Huawei forecast to have narrow advantage in 5G RAN race

Analyst firm Strategy Analytics has taken a look at the runners and riders in the global 5G race and has Huawei ahead of its rivals by a nose.

April 16, 2019

Analyst firm Strategy Analytics has taken a look at the runners and riders in the global 5G race and has Huawei ahead of its rivals by a nose.

In a report titled ‘Comparison and 2023 5G Global Market Potential for leading 5G RAN Vendors – Ericsson, Huawei and Nokia’, SA took a look at the relative competitiveness of the big three kit vendors when it comes to 5G radio access network kit and made some market share forecasts accordingly.

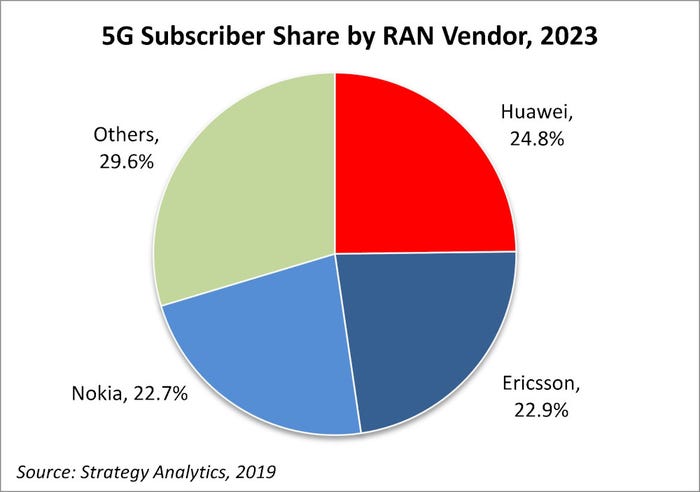

The long and short of it, as you can see in the first table below, is that SA reckons by 2023 Huawei will account for around a quarter of the 5G RAN market, while Ericsson and Nokia will have closer to 23%. On top of that the ‘others’, largely Samsung and ZTE, will account for almost 30% between them, which is a decent effort. Samsung seems to be doing especially well in South Korea, funnily enough.

“By 2023 5G looks to be a very competitive global market as this premium technology finally achieves economies of scale that will drive down the costs per Gigabyte of throughput to make 5G an affordable technology on a global basis,” said Phil Kendall of SA. “The neck and neck battle between Huawei, Ericsson and Nokia for share of 2023’s 5G radio access should lower costs for all segments of mobile, IoT and fixed 5G applications, even as smaller new vendors find specific niches below these three.”

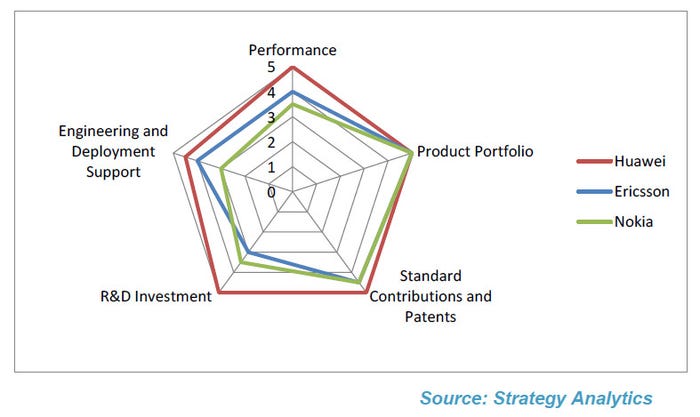

The report also digs down into the strengths and weaknesses of the big three vendors. Specifically it looks at five broad categories: R&D, patents, product portfolio, product performance and deployment support. The bad news for the Nordic vendors is that Huawei comes top in all five categories, only having to share that spot with the other in the case of product portfolio. It looks like Ericsson needs to start putting its hand in its pocket and Nokia wants to take on a few more engineers.

“R&D investment backed by market scale is the most crucial factor for the long term competitiveness of 5G infrastructure vendors,” said SA’s Guang Yang. “Huawei has maintained steady growth in its 5G R&D investment, which bodes well for long term advances in energy efficient, cost effective 5G technology.”

With all that in mind it’s kind of surprising SA doesn’t anticipate a bigger lead for Huawei in four years’ time. The reason, presumably, is that Huawei will be excluded from a bunch of markets thanks to all the US aggro it faces. Opinion seems to be divided about how much slack will be picked up by Chinese sales, with Huawei revealing it has yet to do any 5G deals in mainland China, but the analyst in the video below still seeing that country as a big competitive advantage for them.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)