Lumen could raise $5 billion-plus from asset salesLumen could raise $5 billion-plus from asset sales

US B2B comms outfit Lumen Technologies is looking to raise US$5 billion or more by selling certain consumer operations, according to a rumour that emerged this week.

July 15, 2021

US B2B comms outfit Lumen Technologies is looking to raise US$5 billion or more by selling certain consumer operations, according to a rumour that emerged this week.

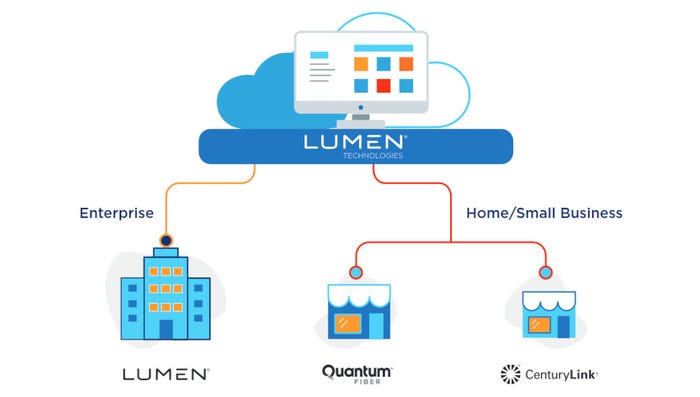

When Lumen adopted its current brand just under a year ago, it appeared the writing could be on the wall for the legacy CenturyLink side of its business, and if Bloomberg’s report that Apollo Global Management is looking to buy an as-yet unspecified portfolio of consumer assets proves correct, that may well be the case.

Citing unnamed sources, the newswire reported that Lumen is in talks with Apollo that could lead to it carving out its consumer operations in certain US states. The deal – which has not yet been finalised and could still collapse – would be worth north of $5 billion, the sources said. A deal could be announced in the coming weeks.

Lumen’s consumer and small business operations are split between two brands: Quantum Fiber covers connectivity and services delivered over fibre, while the old CenturyLink brand serves residential customers and small businesses using legacy networks. For the most part, CenturyLink means DSL. And when it rebranded last September, Lumen made it pretty clear that it was looking ahead to next-generation connectivity, which seemed to signal the end of the road would not be too far away for CenturyLink.

That said, the rumoured deal with Apollo seems to be more geographically-defined than technology-based.

Bloomberg provided no indication of which states Lumen is looking to part with, although the implication is that it is not offloading its entire consumer business.

Lumen’s consumer and small business broadband ops form part of its Mass Markets segment for reporting purposes. In the first quarter of this year the division turned in $1.4 billion in revenues, a decline of around 4%, which was in line with the performance of the rest of the organisation. Mass Markets contributes close to 29% of group revenues, the rest coming from the business division, which includes international and global accounts, medium and large enterprises, and wholesale.

It makes sense that Lumen would prefer to focus its efforts on the global and enterprise side. Indeed, the company reviewed its consumer ops a couple of years ago, but reached no decision on their future, the newswire noted.

“As we continually invest in our platform capabilities and forge valuable strategic partnerships, we remain uniquely positioned to meet our enterprise customers’ evolving needs,” Lumen chief executive Jeff Storey said in a canned statement accompanying the telco’s Q1 results. He made no mention of the consumer side.

Furthermore, during the webcast presentation of the firm’s results, Storey made it clear that assets sales are on the cards.

“I want to be clear that we are actively looking at selling non-core assets to unlock value in our business, further accelerate deleveraging and implement potential buyback programmes,” he said. “That said, we have been and will remain disciplined. We have confidence in our future and don’t feel compelled to undertake any specific transaction. If we find transactions that are positive to shareholders, we won’t hesitate to move forward.”

The consumer business is the obvious choice, but with a reported ballpark $5 billion deal valuation, it seems unlikely Lumen is about to announce that it selling all of it.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)