Nokia shares tank after 5G weakness admission

Finnish kit vendor Nokia announced the suspension of its dividend and a significantly downgraded outlook as it struggles to make a profit from 5G.

October 24, 2019

Finnish kit vendor Nokia announced the suspension of its dividend and a significantly downgraded outlook as it struggles to make a profit from 5G.

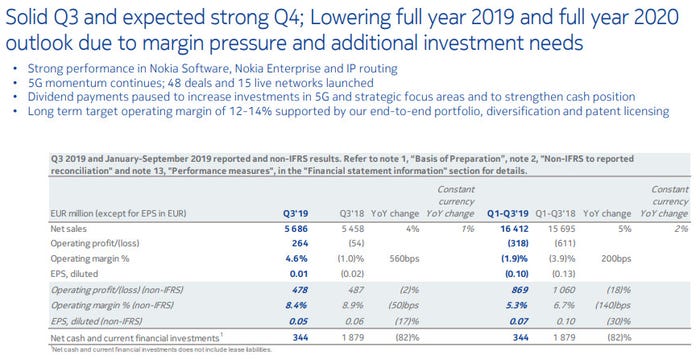

Investors were clearly not expecting such a downbeat outlook and punished Nokia’s share price accordingly, sending it down 20% at time of writing to its lowest level for years. As you can see from the table below the sales performance wasn’t bad, with year-on-year growth of 1%. The key downer, however, is declining margin and the consequent effect on Nokia’s cash position.

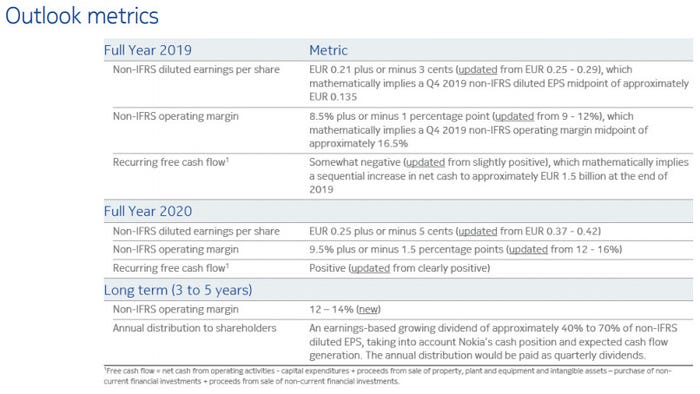

Nokia doesn’t see the margin situation improving, even in the mid-term, and consequently downgraded its margin outlook for both this year and next. Full year 2019 has had its margin downgraded by a couple of percentage points, while the 2020 margin outlook is now 5.5 percentage points lower than previously.

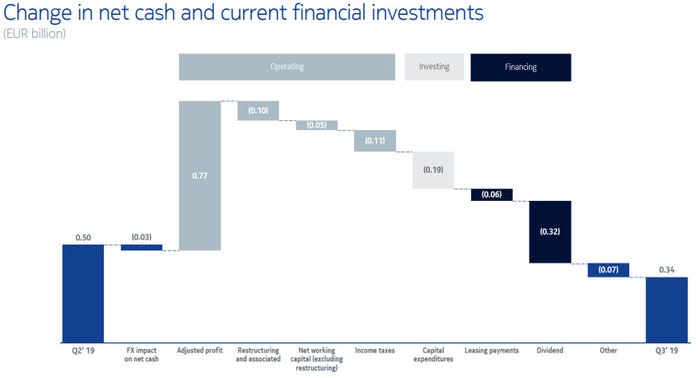

The most immediate crisis, however, seems to be Nokia’s cash position, which is now a mere €344 million. Nokia paid out around that amount in dividends last quarter, during which its cash pile was diminished by €160 million. If this trend continues then it will have run out of cash in a couple more quarters, so something clearly needed to be done. That took the form of an indefinite suspension of the dividend until the Nokia bank balance hits €2 billion, with a significant improvement expect at the end of the next quarter.

“Many of our businesses are performing well and we expect Q4 to be strong, with a robust operating margin and an increase in net cash of approximately EUR 1.2 billion,” said Nokia CEO Rajeev Suri. “At the same time, some of the risks that we flagged previously related to the initial phase of 5G are now materializing. In particular, our Q3 gross margin was impacted by product mix; a high cost level associated with our first generation 5G products; profitability challenges in China; pricing pressure in early 5G deals; and uncertainty related to the announced operator merger in North America.

“We expect that we will be able to progressively mitigate these issues over the course of next year. To do so, we will increase investment in 5G in order to accelerate product roadmaps and product cost reductions, and in the digitalization of internal processes to improve overall productivity. We will also continue to invest in our enterprise and software businesses, which are developing rapidly and performing well. Given these investments and the risks we see materializing, we are adjusting our targets for full-year 2019 and 2020; and we expect our recovery to drive improvement in our 2021 financial performance relative to 2020.

“I am confident that our strategy remains the right one. We continue to focus on leadership in high-performance end-to-end networks with Communication Service Providers; strong growth in enterprise; strengthening our software business; and diversification of licensing into IoT and consumer electronics.”

Suri seems to be saying it’s harder to make money out of 5G than had previously been thought. This is presumably due to a combination of the gear being more expensive to make than hoped and customers paying less for it. Huawei will be competing extra hard in those markets it’s allowed to participate in and Ericsson seems to be growing in strength, so Nokia is facing some pretty stiff competitive pressures.

With the suspension of the dividend Nokia will have several hundred thousand euros of extra working capital to invest in R&D and to cut prices if necessary. For some reason Nokia seems to be less competitive in 5G than expected, maybe it took its eye off the ball a bit during the Alcatel Lucent acquisition. Whatever the reason, it’s now playing catch-up and will ask its investors to remain patient for at least another year.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)