Three to decouple traffic growth from price with CityFibre backhaulThree to decouple traffic growth from price with CityFibre backhaul

CityFibre has been announced as the new preferred supplier for 5G backhaul for Three, as the telco aims to increase competition among its suppliers.

February 18, 2020

CityFibre has been announced as the new preferred supplier for 5G backhaul for Three, as the telco aims to increase competition among its suppliers.

Three is the first major telco to be wooed by the CityFibre team, demonstrating the progress of the business over recent years. CityFibre should no-longer be considered a petulant disruptor in the connectivity world, but perhaps this is an indication the infrastructure challenger is a genuine contender.

“This is a huge vote of confidence in CityFibre from a national mobile operator with big plans for 5G,” said Greg Mesch, CEO at CityFibre. “Three’s decision to leverage our rapidly expanding networks nationwide shows the critical role full fibre infrastructure has to underpin 5G rollouts and reinforces CityFibre’s position as the UK’s third national digital infrastructure platform.”

“A competitive fibre backhaul market is critical for the fast and efficient rollout of 5G,” said Dave Dyson, CEO at Three UK. “CityFibre are aggressively rolling out fibre across Britain and our strategic partnership with them will use the UK’s largest 5G spectrum portfolio to deliver the fastest 5G network nationwide.”

As part of the agreement, CityFibre will connect the 5G sites which are set to go live in the coming months as Three launches its commercial 5G services. CityFibre will also provide Dark Fibre services to Three, and small cell access points throughout its city-wide networks, providing the local fibre capacity required to support 5G services in busy urban areas.

After talking to Three, this is an effort to future-proof it’s backhaul relationships against the growing tides of data consumption in today’s 4G environment and the forecasted 5G era.

The surge in data consumption has been regularly discussed in recent years, especially with the emergence of 5G, but it is important to remember this was an existing trend in the 4G era. As applications become more data intensive, telcos have had to bring down the price per GB to meet the demands of consumers. Three suggests traffic across its network could increase 20X thanks to 5G, but in 2010 the average consumer only used 269 MB of data per month.

As it stands, the price of data transmission is directly linked to the amount of traffic which flows across a network; the price per GB is fixed irrelevant of the volume of traffic. Three has said by diversifying its supplier base and increasing competition, the aim is to decouple price from traffic growth.

An oversimplification of this process would be to imagine economy of scale. The more of a service which is purchased, the price per unit decreases. The relationships which are in place moving forward are obviously much more complicated than this, though it does appear to be a case of Three attempting to ensure it is not backed into a corner with a single supplier holding the aces.

While this is a headline which has the potential to turn heads, diversification is a process which has been on-going within the Three business for some time.

BT Wholesale, a customer of Openreach, was the primary supplier of backhaul services for Three during the 4G era, though in recent years it has been unbundling BT exchanges for years. In July 2018, Three announced a major project to unbundle 177 BT exchanges with SSE Telecoms, while it has already been working with CityFibre to provide backhaul services in Hull.

The objective here is to have less of a reliance on a single supplier, BT Wholesale and Openreach as a result, and to improve diversification. It is working towards creating a more sustainable and healthy vendor ecosystem.

This is of course not the end for the Three/BT relationship. CityFibre can offer services in certain regions across the UK but not everywhere. SSE Telecoms will help fill the void, though there are locations where it is not commercially attractive for anyone to build out moving forward. These areas, where Openreach is the sole supplier, are subject to a price ceiling consultation from Ofcom.

With the likes of CityFibre and SSE Telecoms aggressively expanding networks, Openreach will certainly face tougher competition in the coming years. For decades, Openreach has maintained a defacto monopoly on backhaul services across the market, though the telco desire for reduced costs and resilience through supplier diversity does seem to be translating into fresh competition.

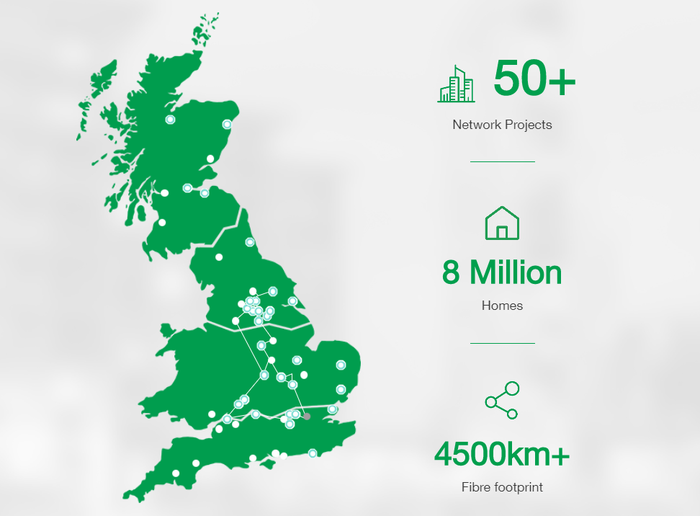

CityFibre network:

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)