North American smartphone shipments are a lot healthier than China's

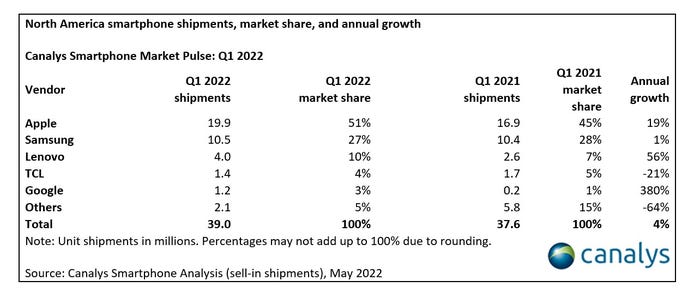

Smartphone shipments in North America clocked in at 39 million units in Q1 2022, contrasting with Chinese figures which have taken a nosedive.

May 19, 2022

Smartphone shipments in North America clocked in at 39 million units in Q1 2022, contrasting with Chinese figures which have taken a nosedive.

In terms of the major smartphone manufacturer rankings, Apple grew 19% and grabbed a 51% market share in North America for Q1, according to figures from analyst Canalys. Samsung was up 1% to swipe a 27% market share, for which its S and A series are given the credit. Motorola took third place with 10%, followed by TCL (4%) and Google (3%).

A lot of the strength of the market can apparently be laid at Apple’s door, who has enjoyed bumper sales both from its latest flagship device the iPhone 13, and the latest iteration of the more wallet friendly iPhone SE.

“The North American smartphone market has been buoyed by Apple’s strong growth,” said Canalys Analyst Brian Lynch. “This quarter, the iPhone 13’s high popularity was the key driver. With global demand more uncertain, Apple has shifted more devices back into North America after prioritizing other regions in Q4 2021, allowing it to greater fulfill demand and deliver on backorders from the previous quarter. In addition, the launch of the latest edition of the iPhone SE offers an affordable option for many of North America’s fiercely loyal iOS users. Despite not being mmWave-enabled, carriers’ increasing investments in C-band and sub-6GHz spectrums will open the door for the iPhone SE’s market growth in the coming quarters.”

While rising inflation and ongoing supply chain issues seem to almost guarantee some choppy waters ahead in all aspects of the economy, Canalys remains optimistic on the near future of the North America smartphone market.

“High inflation places an enormous amount of pressure on carriers in North America as rate increases will be necessary,” continued Lynch. “Heavy discounting and high trade-in values are being used to lure in and retain customers for the region’s biggest telcos, easing pressure on the high-end smartphone market. Supply will remain a key bottleneck for the top vendors in the upcoming quarter, but North America will continue to be a priority and is likely to maintain healthy supply levels. The North American market is well placed to avoid any significant volatility in shipments despite the uncertain outlook of its economy.”

Smartphone shipments in China, on the other hand, have taken a nosedive of late. Figures from Counterpoint Research reveal a steady decline since mid-February, which is about the same time extra covid quarantine measures were introduced for the Winter Olympics. However the downward trajectory appears to accelerating, with mobile shipments down 40% in March and almost 30% for the first quarter. Which you don’t have to be a smartphone analyst to recognise is far from ideal.

There seems to be a good reason to suggest the damage is somewhat self-inflicted, since it’s not necessarily inflation or supply chain issues dragging sales in the region down, but that the Chinese government has seemingly endless appetite for imposing particularly harsh lockdowns on huge areas of the country for as often and for as long as it likes.

Most nations seem to have given up on the idea of zero covid, but for whatever reason China is insistent that such a thing is possible and worth whatever cost the pursuit of it incurs, despite restrictions practically disappearing in other parts of the world, the availability of vaccines, and the latest Omicron variant presenting nothing like the health risk the original version of Covid did.

Whatever else is going on in the global economy – and not much of it is good right now – the situation will continue to be made worse by plummeting sales and production in China across all sorts of market areas, but that seems to be what we are condemned to for as long as its leaders continue to reserve the right to shut the world’s second biggest economy and number one manufacturing region down at the drop of a hat.

Observed in isolation, of course there are worse things going on right now than a downward trend in regional sales of consumer electronics. But no market area does exist in isolation – and the damage all adds up. Ultimately no problem is made better by the prospect of a global recession.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)