifically, the PON space declined after a couple of years of strong investments, which more than offset growth in optical transport and SP routers, Dell'Oro said.

It also highlighted an inventory correction following Covid era disruption – hoarding and supply chain issues, essentially – which had an impact on the overall market, despite mainly affecting the RAN sector in 2023. And the macroeconomic situation also played its part in the market decline, as well as foreign exchange effects – specifically the US dollar against the Chinese yuan and Japanese yen – and higher borrowing costs.

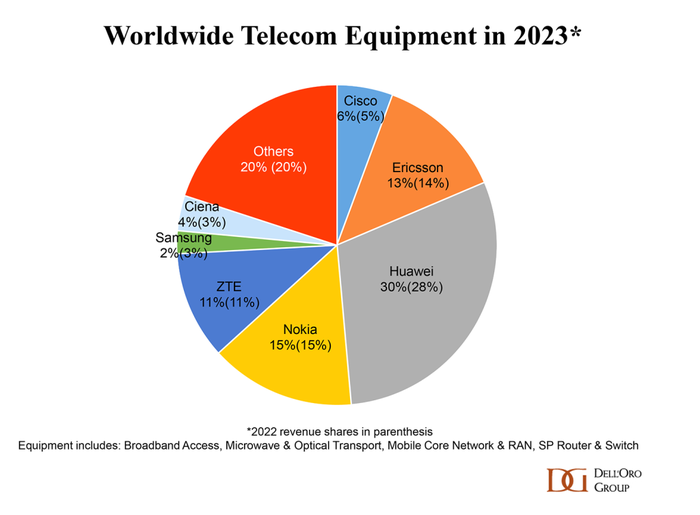

Despite the change in fortunes compared with 2022, the shape of the market did not change much when it comes to vendor shares. Huawei still dominates, increasing its market share by two percentage points last year to 30% (see chart below), something Dell'Oro attributes to its limited exposure to North America.

Nokia edged ahead of Ericsson into second place, but it's worth pointing out that the Finnish vendor's triumph could well be limited; that AT&T Open RAN deal going to Ericsson late last year could have an impact going forward.

All equipment makers will have their work cut out next year though, with Dell'Oro predicting that market conditions will "remain challenging in 2024." The overall market will decline again, it says, albeit less sharply than in 2023. It estimates that global telecoms equipment will contract by up to 5% this year.

Clearly, that's not great news for the kit makers, which means we will hear a lot more from them as the year progresses as they try to persuade telcos to up their spending. 5G Advanced will likely be front and centre.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)