Giesecke+Devrient lands Swatch contactless payment gigGiesecke+Devrient lands Swatch contactless payment gig

Mobile security company Giesecke+Devrient is helping Swiss watch company Swatch with its own contactless payment technology.

January 17, 2019

Mobile security company Giesecke+Devrient is helping Swiss watch company Swatch with its own contactless payment technology.

Rather annoyingly called SwatchPAY!, the contactless platform was launched in China back in 2017 and is now available in Switzerland. It involves sticking an NFC chip in a watch, which you can then sync with your credit card. In that respect it’s pretty much a contactless card embedded in a watch.

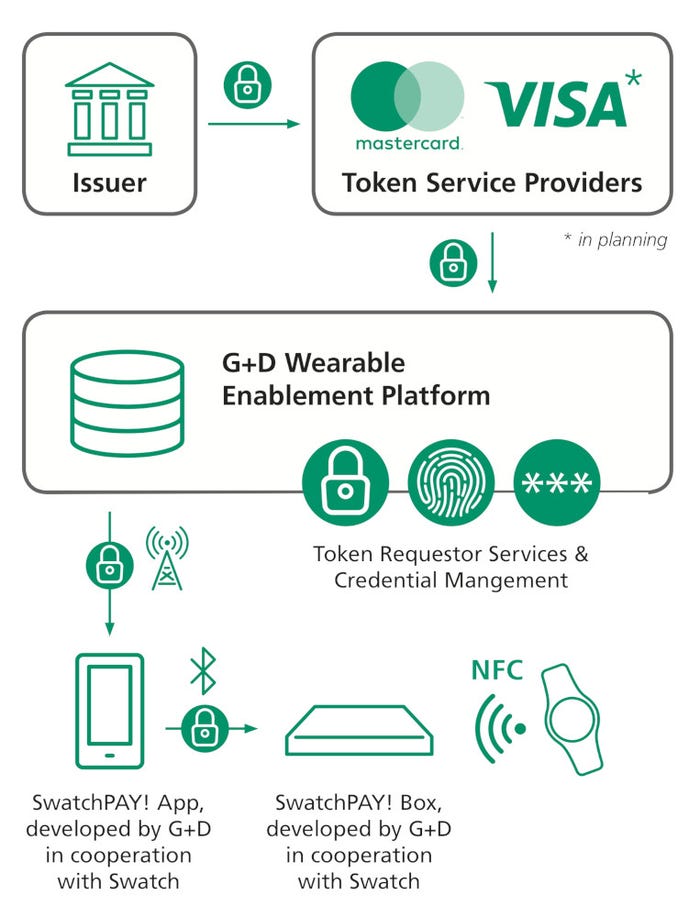

Whether it functions just as easily is unclear, but Swatch seems to have partnered with all the right companies, including Mastercard, Credis Suisse, UBS and G+D. The latter is doing what it does best in providing the secure element for these watches, which also enables the activation of the contactless payment function in-store, when you buy one. Here’s how it works.

“Continuous innovation is a key strand of the Swatch DNA,” said Carlo Giordanetti, Swatch Creative Director. “This latest advance, with the introduction of the fastest and simplest tokenization, makes it easier than ever to pay ‘forever’ – token up your Swatch, swipe it and you’re done. SwatchPAY! is simple, stylish and swatchy.”

“We are thrilled to be Swatch’s partner for this payment-enabled watch, which has been a huge success in China,” said Carsten Ahrens, CEO of Giesecke+Devrient Mobile Security. “The unique mix of iconic Swatch design and a payment functionality makes this a very appealing product, and we are proud to have contributed our extensive expertise in security, mobile payment and wearables technology.”

The Swiss watch industry has been in a flap about smart watches for a while, so it’s sensible to see one of them develop its own contactless payment platform. They’re fortunate that the killer use-case for smart watches hasn’t been found yet, but it presumably will be eventually. The key to this alternative being a success will be its ease of setup and use and it looks like they might have got that right.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)