Samsung boosted by increased online life during lockdownSamsung boosted by increased online life during lockdown

Samsung Electronics’ solid Q2 has benefited from strong demand for semiconductors by datacentres and PC markets to satisfied online activities that have surged during COVID-19 crisis.

July 30, 2020

Samsung Electronics’ solid Q2 has benefited from strong demand for semiconductors by datacentres and PC markets to satisfied online activities that have surged during COVID-19 crisis.

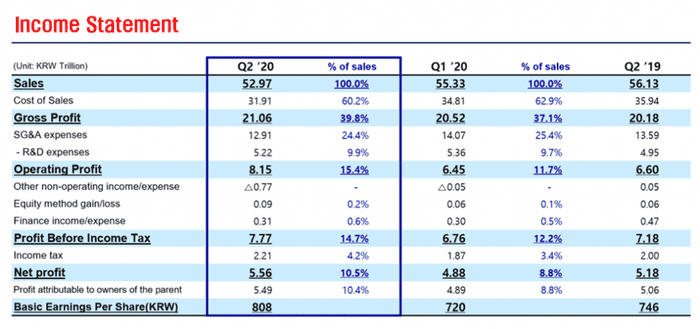

Total revenues went down by 6% year-on-year and down by 4% sequentially to reach KRW52.97 trillion ($44 billion). However, operating profit increased by 23% over last year, and up by 26% from Q1, to reach KRW8.15 trillion ($6.8 billion), with an operating margin of 15.4%, a big improvement from the 11.7% in Q1, and very much in line with the updated quarterly guidance the company published earlier this month. The KRW5.56 trillion ($4.7 billion) net profit represented a 16% increase from Q1, and a 9% increase from the same quarter in 2019.

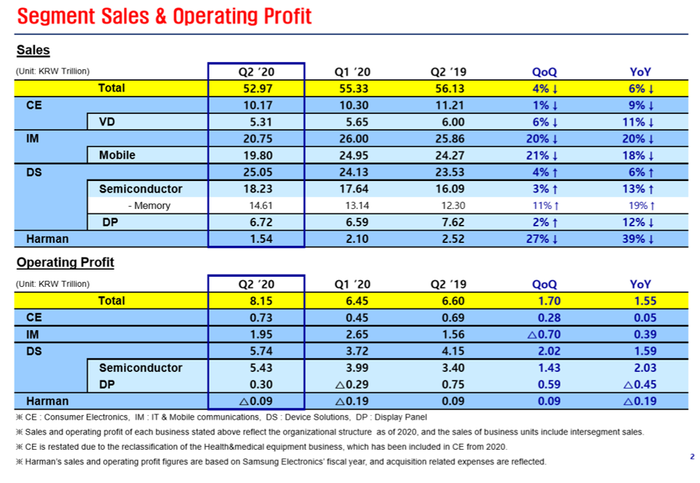

When it comes to the segment performance, the Device Solutions business unit stood out. Responsible for 70% of the company’s operating profit, both semiconductors and display panels achieved double-digit growth year-on-year. The company attributes the growth in its memory chips business to “solid demand from datacentres and PCs.”

On the Display Panel side, “a one-off gain boosted profits from mobile displays while the Company saw losses from larger panels narrow slightly on increased sales of monitors.” The one-off gain was from Apple. Analysts estimated that Samsung could have received a compensation up to KRW1 trillion ($840 million) from the iPhone maker for lower than planned mobile display orders, quoted in earlier report by the Financial Times.

The profitability of Samsung’s IT & Mobile communications segment improved year-on-year, “backed by efficient cost execution — e.g., via reducing marketing costs, including those for offline promotions”. However, both top line sales and profitability declined slightly from Q1, primarily due to weak smartphone sales during the pandemic, with many retail outlets closed.

Separately, on the back of Samsung’s smartphone sales contraction, research firm Canalys declared that Huawei has edged past its Korean competitor to become the world’s largest smartphone maker for the first time. Though neither company published official smartphone shipment volumes, based on Canalys’s calculation, Huawei sold 55.8 million smartphones in the quarter, against Samsung’s 53.7 million. Huawei owed much of its strong position to its home market.

Looking ahead to the second half of the year, Samsung expects the memory chips business to recover “backed by launches of new smartphones and game consoles”. The company foresees revenue growth in the smartphone business in Q3 both because of seasonality and on its strengthened product portfolio with the launches of flagship products, including the new Note phablet and new Fold smartphone model. This outlook is more upbeat than the dire warning the company released three months ago.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)