Report commissioned by Ericsson and Qualcomm insists mmWave is a great ideaReport commissioned by Ericsson and Qualcomm insists mmWave is a great idea

The deployment of millimetre wave (mmWave) spectrum for 5G in Europe will bring a huge economic benefit, according to a new report by Analysys Mason.

June 8, 2021

The deployment of millimetre wave (mmWave) spectrum for 5G in Europe will bring a huge economic benefit, according to a new report by Analysys Mason.

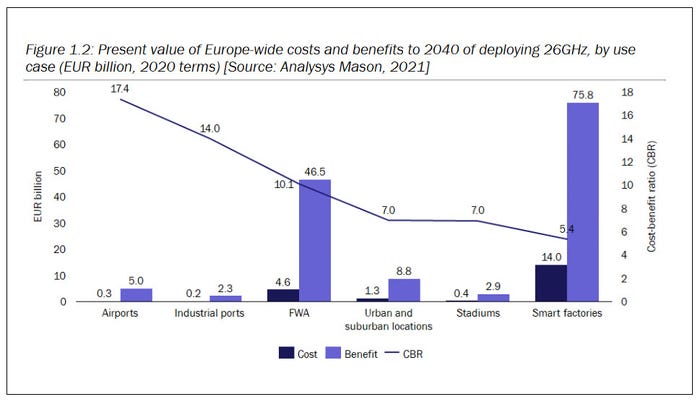

The analyst firm was commissioned by Ericsson and Qualcomm to carry out a study of the impact of 26 GHz – or mmWave – spectrum, particularly from a cost and benefit point of view. One of its key conclusions was that the economic benefit of rolling out 26 GHz could be as great as 20 times its cost. Music to the ears of tech firms keen to sell mmWave kit, no doubt.

But the study also serves as a call to European regulators to get a move on when it comes to allocating 26 GHz spectrum for 5G.

Analysys Mason’s modelling of various use cases showed that deploying 5G mmWave – primarily together with 3.5 GHz, but also as dedicated cells, and based on a base case mobile broadband network deployment – could bring an estimated economic benefit of between five and 20 times its cost. The firm put the GDP uplift across 30 European markets at more than €140 billion to 2040, with the additional cost of rolling out the technology estimated at €21 billion.

Many mobile network operators are already on the case. The company interviewed a number as part of its study and learned that they expect to use mmWave in a variety of use cases: including mobile broadband in high-capacity locations, 5G-based FWA, smart factory and other industrial applications, connected vehicles and venue-specific coverage. Operators said trials and commercial deployments have proven that 5G mmWave will provide the high capacity they need in certain areas.

However, Europe is not particularly advanced in this regard.

While multiple commercial mmWave networks have been deployed throughout the world, Europe is still playing catch-up. European telcos interviewed by Analysys Mason said that further deployments in Europe, as well as those elsewhere in the world, like Australia and Brazil, will help to build the required 26 GHz equipment and device ecosystem.

Meanwhile, further progress on mmWave licensing in Europe, in line with the targets set in the EU’s 5G Action Plan (5GAP) will help to increase certainty and take-up.

“This study demonstrates the importance for European regulators to complete 5G licensing in all of the bands identified at an EU level,” said Janette Stewart, Partner at Analysys Mason.

While many European markets have carried 5G licensing processes in the 700 MHz and 3.5 GHz bands, only seven have allocated 26 GHz spectrum, the report notes. They are Denmark, Finland, Germany, Greece, Italy, Slovenia and the UK. The figures refer to the 30 markets covered by the study: the EU27 plus the UK, Norway and Switzerland, incidentally.

Croatia, Estonia, Malta, Spain and Sweden all intend to allocate 26 GHz before the end of the year. As such, 40% of European countries will have made available part or all of the 26 GHz band for 5G by the end of the year, Analysys Mason notes.

“It is clear from the report that deploying 5G mmWave alongside sub-6 5G deployments will bring significant positive economic impact to Europe,” said Wassim Chourbaji, Senior Vice President, Government Affairs EMEA, at Qualcomm. “We are encouraged to see the positive progress made thus far in Europe to award 26 GHz mmWave spectrum. It is clear however that there is much work to do to catch up with other regions around the world that are seeing the benefits of commercialising 5G mmWave services.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)