Telecoms revenue per user is falling despite 5G and fibre rolloutsTelecoms revenue per user is falling despite 5G and fibre rollouts

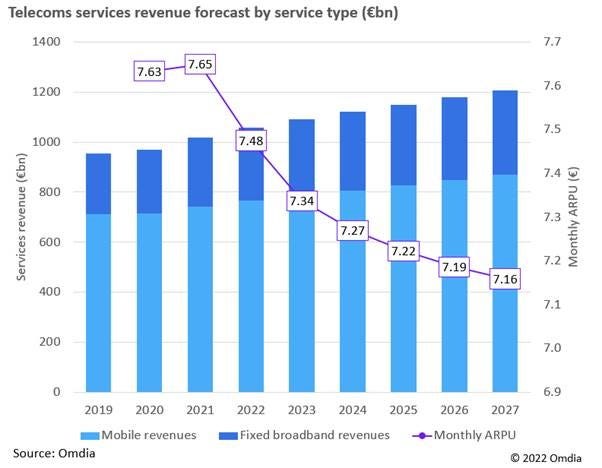

A report by analyst firm Omdia claims revenues from mobile and fixed broadband services will grow 14% between 2022 and 2027, however monthly Average Revenue Per User will fall by 4.2%.

October 13, 2022

A report by analyst firm Omdia claims revenues from mobile and fixed broadband services will grow 14% between 2022 and 2027, however monthly Average Revenue Per User will fall by 4.2%.

Revenue for total global telecoms services is expected to be around €1.2 trillion by 2027 according to the report, but monthly Average Revenue Per User (ARPU) combined across both mobile and fixed broadband will fall by 4.2% from €7.48 in 2022 to €7.16 in 2027.

The report asserts that the hugely hyped 5G train will not be sufficient to offset ARPU decline, largely because consumers are unwilling to pay more for it than 4G. There are plenty of unlimited 5G data and video streaming bundles being sold of course, but this apparently ‘only gives the industry the illusion of a 5G ARPU uplift.’

On the broadband side, while the fibre rollout provides a noticeable upgrade in home connections, markets with high penetration – such as France, Spain and China – are actually seeing a significant drop in ARPU because competition is very high ‘and there isn’t a clear monetisation path for fibre customers once they transitioned,’ claims the report.

“People don’t buy technology; they buy fun exciting new experiences,” said Omdia Research Director Ronan de Renesse. “There is a misconception that operators should be reselling the technology they buy directly to customers, and it doesn’t work. The network is the bedrock on which innovation and creativity can flourish like 4G and mobile apps. It is not just up to operators to solve the ARPU growth challenge but rather the rest of the digital services ecosystem. We will be discussing this issue as a matter of priority at the upcoming Network X event in Amsterdam.”

You have to feel for the operators who have put billions into upgrading mobile network infrastructure with 5G tech sometimes. But bespoke b2b use cases aside, there still hasn’t really been a very good pitch to the consumer as to what it is they are actually getting from it that they don’t already have – the best we get is ludicrous use cases like robot shaving and vague assurances that the metaverse might use it.

So the idea that people are not willing to spend more than they already are on mobile connections seems to hold water – until the average person on the street is able to see an advert for a 5G function that’s substantial enough to make them want it, and want it enough to pay a bit more for it, you can’t really expect anything else.

On the fibre side the case for upgrading to a new package is easier to get your head around – for things like video streaming, gaming, and having multiple people work from home simultaneously, the benefits are clearly there to be seen. However the assertion by this report is that there is so much competition in many regions that despite rapid uptake, its not necessarily going to mean consumers are paying much more either.

Purely in terms of revenue growth forecasting, this all paints a picture that the global telecoms business model is in a bit of a pickle. For more on this subject, check out our interview with HPE in which we ask if the telecoms market has the right strategy for the 5G era.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)