Germany, UK, Italy still clinging onto copperGermany, UK, Italy still clinging onto copper

Europe is making solid progress in both the rollout and take-up of full fibre connections, according to new market data published this week, but there is still plenty of work to, particularly by three of the continent's major economies.

May 13, 2021

Europe is making solid progress in both the rollout and take-up of full fibre connections, according to new market data published this week, but there is still plenty of work to, particularly by three of the continent’s major economies.

Presenting their latest FTTH market panorama, which tracks progress over the 12 months to September 2020, the FTTH Council Europe and IDATE noted that many countries where legacy infrastructure still dominates have altered their strategies and are increasingly migrating from copper and cable-based networks to fibre, and in some cases are accelerating copper switch-off.

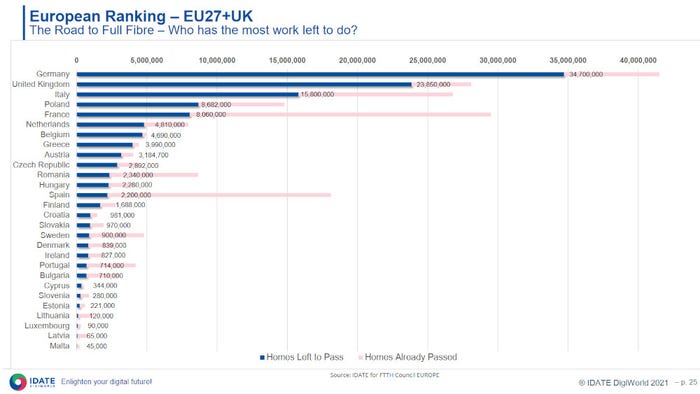

Nonetheless, Germany, the UK and Italy, which the firms describe as “three historically copper-strong countries” account for almost 60% of homes still to be passed with fibre in the EU27+UK region.

As the chart shows, Germany has the most work still to do, with almost 35 million premises still without access to a fibre connection as of September. That shouldn’t come as huge surprise, given that the incumbent, although now pushing its fibre rollout, was one of the slowest off the mark. The publication of Deutsche Telekom’s first-quarter numbers earlier this week coincided with a new set of market statistics from VATM and Dialog Consult, who predict that by mid-2021 Germany will have 6 million FTTH/B lines by mid-year, 3.7 million of which will be provided by altnets and 2.3 million by the incumbent.

Meanwhile, BT is doing its bit to help the UK plug its sizeable full fibre coverage gap, which stands at just under 24 million homes, according to the FTTH Council/IDATE. The UK incumbent on Thursday announced plans to accelerate its fibre rollout target to 25 million homes by 2026, up from the 20 million it was shooting for previously. To hit that number Openreach will double its current rollout rate to 4 million homes passed per year, starting immediately.

The market is a little more complex in Italy, where the previous government’s plan to create a single fibre access network provider looks set to fall apart. However, fibre rollout announcements are coming thick and fast from both TIM, which is in the process of creating independent fibre wholesaler FiberCop, and the state-backed Open Fiber venture whose ownership has just been resolved.

Encouraging signs from those three markets are mirrored in the IDATE data, which shows that Italy, Germany and the UK were respectively the second, third and fourth ranked countries in terms of growth in fibre connections deployed during the year to September 2020. Italy and Germany added 2.8 million and 2.7 million lines respectively, while the UK was a little way behind with 1.7 million.

By far the biggest increase came in France though, where FTTH/B lines installed grew by 4.6 million to 21.4 million, making the country the largest in fibre volume terms in the EU27+UK. Spain ranks second, followed by Italy and Germany; the UK comes in seventh.

Installing the fibre is one thing, but take-up is entirely another. Uptake is growing in Europe, but still fewer than half of homes passed have subscribed to full fibre. In the EU27+UK take-up was at 46.9% in September, an increase of 3.6 percentage points over 12 months.

Spain tops the charts in terms of number of subscriptions with 11.3 million, and ranks highly in penetration terms at 71%. Penetration remains highest in Iceland, where 79% of homes passed have subscribed to an FTTH/B service, although its population is of course tiny compared to the major economies. France comes in second in volume terms with 10.3 million connections and a creditable 48% take-up rate

There were 98.3 million homes passed with FTTH/B in the EU27+UK as of September, up from 82.3 million a year earlier, while the broader EU39, which includes Russia’s almost 50 million homes passed, grew to 182.5 million from 163.3 million. That’s a lot of people with access to full fibre connectivity, and the figure should grow if the big incumbents in the region’s major markets keep up their current momentum.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)