Qualcomm benefits from 5G momentum and gives bullish outlook

Chip giant Qualcomm reported strong quarterly and annual revenues, and profits, on the back of strong market enthusiasm for 5G products.

November 5, 2020

Chip giant Qualcomm reported strong quarterly and annual revenues, and profits, on the back of strong market enthusiasm for 5G products.

Qualcomm published its financial year and fiscal Q4 (ending 30 September) results. Quarterly revenues went up 35% from a year ago to reach $6.5 billion, and the revenues of its FY2019 grew by 12% to reach $21.6 billion. The quarterly and annual net income increased by 76% and 11% respectively.

These are non-GAAP numbers, which Qualcomm uses to measure its performance in a consistent manner. They exclude one-off items such the $1.8 billion settlement with Huawei and the $4.7 billion settlement with Apple. In GAAP terms, the quarterly revenues would be $8.3 billion, up 73% y-o-y, and annual revenues would be $23.5 billion, down by 3%.

“Our fiscal fourth quarter results demonstrate that our investments in 5G are coming to fruition and showing benefits in our licensing and product businesses,” said Steve Mollenkopf, Qualcomm’s CEO, in a statement. “We concluded the year with exceptional fourth quarter results and are well positioned for growth in 2021 and beyond. As the pace of disruption in wireless technology accelerates, we will continue to drive growth and scale across our RF front-end, Automotive and IoT adjacencies.”

Looking at the results by business lines, QCT (or Qualcomm CDMA Technologies, the business unit that sells chips) generated $5.0 billion revenue during the quarter while QTL (Qualcomm Technology Licensing) brought in $1.5 billion. But the latter’s profitability level is much higher: its earnings-before-tax (EBT) accounted for 73% of its revenues, compared with the former’s 20%.

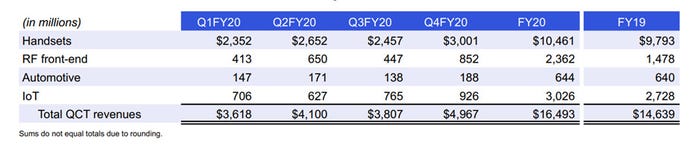

Breaking down QCT’s business to product lines, it is obvious that the biggest segment is handsets (excluding RF front-end) which accounted for 60% of its fiscal Q4 revenues and 63% of the unit’s FY annual income. The fastest growth was registered by RF front-end, which serves IoT, automotive, drones, etc. in addition to mobile devices, powered by RF360 Holdings that Qualcomm brought in-house after buying out its JV partner TDK last year. This segment’s revenues grew by 60% y-o-y. Also disclosed, though for the last time, was that Qualcomm shipped 162 million mobile modems in the quarter, up from 152 million in the same quarter last year.

Figure 1: QCT Revenue Streams

Source: Qualcomm Investor Relations

On the call with analysts after the release, Mollenkopf said the quarterly results “included only a partial quarter impact from a large US OEM customer”, presumably referring to Apple, indicating that this is only the beginning, and the strong momentum in 5G will benefit Qualcomm in the years to come. On the same analyst call, Akash Palkhiwala, the CFO, reiterated Qualcomm’s projection of 5G smartphone outlook. “We are maintaining our bias towards the high end of our previous forecast of 175 million to 225 million units for calendar 2020 5G handsets. In calendar 2021, we are forecasting 450 to 550 million 5G handsets, a year-over-year growth of 150% at the midpoint,” Palkhiwala said.

Mollenkopf believed that “5G represents the single largest opportunity in our history, creating new opportunities to extend our leadership.” Qualcomm vows to grab the opportunity with both hands, not the least by continuously expanding it portfolio. Recently the company announced that it has also entered the 5G RAN business.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)