Smartphone shipments fell to a 10-year low in 2022Smartphone shipments fell to a 10-year low in 2022

Preliminary stats from Canalys suggest the global smartphone market had a year to forget in 2022.

January 18, 2023

Preliminary stats from Canalys suggest the global smartphone market had a year to forget in 2022.

Before getting into the numbers, it is worth mentioning that the two biggest players in the market, Apple and Samsung, have yet to publish their results for the final three months of the year. These are due to come out on 2 February and 31 January respectively. Xiaomi’s latest quarterly report isn’t out yet either, so it is fair to say there is a degree of calculated guesswork going on here.

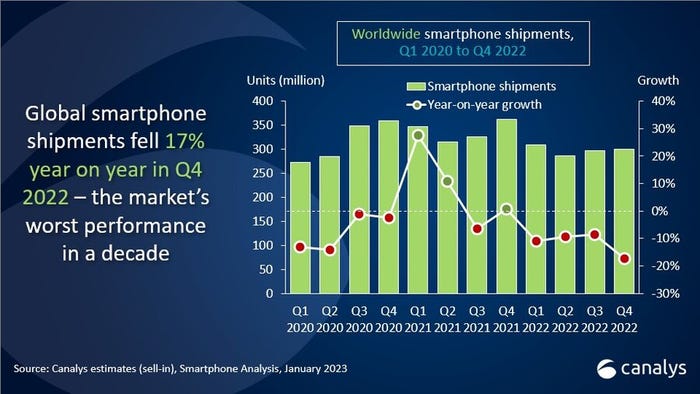

So while these numbers are subject to change, they are unlikely to be too far wide of the mark. And the mark is looking pretty low. According to Canalys, last year, global shipments were 11% lower compared to 2021, dipping below 1.2 billion. In Q4, shipments were down 17% year-on-year.

“Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022,” said Runar Bjørhovde, Canalys research analyst, who highlighted that it marks the worst Q4 and annual performance in a decade. Retailers in Q4 were “highly cautious” about taking on new inventory, a contributing factor to the low shipment volume, he added.

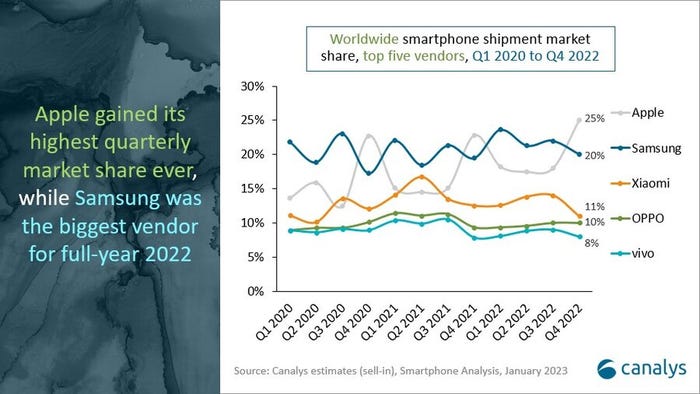

The preliminary figures, published on Tuesday, claim Apple took top spot from Samsung at the end of 2022; the iPhone maker achieved a market share of 25 percent in Q4, compared to its rival’s 20%. In Q3, it was Samsung enjoying the lead with a market share of 22 percent to Apple’s 18%.

Unfortunately for OEMs, the outlook this year for the smartphone market isn’t much better, with Canalys predicting flat to marginal growth.

“Though inflationary pressures will gradually ease, the effects of interest rate hikes, economic slowdowns and an increasingly struggling labour market will limit the market’s potential,” warned Canalys research analyst Le Xuan Chiew.

“This will adversely affect saturated, mid-to-high-end-dominated markets, such as Western Europe and North America,” he continued. “While China’s re-opening will improve domestic consumer and business confidence, government stimuli are only likely to show effects in six to nine months and demand in China will remain challenging in the short term. Still, some regions are likely to grow in the second half of 2023, with Southeast Asia in particular expected to see some economic recovery and a resurgence of tourism in China helping to drive business activities.”

The news, while unwelcome, is hardly surprising. Telecoms.com reported last October that the smartphone market saw its lowest Q3 shipment volume since 2014. Last week, a group of analyst firms including Canalys noted that global PC shipments slumped around 22% in Q4, with Gartner noting that it was the biggest quarterly decline since it began tracking the market nearly 30 years ago.

Gartner added yet more detail to the emerging – and decidedly gloomy – picture on Tuesday, publishing stats that showed that revenue growth in the global semiconductor market slowed considerably in 2022, with a modest year-on-year increase of 1.1%. In 2021, semiconductor revenue grew 26 percent.

“2022 began with many semiconductor devices in shortage resulting in extended lead times and increasing pricing, which led to reduced electronic equipment production for many end markets. As a result, OEMs started hedging themselves from shortages by stockpiling chip inventory,” explained Andrew Norwood, VP analyst at Gartner.

“However, by the second half of 2022, the global economy began to slow under the strain of high inflation, rising interest rates, higher energy costs and continued COVID-19 lockdowns in China, which impacted many global supply chains. Consumers also began to reduce spending, with PC and smartphone demand suffering, and then enterprises started to reduce spending in anticipation of a global recession, all of which impacted overall semiconductor growth,” he said.

With the World Bank warning last week that the global economy is “perilously close” to falling into recession, the situation in the tech sector could quite easily get worse before it gets better.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)