Ofcom says to Openreach to end the cash-printer business

Ofcom has put forward proposals to introduce a cap on Openreach’s rental charges for providers accessing its ducts and poles in an effort to reduce dependence on BT.

August 2, 2017

Ofcom has put forward proposals to introduce a cap on Openreach’s rental charges for providers accessing its ducts and poles in an effort to reduce dependence on BT.

As part of the wholesale local access (WLA) market review, Ofcom is attempting to figure out how to make ultrafast broadband a reality and essentially kick-start the future of connectivity in the UK. To date, progress has been painfully slow due to an ineffective approach from government, and a less-than-adventurous investment strategy from certain corners of the industry. Brits are Brits after all.

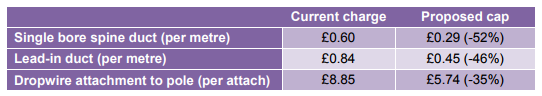

One aspect of the review is to promote infrastructure-based competition, by making it quicker and easier for rival providers to build their own fibre networks by improving duct and pole access (DPA) currently run by Openreach. BT is seen to have too much influence over the WLA market, which is set to change. There have been numerous changes suggested, but the latest are focused around pricing. The latest include imposing a maximum cap on duct and pole rental charges.

The proposed caps are as follows:

“Ofcom is consulting on a range of £4,000 to £6,000 per km as a financial limit for the recovery of such network adjustment costs, with any costs incurred above this limit to be recovered from the telecoms provider making the request,” Ofcom has said.

Considering how much the reduction is pricing actually is, don’t expect this to be a smooth ride for Ofcom. BT Openreach lawyers will be sharpening their pencils as they prepare to battle the regulator in what is likely to be a long and tedious process in the courts. Arguments will flow back and forth over the unfair reduction in prices, damages to the business model and danger to future investment, but the end result will most likely be a cap.

The final cap will probably be somewhere in the middle and maybe this is a negotiating tactic from Ofcom. BT Openreach will probably realise a cap is coming, so it is all about damage limitation now. If Ofcom has tried to cap on today’s rates, there would have been an argument to rise them to account for inflation, and they will probably argue that the caps are way too low. Whatever Ofcom suggested would be criminal in the eyes of BT Openreach.

By putting the cap so low, BT will argue upwards and the negotiating battle will begin. Someone will say ‘not 29p, but how about 55p?’ The response will then come ‘how about 35p’, ‘no that won’t do, we’d be destroyed, about 45p’ and so on. Low ball and aim for something below todays price. Whatever it is then, Ofcom is a winner. Cynical. Playing the system. Underhanded. Call it whatever you want, it an effective bartering strategy in the markets of Marrakesh; why shouldn’t it work here?

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)