Huawei somehow made more profit than ever last yearHuawei somehow made more profit than ever last year

Despite experiencing a 29% drop in revenues, Chinese vendor Huawei managed to almost double its profits in the 2021 financial year.

March 28, 2022

Despite experiencing a 29% drop in revenues, Chinese vendor Huawei managed to almost double its profits in the 2021 financial year.

The company unveiled its 2021 annual report during a live ceremony that featured a lengthy Q&A section. This marked an apparent change in its public accountability strategy since previous numbers announcements have been more abrupt and closed. It was also remarkable in being led by CFO Meng Wanzhou, who has been unable to perform such a function for years thanks to being under house arrest in Canada while the US attempted to extradite her, before eventually throwing in the towel.

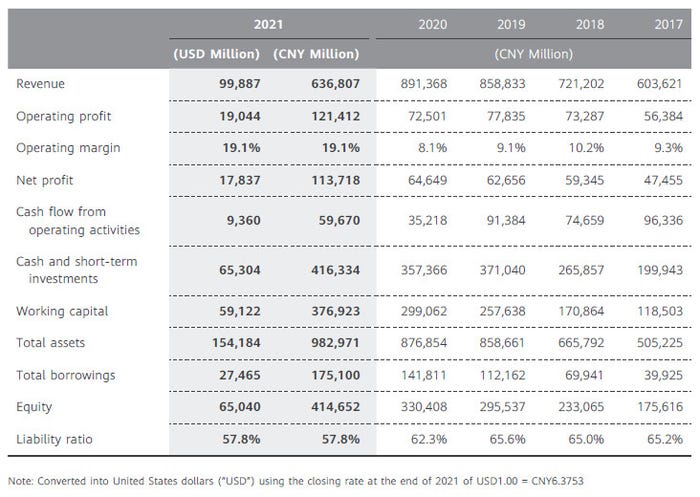

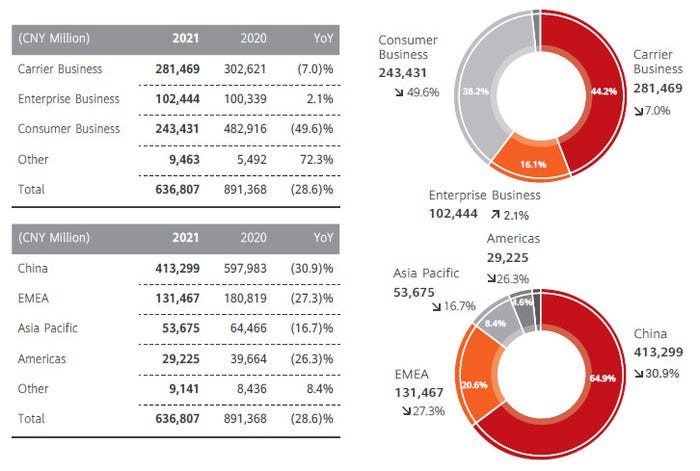

“Despite a revenue decline in 2021, our ability to make a profit and generate cash flows is increasing, and we are more capable of dealing with uncertainty,” said Meng. You can see the numbers as they compare with the previous five years in the table below, followed by the splits by business unit and geography. Net profit was up 76% year-on-year and R&D spend was apparently at its highest level for a decade.

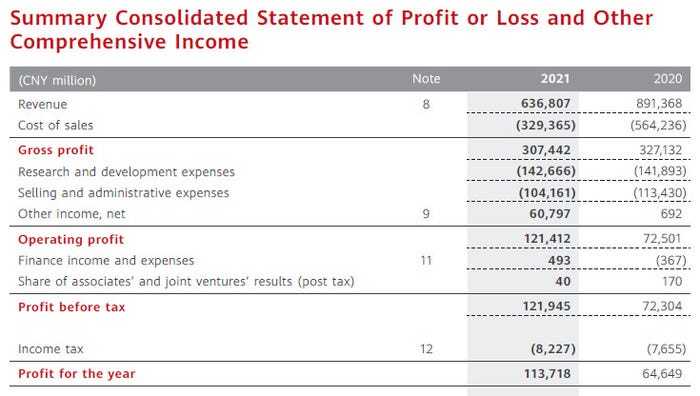

Since profit is essentially revenue minus overhead, how has Huawei managed to increase its profit so dramatically at a time when its revenues are sharply declining and it’s spending more than ever on R&D? The answers appear to lie much further down the lengthy annual report, in a table breaking down that profit figure.

Meng spoke regularly of ‘efficiencies’, without going into much detail, although a later question regarding employee numbers was dodged. As you can see, those efficiencies are considerable, with the ‘cost of sales’ falling by a remarkable 42% year-on-year. The other exceptional item in the above table is ‘other income’ which increased by several orders of magnitude. You can see the breakdown of that item below.

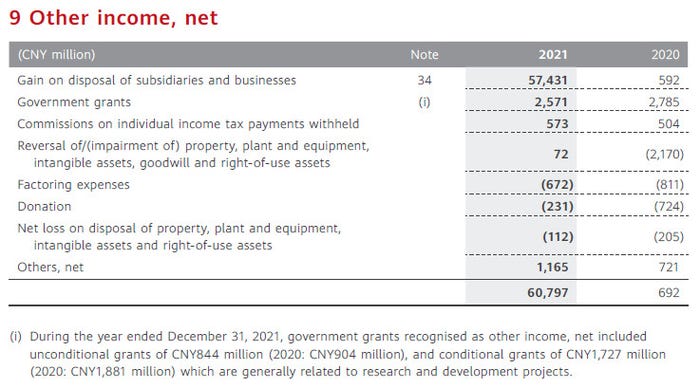

The source of nearly all of this other income is ‘gain on disposal of subsidiaries and businesses’. The corresponding note identified those disposals as the Honor smartphone business and xFusion Digital Technologies, which seems to be the x86 server operation it flogged late last year to, you guessed it, a state-owned firm. Honor was sold a year earlier but the numbers weren’t accounted for until the 2021 financial year.

So, without those two exceptional items the profit is more or less halved and had the cost of sales been at the same proportion to sales as it was the previous year, Huawei would have booked a loss. Having crunched the numbers, it’s hard know what to make of Meng’s statement. Huawei’s increasing ability to make a profit seemed to rely entirely on one-off items in 2021, so it will be interesting to see what new rabbits it pulls out of the hat in a year’s time.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)