T-Mobile buddies up with Verizon on FWA broadband missionT-Mobile buddies up with Verizon on FWA broadband mission

T-Mobile US is on a mission to prove that fixed wireless access (FWA) is succeeding as a replacement for traditional broadband services and has chosen an unlikely ally to help it get its message across: rival operator Verizon.

December 9, 2022

T-Mobile US is on a mission to prove that fixed wireless access (FWA) is succeeding as a replacement for traditional broadband services and has chosen an unlikely ally to help it get its message across: rival operator Verizon.

The US mobile operator has spent years taking pot shots at its telco competitors, positioning itself as the un-carrier taking on established players AT&T and Verizon. Thus, it came as something of a surprise when it published its 2022 State of Fixed Wireless report this week to discover that Verizon is no longer the enemy. The pair are apparently on the same side when it comes to FWA.

Now the foe is big broadband, the cable industry in particular. That in itself is no great bombshell. T-Mobile went on the offensive against America’s fixed ISPs earlier this year when it launched a new 5G-based FWA consumer broadband offering, a move that marked a renewed push into the home Internet space. The telco did not mince its words, encouraging customers to ditch their broadband providers in favour of a mobile alternative, hitting out at a legacy of poor service and high prices.

It’s starting to look like some consumers listened.

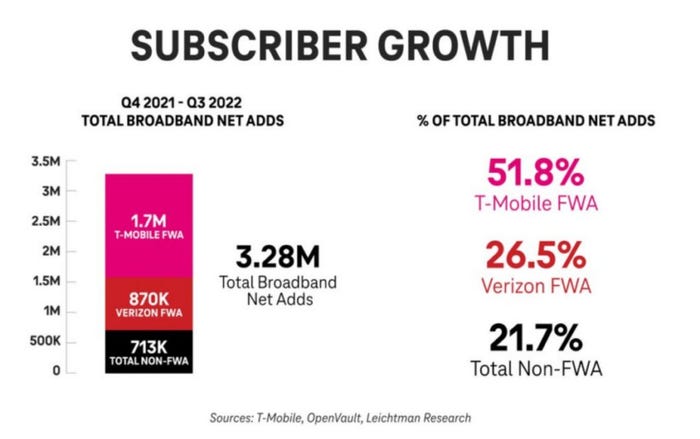

In the third quarter of this year T-Mobile signed up its 2 millionth FWA Internet customers, doubling its base in six months. Indeed, the telco claims it was the fastest growing ISP in the US for the last four quarters.

“It’s clear FWA is taking a bite out of Big Internet, growing by more than 70% across all providers since Q1 of this year,” T-Mobile said, in a statement accompanying its FWA report.

“In fact, over the last year, the broadband industry’s growth has come almost entirely from fixed wireless. And that shift is expected to continue,” it added. “T-Mobile and Verizon are expected to have 11 to 13 million total FWA customers by the end of 2025.”

And there’s the ‘needle off the record’ moment. Unlikely bedfellows indeed.

Just to clarify, there’s no suggestion that the pair are working together to push the FWA agenda. They just happen to be both pushing in the same direction for once.

Verizon reported having a total of almost 1.1 million FWA connections at the end of the third quarter, incidentally, including 621,000 on the consumer side, the majority of which were added during the course of 2022. Given that its base is about half that of T-Mobile, there can be no suggestion the latter is using its rival’s size to boost the overall telco FWA numbers prediction for end-2025. Indeed, T-Mobile expects to have 7 million-8 million FWA subs by that date to Verizon’s 4 million-5 million.

There is more than a hint of ‘you’ve changed, man’ about this T-Mobile announcement…but fear not, it doesn’t last.

“It’s no secret that fixed wireless is disrupting a historically broken broadband industry, offering choice and competition at a time when consumers need it the most,” said Mike Katz, Chief Marketing Officer at T-Mobile US, shortly after the company again waxed lyrical about “decades of dissatisfaction” with traditional ISPs, and the lack of choice and competition in the market.

“Just one year after fixed wireless entered the broadband scene, we’ve seen remarkable growth, with many customers ditching their traditional ISP,” Katz added. “This report further highlights the massive demand for a new option, and 5G’s ability to meet that need.”

T-Mobile’s data suggests the cable operators are the one losing out. The operator says it is winning 51 percent of FWA customers from cable rivals, the remainder migrating away from satellite or DSL services, or with no previous provider. It’s quite telling that there’s no mention of fibre in there, but that’s probably not altogether surprising.

Similarly, it’s no shock to learn that the bulk of customers switching to FWA do so for lower prices; 58 percent cite that as a reason, according to the report. 41 percent mention the lack of an annual contract obligation, while 32 percent are just taking advantage of a newly-available service.

This data – and there’s a link to the full report here – from T-Mobile makes interesting reading, but it will be a year or two before we get the full picture of how the FWA market in the US is performing against the established broadband sector. It’s still early days.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)